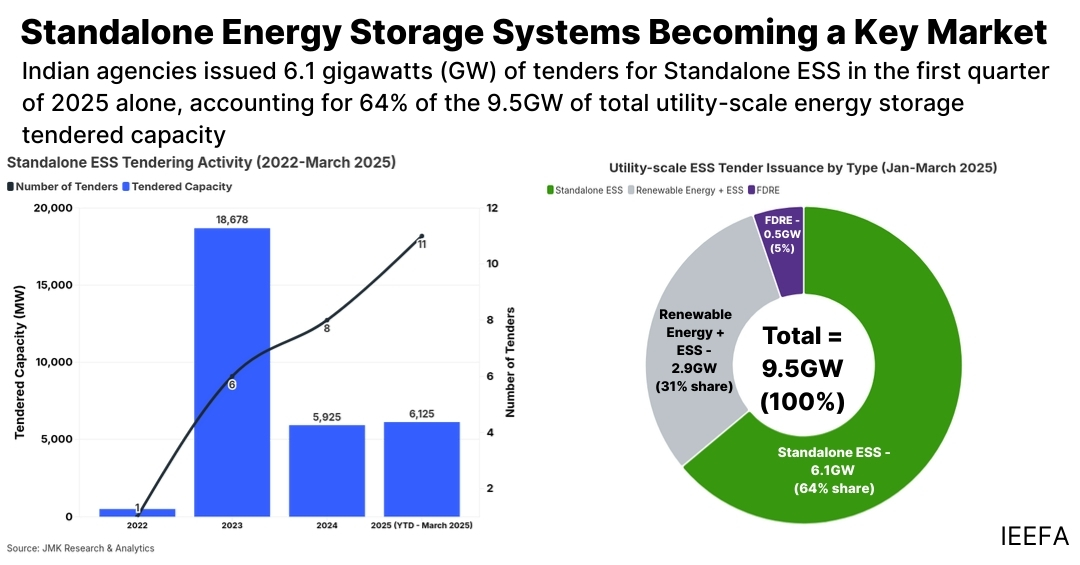

Standalone energy storage systems account for 64% of utility-scale tendering activity in first quarter of 2025

The segment, which is crucial for India to scale up renewable energy capacity, is rapidly emerging as a key market, with 6.1 gigawatts of tenders issued between January and March 2025 alone.

Key Takeaways:

Tenders supported by Viability Gap Funding (VGF) demonstrate significantly improved viability, with tariffs approximately 40% lower than non-VGF projects for two-hour storage durations.

Companies such as IndiGrid and HG Infra Engineering are focused on Battery + ESS (BESS). In contrast, Greenko focuses solely on Pumped Hydro Storage, while JSW Energy has a presence across both BESS and PHS segments.

Despite the growth in the tendering activity, Standalone ESS projects face persistent challenges such as project cancellations, supply-chain constraints, weak domestic manufacturing and power purchase agreement delays.

Standalone Energy Storage Systems (ESS) are becoming the backbone of India’s utility-scale ESS auctions, accounting for 64% of the total tenders issued between January and March 2025 alone, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics.

The report finds that various Indian agencies tendered 6.1 gigawatts (GW) of Standalone ESS capacity in the first three months of 2025.

“Standalone ESS are ideal to facilitate the rapid development and deployment of variable renewable energy (VRE) resources across India. Energy storage is integral to renewable integration and grid resilience, and Standalone ESS will play a defining role in shaping a reliable and flexible energy system,” says the report’s contributing author, Charith Konda, Energy Specialist - India Mobility and New Energy, IEEFA.

“They operate as flexible, independent assets that can respond to grid requirements rather than generator constraints, offering network stability and optimising energy use,” he added.

The government’s viability gap funding (VGF) scheme, which offers up to 30% support to project developers for capital expenditure on standalone BESS projects, has been a key driver of the surge in Standalone ESS tenders.

“This initiative has addressed high initial project capital expenditure (CAPEX) of BESS projects and enhanced project viability. The VGF framework has also made projects more economically viable,” says the report’s co-author, Prabhakar Sharma, Senior Consultant, JMK Research & Analytics.

“In recent auctions, battery energy storage system tenders in Maharashtra and Rajasthan secured tariffs as low as Rs219,000-221,000 per megawatt (MW) a month (US$2,561-$2,586/MW/month), representing almost a 40% reduction compared with non-VGF projects with similar specifications,” he added.

While utilities, grid operators or third-party entities can own and deploy Standalone ESS, innovative new business models are emerging. Energy Storage as a Service (ESaaS) lowers the entry barrier for users by offering storage as a service through subscription or pay-per-use arrangements.

The heightened interest in Standalone ESS is attracting new players to the sector. Large, established power producers such as JSW Energy, Greenko and Torrent Power have been joined by newer entrants Pace Digitek, Oriana Power, Kintech Synergy and Bondada Engineering with Battery + ESS (BESS)-based tenders.

While the initial growth has been impressive, the nascent Standalone ESS market is not immune to the challenges facing other sectors of India’s energy transition.

“A key barrier has been the delay or cancellation of power sale and storage agreements, often triggered by offtakers anticipating further tariff reductions due to falling battery prices,” says the report’s co-author, Pulkit Moudgil, Research Associate, JMK Research & Analytics. “These uncertainties have already led to the cancellation of 6.4GW of awarded capacity.”

The report also highlights several structural barriers in the market. These include a limited number of utility-scale equipment vendors, a lack of domestic battery cell manufacturing and heavy reliance on critical mineral imports like lithium and cobalt. This dependence creates exposure to global price fluctuations and geopolitical risks. Additionally, smaller developers struggle to secure affordable project financing due to investor caution regarding early-stage risks and long payback periods.

“Looking ahead, India’s Standalone ESS market stands at a critical inflexion point,” says Sharma.

“With the right mix of sustained policy support, streamlined regulatory processes, and targeted investments in domestic manufacturing and supply chains, the sector can overcome early-stage barriers and unlock its full potential,” he adds.

Read the report: The Standalone Energy Storage Market in India

Media Contact: Prionka Jha ([email protected]); +91 9818884854

Author contacts: Charith Konda ([email protected]); Prabhakar Sharma ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)

About JMK Research & Analytics: JMK Research & Analytics provides research and advisory services to Indian and international clients across renewable energy, electric mobility and the battery storage market. (www.jmkresearch.com)