IEEFA: There’s no way out for India’s stranded thermal power assets

India’s 40 gigawatts (GW) of stressed and stranded thermal power assets, identified by a special parliamentary committee in March 2018, still linger on – most of them without any feasible resolution.

The multitude of fundamental problems still persist despite efforts to resolve them by the government, lending institutions and proponents of the projects. These include lack of appropriate coal linkages, lack of power purchase agreements (PPAs) and capital cost overruns due to delays in acquiring land, accumulated interest funding costs and getting environmental clearances.

For example, some 24.4GW of the total stranded capacity was fully commissioned, however 8.2GW of it lacked PPAs as per the committee’s report.

Coal-fired generation continues to lose market share

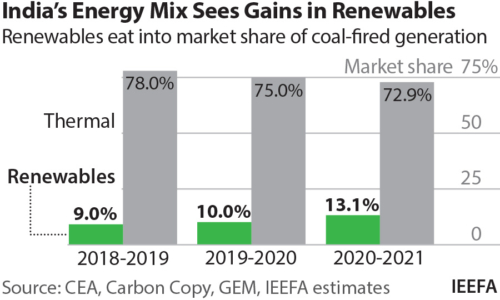

Consecutive years of flattening power demand are extinguishing hopes that a sustained rise in power demand growth might partially revive the stranded capacity without PPAs. Also, availability of ultra-cheap renewables at sub-Rs2.5/kWh compared to coal-fired power tariffs of above Rs4.0/kWh means that renewables are eating into the market share of coal-fired generation and going forward will serve the incremental supply requirements when electricity demand starts growing at the expected rate of 5-6% per annum.

India’s total electricity demand grew by only 0.9% in the fiscal year (FY)2019/20 and was further suppressed by the COVID-19 pandemic. Year-to-date demand in FY2020/21 is down 2.6% in FY2020/21. In FY2019/20 thermal generation (including gas) dropped by 2.7% compared to FY2018/19, losing market share from 78% of the total generation in FY2018/19 to 75% in FY2019/20. Whereas renewable generation increased 9.1% in FY2019/20 and is up by 2.2% year-to-date in FY2020/21 despite an overall drop in demand due to the pandemic.

No way out for the stranded assets

The Reserve Bank of India (RBI) wants to push the 40GW of non-performing assets to bankruptcy proceedings if the proponents and the lenders are unable to resolve the assets outside the National Company Law Tribunal (NCLT).

Fully or partially built projects with coal linkages and PPAs have a greater chance of finding resolutions outside NCLT through strategic debt restructuring or recapitalisation from the lenders, albeit only after taking significant writedowns. However, most of the stressed projects are still not fully resolved. And some of the projects saw previously interested investors back away in 2020.

JSW Energy recalled its bid for acquiring Ind-Barath thermal power plant (owned by Australian asset manager Macquarie Group) through the insolvency process initiated in 2019, citing the COVID-19 pandemic.

The power generation infrastructure developer had agreed to pay Rs845 crore (US$116m) upfront for the under-construction pithead 700MW coal-fired power plant in Odisha.

But JSW Energy leveraged an ‘adverse events’ clause to pull out from the deal structured in October 2019, due to the pandemic impacting the viability of the project.

IEEFA has looked at some of the non-performing assets for which either a resolution has yet to be agreed, or one has been agreed but not yet executed. These are projects that are fully commissioned or very near to completion with adequate PPAs and coal linkages. Some of them are pithead plants with levelised tariffs of below Rs4/kWh.

Andhra Pradesh State Power Generation Company was planning to acquire the 1.2GW Athena Chhattisgarh power plant (co-owned by Athena Ventures, PTC India and IDFC) to resolve the stranded asset outside NCLT. However, the Andhra Pradesh State Engineering Board (APSEB) in April 2020 wrote to the Andhra Pradesh Energy Secretary to advise against acquiring the asset. APSEB suggested that acquisition of the power plant would be risky (as it still does not have a coal linkage), expensive and techno-commercially unfeasible for the state’s grid.

Similarly, Adani Power withdrew its offer to acquire 3.6GW (1.8GW still under construction) of KSK’s Mahanadi Chhattisgarh power plant after the Uttar Pradesh distribution company (discom), one of the major off-takers of the power plant, demanded a Rs0.32/kWh reduction in the agreed tariff.

Lanco’s 1.2GW Anpara C, Jindal Power’s 1.2GW Derang, Jaypee Power’s Nigrie and Bina projects have no resolutions yet as there are no interested buyers for the assets.

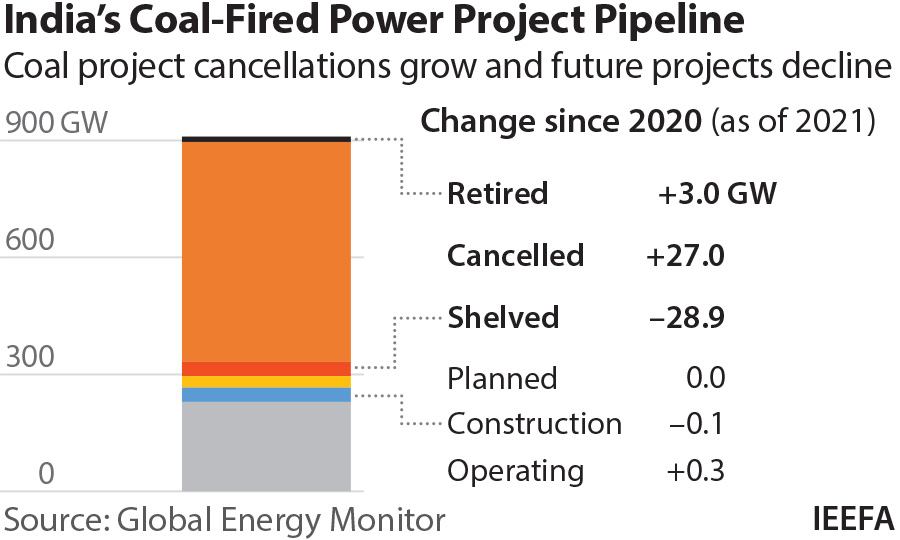

No new coal-fired power plants announced in the last 12 months

According to Global Energy Monitor’s (GEM) data no new Indian coal-fired power plants were announced in the last 12 months. Moreover, there has been no movement in the 29.3GW of pre-construction (announced + pre-permitted + permitted) project pipeline in the last 12 months. This is an indication of the lack of availability of financing for new coal-fired power projects and/or demand for additional power by discoms. The continued financial distress in India’s power distribution sector makes thermal PPAs even more unbankable absent long-delayed distribution sector reforms.

Note: GEM’s data also accounts for some of the above 30MW captive capacity

In September 2020, the Indian government-owned thermal behemoth, NTPC, announced that it will not be pursuing any new greenfield development of coal-fired power projects. Last year the states of Maharashtra and Chhattisgarh announced they will not pursue new coal-fired power project development, as did Gujarat.

With the persisting structural issues in India’s coal-fired power sector there is no appetite from international or domestic investors, apart from state-owned Power Finance Corporation (PFC) and Rural Electrification Corporation (REC), to risk capital in a sector that continues to carry US$40-60 billion of non-performing assets.

GEM’s data shows more than 601GW of coal-fired power projects have been cancelled in the last decade.

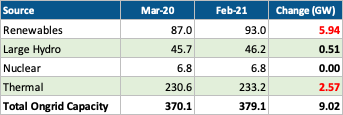

India’s thermal capacity additions could hit an historic low in FY2020/21

Year-to-date thermal capacity additions could hit a record low in FY2020/21 with just 1.27GW of net new coal-fired capacity added as of January 2021. There was 0.76GW of end-of-life coal-fired capacity retired against 2.03GW gross new coal-fired capacity additions.

India’s Installed Capacity February 2021

Source: CEA, IEEFA calculations

New thermal capacity additions form only 18% of the total capacity added in FY2020/21. On the other hand, variable renewable capacity forms 77% of the total new capacity added with 5.52GW of new capacity additions as of January 2021 (1.4GW of new solar was added in January 2021 alone).

Although renewable capacity installations are nowhere near the targeted annual capacity additions of ~35GW to reach India’s ambition of building 450GW of renewables by 2030, the significantly higher share of renewables compared to coal is reflective of the transition that is well underway in India’s electricity market.

The recent record low tariffs of Rs1.99/kWh achieved in Gujarat Urja Vikas Nigam’s (GUVNL) 500MW auction and Rs2.00/kWh in Solar Energy Corporation of India’s (SECI) 1.2GW auction, 16% lower than the previous record low tariff of Rs2.36/kWh just six months earlier, illustrate continued accelerated deflation in India’s renewable energy prices.

Against the mounting pressure of fuel cost inflation and high capital costs of emissions control systems, expensive and inefficient coal-fired power plants will have to be retired. Moreover, partially built stressed assets will have to be written down, realising a massive loss for India of public and private capital.

Kashish Shah is an energy finance analyst at IEEFA.

This commentary first appeared in Hindu Business Line

Related items:

IEEFA: Solar is the new ruler of the Indian electricity market

IEEFA: India may face unbudgeted energy transition risk of nearly $9 billion

IEEFA: NTPC is the flag-bearer for India’s electricity sector transition