IEEFA: Indexed renewable energy tariffs could save India’s discoms up to Rs21,880 crore (US$3bn) over five years

21 October 2020 (IEEFA India): The inflation indexation of tariffs for future solar capacity could provide much-needed financial respite to the distressed power distribution sector and help India move away from coal-fired power, according to a joint briefing note by the Institute for Energy Economics and Financial Analysis (IEEFA) and the CEEW-Centre for Energy Finance (CEF).

Zero indexation tariffs have been the norm in India for many years, say co-authors CEEW-CEF Adviser Gagan Sidhu and IEEFA Research Analyst Kashish Shah.

Zero indexation tariffs have been the norm in India for many years, say co-authors CEEW-CEF Adviser Gagan Sidhu and IEEFA Research Analyst Kashish Shah.

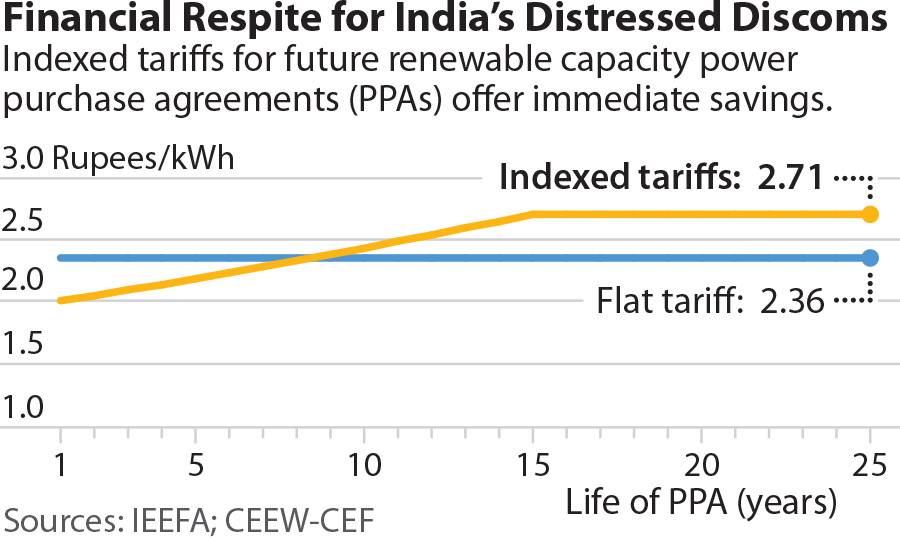

Indian solar power tariffs hit a record low of Rs2.36 per unit in June 2020, with zero inflation indexation for 25 years. But the authors say the state-owned power distribution companies (discoms) have not been able to take full advantage of new cheaper renewable energy due to two-part thermal contracts which command a fixed capacity charge even if no power is drawn.

The note proposes that solar tariffs start at a very low Rs2.00/kWh for the first year of the 25-year PPA, rising at an indexed rate of 2.2% of annual inflation for 15 years and then at a flat rate of 0% for the remaining life of the contract.

“The discoms face the twin challenges of a decline in electricity demand, exacerbated by the COVID-19 crisis, and expensive and under-utilised legacy thermal power contracts at a time when ambitious growth in new renewable energy capacity is being targeted,” says Sidhu.

“Our modelling shows that the discoms could save up to Rs21,880 crore (US$3bn) over the next five-year period under a partially indexed tariff structure, even with ongoing deflation of solar tariffs.

“This is compared with cash outflows resulting from incremental renewable capacity auctioned under a flat tariff regime.

“We assumed that flat solar tariffs would decline at just 2.5% year over year for the next five years, reaching Rs2.13/kWh by 2025/26.

“This is an interim solution to ease the unsustainable near-term financial pressure on discoms. The pandemic has compounded the discoms’ long-standing structural and financial issues and lower renewable tariffs achieved through indexation would give them vital breathing room to implement more durable and lasting reforms.”

The note points out that from a developer perspective, the proposed indexed tariff structure still results in a post-tax equity internal rate of return that is comparable to a flat tariff environment.

Front-ending tariffs at a rate of Rs2.00/kWh would not only give the discoms short- to medium-term relief, it would also provide them with an added incentive to increase purchasing of renewable energy instead of coal-fired power. Though the note says the need for indexed over flat solar tariffs to displace coal would taper off by 2025/26 as flat solar tariffs will decline below Rs2.00/kWh levels.

“The already low utilisation rates of coal-fired plants would come under further downward pressure while uptake of incremental renewable capacity would accelerate,” says Shah.

“This will help India to grow renewable energy capacity from the current level of 89 gigawatts (GW) to achieve its target of 450GW by 2030.

“It will also unlock demand for an acceleration in new investment and jobs as India climbs out of the COVID-19 recession.

“However, such an ambitious rollout of renewable energy will need to be managed carefully to ease pressure on the discoms, with renewable capacity priced to reflect the current competitive environment, buoyed by strong and growing global capital markets’ interest in Indian renewable infrastructure investments.”

Read the briefing note: The Case for Indexed Renewable Energy Tariffs

Media contact: Rosamond Hutt ([email protected]) +61 406 676 318

Author contact: Gagan Sidhu ([email protected]); Kashish Shah ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org

About CEEW-CEF: The CEEW Centre for Energy Finance (CEEW-CEF) is an initiative of the Council on Energy, Environment and Water (CEEW), one of Asia’s leading think tanks. It was launched in July 2019 in the presence of H.E. Mr Dharmendra Pradhan and H.E. Dr Fatih Birol at Energy Horizons.

CEEW-CEF acts as a non-partisan market observer and driver that monitors, develops, tests, and deploys financial solutions to advance the energy transition. It aims to help deepen markets, increase transparency, and attract capital in clean energy sectors in emerging economies. It achieves this by comprehensively tracking, interpreting, and responding to developments in the energy markets while also bridging gaps between governments, industry, and financiers. cef.ceew.in