IEEFA: Battery storage and green hydrogen can boost India’s renewable energy efforts

21 October (IEEFA India): Battery storage and green hydrogen – markets that are critical for India’s renewable future and energy security – could scale up rapidly in the country, bolstered by government policy and private company ventures, according to a new briefing note from the Institute for Energy Economics and Financial Analysis (IEEFA).

“Grid-scale energy storage technologies will play a critical role in India’s decarbonisation journey, helping to integrate the 450 gigawatts (GW) of variable renewable energy capacity targeted by 2030 into the grid,” says the note’s author IEEFA analyst Kashish Shah.

“The Government of India is giving the right push for the Battery Energy Storage Systems (BESS) market through production-linked incentive schemes, big battery storage capacity tenders and improving the market structure to be more competitive.”

In addition, Shah says, Indian conglomerate Reliance Industries Ltd’s recent entry into the country’s clean energy scene, including plans for battery manufacturing and green hydrogen production, has provided huge impetus.

Reliance Industries Ltd’s entry into India’s clean energy scene has provided huge impetus

“By acquiring Norwegian solar module manufacturer REC and a 40% stake in India’s Sterling and Wilson Solar, Reliance is already showing it’s serious about delivering on its ambition to lead renewable energy investment in India,” he says.

“India’s battery market could boom quickly,” Shah adds, “just as we have seen happen in other markets such as the U.S. and Australia.”

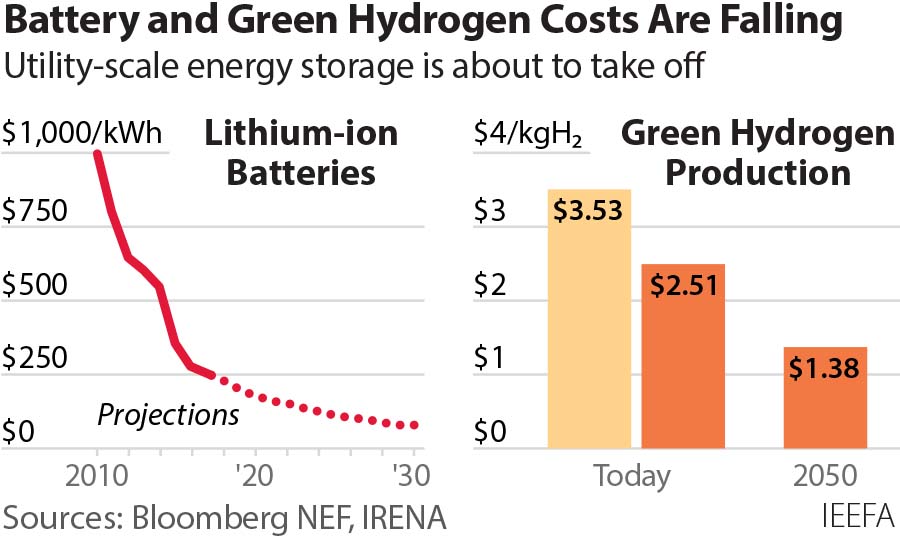

To date, the cost of grid-scale battery storage has been prohibitive for India which does not yet have a domestic battery manufacturing value chain, but globally the cost of battery storage has reduced dramatically – from US$1,100/kWh in 2011 for a standalone lithium-ion battery set-up, the price is projected to drop to US$58/kWh by 2030.

Momentum in the energy storage market

The note also points to positive signs that the market in India is gearing up for batteries with growing momentum from private power companies. Tata Power’s 10MW/10MWh (1-hour storage) battery in its Delhi distribution network is currently the only grid-scale battery operating in India but the company’s upcoming storage project in Ladakh – comprising 50MWh of storage capacity co-located with 50MW of solar capacity – will be India’s largest battery.

The market in India is gearing up for batteries with momentum from private power companies

The involvement of credible government-owned counter parties, the note observes, is vital to enabling capital deployment for battery storage. State-owned entities, Shah says, have also now come into the fold for facilitating grid-scale battery storage development, citing the Solar Energy Corporation of India (SECI) and NTPC calling for tenders to develop 2,000MWh and 1,000MWh of battery storage capacity, respectively, having built strong track records as credible counter parties by developing renewable energy capacity of more than 40GW.

In another policy development, the Central Electricity Regulatory Authority (CERC) aims to bring battery storage and pumped hydro storage (PHS) into the ambit of the frequency control and ancillary services (FCAS) market.

“Valuing the speed and accuracy of grid balancing services that batteries and PHS could provide at competitive market prices will allow a clear revenue stream for the owners of these storage assets,” says Shah.

Domestic enterprises and global giants, attracted to India’s market potential and buoyed by government support, are assessing local battery manufacturing and, Shah says, further regulations will be required to guide development and underpin commercial success.

Building the green hydrogen value chain

Meanwhile, steel giant ArcelorMittal has plans to build 4.5GW of solar capacity in Rajasthan and green hydrogen production capacity backed by solar and wind in Gujarat. Also, ACME Solar, one of India’s biggest solar developers, has commissioned the world’s first commercial pilot of an integrated green hydrogen and green ammonia production facility in Rajasthan.

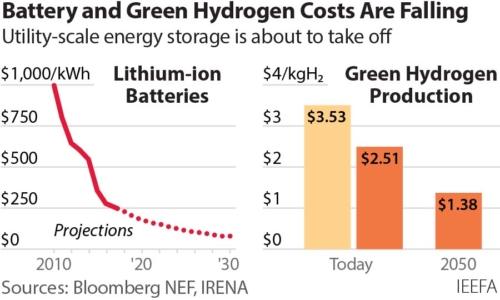

“As with batteries, the green hydrogen industry will require the building of a domestic hydrogen production value chain,” Shah says. “The most important part of this value chain is the electrolysers for which the costs have come down across the globe, led by makers in the U.S., China and Scandinavia.”

Electrolyser costs have come down across the globe, led by makers in the U.S., China and Scandinavia

The note points out that to support this value chain, the government plans to implement a green hydrogen consumption obligation (GHCO) mechanism in fertiliser production and petroleum refining, similar to the renewable purchase obligation (RPO). To further encourage usage of green hydrogen by industries, the fuel has been included under the RPO regulations.

There is also interest in developing industrial clusters that pair green hydrogen production with its industrial use, such as hubs of steel, coal, fertiliser, biogas, and heavy transport.

“These are all industries that have much to gain from a transition to green hydrogen,” says Shah. “Similar clusters are under development in the Netherlands, Germany, the UK and Australia.”

Read the report: Batteries and Green Hydrogen: The Next Chapter in India’s Clean Energy Story

Media contact: Rosamond Hutt ([email protected]) Ph: +61 406 676 318

Author contact: Kashish Shah ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)