The race for new-generation clean energy technologies in India

Key Findings

Indian government's initiatives and policy support are helping drive investments in new clean energy technologies, such as green hydrogen, energy storage and offshore wind.

Profitability and value appreciation will be at the core of how successful India's new energy ventures turn out to be.

The recent sharp rise in India’s electricity demand has intensified the need to accelerate capacity building in clean energy.

India made remarkable progress in its renewable energy journey in the fiscal year (FY) 2021/22. The country installed a record 15.5 gigawatts (GW) of renewable capacity – 50% more than the 10GW added in FY2020/2021.

There were no new coal additions in the first two months of FY2022/23

Investment in renewable energy also hit a record in 2021/22 at US$14.5 billion, an increase of 125% over the preceding fiscal year.

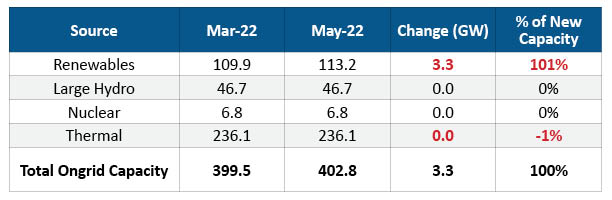

This momentum has continued in the first couple of months of FY2022/23 with 3.3GW (3GW of solar and 0.3GW of wind) added to the national grid. By comparison, there were no new coal additions in the first two months of FY2022/23.

India’s installed on-grid Electricity Capacity (GW) FY2022/23 vs FY2021/22

Note: 20MW of gas-fired capacity was retired in West Bengal

The recent sharp rise in India’s electricity demand has intensified the need to accelerate capacity building in clean energy. Shortfalls in supply and, more importantly, the impact of high coal and gas prices globally have put the electricity system and prices under immense pressure.

The Government of India is laying the foundations for a massive energy transition with policy support for new clean energy technologies such as green hydrogen, battery energy storage and offshore wind.

At the same time, it is trying to fix the fundamentals necessary for a robust power system by allowing private competition in the power retail and distribution sector and introducing market-based economic dispatch of power.

The government is also supporting localisation of the value chain with production-linked incentives (PLI) schemes for solar module and battery manufacturing in India.

Steps forward for green hydrogen, energy storage and offshore wind

Government initiatives and policy support are helping to drive investment, and developments in some new clean energy technologies are coming thick and fast.

In June 2022, Indian renewable energy developer ACME signed a memorandum of understanding (MOU) with the state government of Karnataka to develop an integrated solar to green hydrogen to green ammonia facility worth Rs52,000 crore (US$7 billion) that will produce 1.2 million tons per year (mtpa) of green hydrogen by 2027. The state government would possibly facilitate project land, off-takers and export-related facilities to support the execution of the project.

In the same month, French oil and gas giant TotalEnergies announced another partnership with Adani Group subsidiary Adani New Industries Limited (ANIL) to invest US$50 billion in 10 years to produce green hydrogen.

In April 2022, ReNew Power, another Indian renewable energy developer gaining a foothold in the green hydrogen space, announced a joint venture (JV) with state-run Indian Oil Corporation (IOC) and engineering and construction major Larsen & Toubro (L&T) for green hydrogen production.

State-owned power utility Gujarat Urja Vikas Nigam Limited (GUVNL) issued a renewable energy plus storage tender of 500MW/250MWh. The contract will allow for differentiation between peak and off-peak power. The off-peak power tariff is fixed at Rs2.29/kWh. This is the first RE plus storage tender by a state-owned utility in India.

ReNew Power is also eyeing the energy storage market

ReNew Power is also eyeing the energy storage market with its first solar plus 300MW/150MWh utility-scale battery storage project in Karnataka. When commissioned this will be India’s biggest battery. ReNew Power is developing this project with Fluence, a leading battery storage developer.

The Ministry of New and Renewable Energy (MNRE) recently announced a 4GW offshore wind tender off the coasts of Tamil Nadu and Gujarat. This will be an important step towards unlocking India’s offshore wind potential and pursuing the country’s mega target of 30GW of offshore wind by 2030.

Ambitious moves to support energy transition

The development of new clean energy technologies of battery energy storage, green hydrogen and offshore wind are at a nascent stage in the Indian market.

Leading Indian renewable energy developers such as ReNew Power, Greenko and ACME find themselves in a tricky position – expanding into the untested waters of the Indian market while trying to stay profitable.

The growth and ambition of renewable energy developers are critical to India’s energy transition. Profitability and value appreciation will be at the core of how successful these new energy ventures will turn out to be. ReNew Power is a case in point.

As of May 2022, the company had a total of 7.3GW of operational solar and wind power capacity and an additional 5.2GW under development.

ReNew Power was listed on the U.S. stock exchange NASDAQ in August 2021 and raised US$1 billion by allocating 20% of its equity to new institutional investors. The stock opened at US$9.19 and the listing momentum led to a price peak of US$10.88 in September 2021. The stock price has since tailed off and was at US$6.40 as of 22 June 2022, down by 30% since the listing.

The company booked a loss of Rs1,612 crore (US$213 million) in FY2021/22. Earnings Before Interest and Tax (EBIT) stood at Rs3,352 crore (US$442 million), rising 24.3% compared to last year, although slower than the topline due to a 260% rise in employee benefit expenses.

ReNew Power’s debt profile is favourable with 71% debt at fixed interest rates. With plans to reach 18GW of renewable energy by 2025, leverage management will be key to maintaining profitability and growing sustainably. Interest costs have gone down in the past 24 months. The company raised US$400 million of bonds in January 2022 at 4.5% to refinance the existing debt.

As only the second Indian renewables company after Azure Power to be listed on foreign markets, ReNew Power stands to benefit from access to a much wider investor base and richer financial markets, enabling it to seek debt capital at more competitive rates.

ReNew Power is one of the few renewable energy developers committing capital in these nascent yet promising segments in India. Successful execution of these ventures will unlock the potential value of the company and support India’s energy transition.

This article was originally published in RenewableWatch.