India’s renewable energy sector ripe for global and domestic investments

Upcoming Union Budget offers the Indian government an opportunity to introduce reforms and streamline policies to attract investors

Key Takeaways:

Renewable energy companies are getting ready to ride the next wave of sectoral reforms to accelerate India’s growth as a sustainable energy economy.

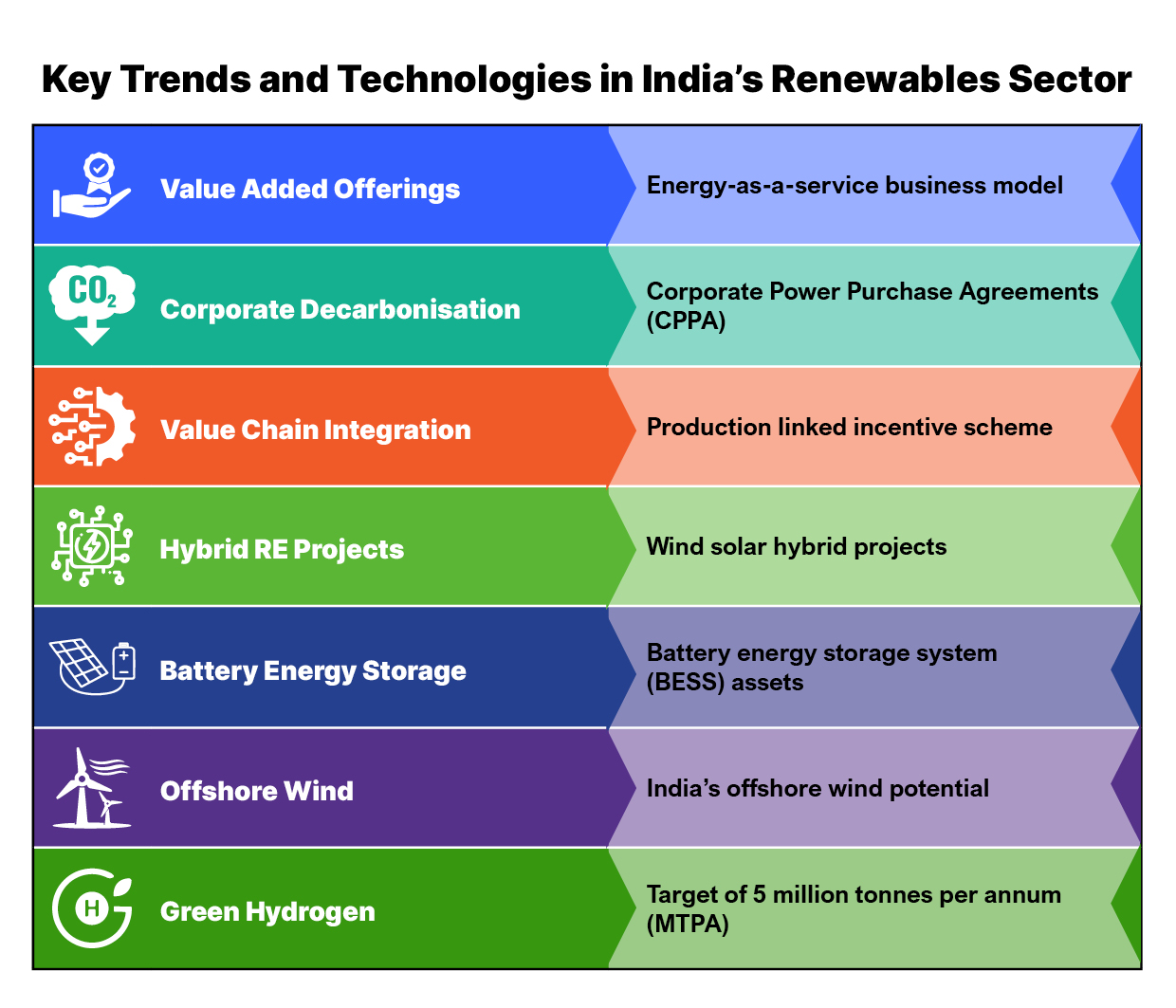

Along with developments in the generation, distribution, and transmission of renewable energy business models, value-added products and services, such as Energy-as-a-Service and corporate decarbonisation solutions, are evolving rapidly.

Financial incentives and/or grid-scale tenders are helping commercialise key new technologies such as offshore wind, battery energy storage systems and green hydrogen.

Several investment opportunities exist at the company and asset level as corporations redefine their business models and add additional revenue streams, both of which require additional capital outlays.

18 January (IEEFA India): India's renewable energy sector, which is on the cusp of another growth spurt driven by the next wave of policies and reforms, offers significant investment opportunities for global and domestic investors, according to a new joint report by the Institute for Energy Economics and Financial Analysis (IEEFA) and Invest India.

The report highlights several sectoral reforms that will attract more investment to Indian renewable energy sector companies. The reforms include the green energy corridor scheme, Production Linked Incentive (PLI) schemes, state electricity distribution companies (DISCOMs) privatisation and more. In the upcoming Union Budget, industry and investors alike will be hopeful for more such reforms.

“Ahead of the Union Budget 2023-24, the government’s approval of an initial capital outlay of Rs19,744 crore (about US$2.43 billion) under the green hydrogen mission is the latest example of a policy push that will position India as a green hydrogen export hub and attract global investors, says report co-author Shantanu Srivastava, Energy Finance Analyst, IEEFA.

“Investors would now be looking forward to a detailed breakup of the outlay for the PLI scheme for green hydrogen production and electrolyser manufacturing under the Strategic Interventions for Green Hydrogen Transition (SIGHT) programme of the green hydrogen mission,” he added.

The report finds that several new technologies and associated business models are taking shape in India, in line with global developments. It identifies three technologies where there is ample space for global investments – battery energy storage systems (BESS), offshore wind and green hydrogen.

“India plans to integrate large-scale solar and wind energy into its grid by 2030. In this context, battery storage is a vital technology solution as it allows time to shift the dispatch of solar and wind power,” says the report’s co-author Amit Manohar, Sector Lead – Renewable Energy, Invest India.

According to Srivastava, the government should look to use the Union Budget to introduce a PLI scheme for grid-scale storage to scale up domestic capacities. “The government should also look to offer import duty waivers in the Budget for setting up local battery manufacturing capacities.”

The report also finds strong potential in India’s offshore wind power segment. “Despite the slowdown, the Ministry of New and Renewable Energy’s announcement of a 4GW tender for offshore wind power off the coasts of Tamil Nadu and Gujarat has reinvigorated the sector. Offshore wind potential in India is pegged at 195GW along the 7,600km coastline with an ability to provide utilisation factors of more than 50-55%,” says Manohar.

Here too, Srivastava suggests that the government should provide tax and non-tax incentives in the upcoming Union Budget to facilitate offshore wind projects' growth, similar to what it did for solar and onshore wind in the past.

Besides technologies, the report also identifies some emerging trends that offer new avenues for investments in India’s renewable energy sector. Two such significant trends are corporate decarbonisation and energy-as-a-service model.

“Corporate decarbonisation is a growing trend buoyed by increasing net-zero commitments by Indian companies. The booming corporate power purchase agreement (PPA) market is catering to this demand, as witnessed by the recent spate of large CPPA deals in the country,” says Srivastava.

Energy-as-a-service model, which offers high margins and growth prospects, is seeing rapid adoption. Energy efficiency services, demand side management and cloud energy storage offerings are just a few of the new offerings under this model.

The other key emerging trend is that of hybridising solar and wind power for minimising variability and optimally utilising the infrastructure.

“With an installed capacity of approximately 104GW of wind and solar to date, the renewable energy sector is making strides to provide solutions for the intermittency of the two generation sources. The government has now released tenders for renewable energy auctions for round-the-clock and hybrid projects,” says Manohar.

Srivastava adds that the government should provide incentives in the budget to facilitate the growth of the wind power equipment manufacturing industry and bring in more domestic competition. This will help invigorate the wind-solar hybrid market.

Of late, there has also been a push for privatising DISCOMs, which offers new investment opportunities.

“Renewable energy and power sector companies can find several opportunities for value creation if state governments privatise larger DISCOMs. State governments should incentivise DISCOMs to partner with private counterparts to reduce aggregate technical and commercial (AT&C) losses and bring efficiencies to the sector,” Srivastava says.

Lastly, the government should also look at providing financing support in the budget for industrial decarbonisation, the next frontier for energy transition in the country. “Rolling out sovereign sustainability-linked bonds linked to India’s updated Nationally Determined Contributions, is a viable option,” says Srivastava.

Read the report: Emerging Investment Opportunities in India’s Clean Energy Sector

Media contact: Prionka Jha ([email protected]) Ph: +91 9818884854

Author contacts: Amit Manohar ([email protected]); Shantanu Srivastava ([email protected])

About Invest India: Invest India is the National Investment Promotion and Facilitation Agency of India, set up as a non-profit venture under the aegis of Department for Promotion of Industry and Internal Trade, Ministry of Commerce and Industry, Government of India. It facilitates and empowers all global as well as domestic investors under the ‘Make in India’ initiative to establish, operate and expand their businesses in India. (www.investindia.gov.in)

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)