Key Findings

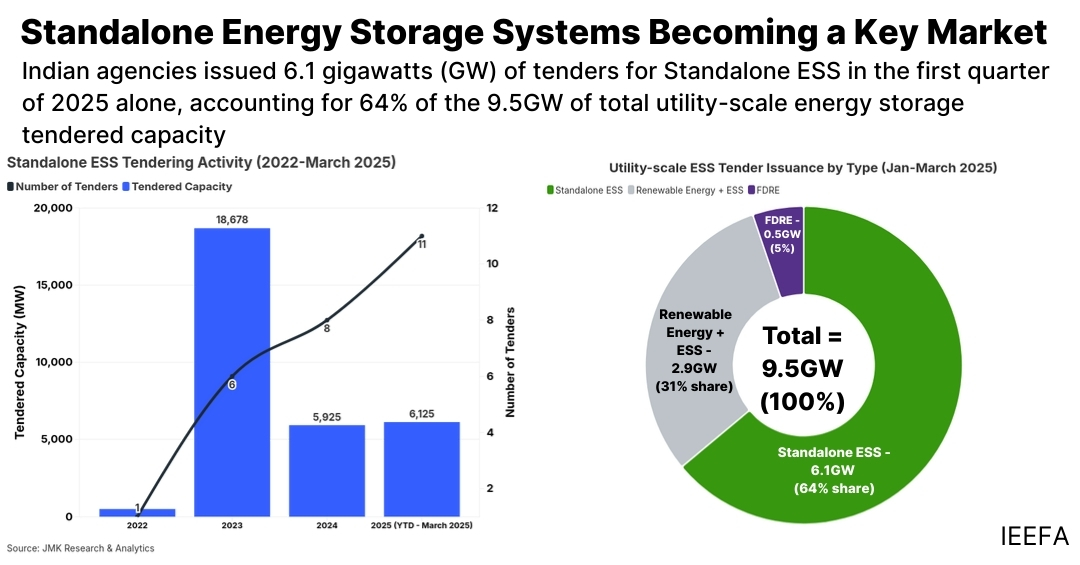

Standalone Energy Storage Systems (ESS) are rapidly emerging as a key market, with 6.1 gigawatts of tenders issued in the first quarter of 2025 alone, accounting for 64% of the total utility-scale energy storage tendering activity.

Tenders supported by Viability Gap Funding (VGF) demonstrate significantly improved viability, with tariffs approximately 40% lower than non-VGF projects for two-hour storage durations.

The Standalone ESS industry continues to face persistent challenges such as project cancellations, supply-chain constraints, weak domestic manufacturing and power purchase agreement delays.

Players such as IndiGrid and HG Infra Engineering are focused on Battery + ESS (BESS). In contrast, Greenko is solely concentrated on Pumped Hydro Storage (PHS), while JSW Energy has a presence across both BESS and PHS segments.

Executive Summary

India’s ambitious clean energy transition demands a parallel development in energy storage infrastructure, with Standalone Energy Storage Systems (Standalone ESS) emerging as a key enabler. As the country rapidly scales up variable renewable energy (VRE), Standalone ESS offers a dispatchable solution to address the intermittency of renewables, support grid stability, and optimise energy usage.

Unlike VRE-paired ESS, which is typically owned or contracted by renewable energy developers to store and dispatch power to smoothen renewable integration, Standalone ESS functions as an independent asset. Utilities, grid operators or third-party entities can own and deploy it flexibly to provide grid balancing, peak shaving and ancillary services, enabling storage to operate based on grid requirements rather than generator constraints. Additionally, emerging business models such as Energy Storage as a Service (ESaaS) offer storage as a service rather than an owned asset, lowering the entry barrier for users through subscription-based or pay-per-use arrangements.

In the first quarter of 2025, Standalone ESS tenders reached 6.1 gigawatts (GW), which accounted for 64% of all utility-scale energy storage tenders, which included all other use cases of ESS such as Standalone ESS, renewable energy + ESS, and Firm and Dispatchable Renewable Energy (FDRE). This capacity, issued across 11 tenders in just three months has already surpassed the total issuance in 2024. The Viability Gap Funding (VGF) scheme, which offers up to 30% support for capital expenditure of standalone Battery ESS (BESS) projects, has primarily driven this acceleration. This initiative has addressed declining battery costs while enhancing project viability.

The VGF framework has also made projects more economically viable. In recent auctions, BESS tenders in Maharashtra (August 2024, 300 megawatts (MW)) and Rajasthan (November 2024, 500MW) secured monthly tariffs as low as Rs219,001-221,100/MW (US$2,561-$2,586/MW/month), representing almost a 40% reduction compared to non-VGF projects with similar specifications.

Central and state agencies continue to play a crucial role in scaling deployment. NTPC leads the way, having issued six BESS tenders totalling 5.75GW since 2022. At the state level, Gujarat Urja Vikas Nigam Limited (GUVNL) and Maharashtra State Electricity Distribution Company Limited (MSEDCL) have further advanced adoption by issuing large-scale tenders tailored to their grid and reliability requirements.

India’s grid-scale Standalone ESS market is also witnessing a diversification of players, with both established power sector giants and new entrants actively participating. Large independent power producers (IPPs) such as JSW Energy, Greenko, and Torrent Power are leveraging their experience to lead deployments. JSW Energy, for instance, has emerged as the market leader with nearly 2GW of awarded capacity. At the same time, newer entrants such as Pace Digitek, Oriana Power, Kintech Synergy and Bondada Engineering are gaining ground in BESS-based tenders, expanding the market beyond traditional players.

Despite growing policy momentum and market activity, India’s Standalone ESS sector remains nascent, primarily due to persistent execution and commercial bottlenecks. A key barrier has been the delay or cancellation of power sale and storage agreements, often triggered by offtakers anticipating further tariff reductions due to falling battery prices. These uncertainties have already led to the cancellation of 6.4GW of awarded capacity.

Beyond contracting delays, the sector faces structural hurdles related to supply chains, manufacturing and financing. India’s installed BESS capacity remains limited, with most utility-scale projects relying on a small pool of vendors, many of whom operate through international joint ventures. A lack of domestic battery cell manufacturing, compounded by heavy dependence on critical mineral imports such as lithium and cobalt, further exposes the market to global price volatility and geopolitical risks. While recent mineral discoveries in India offer long-term promise, delays in refining infrastructure and commercialisation timelines limit their short- to medium-term impact. Meanwhile, access to affordable project financing remains challenging, especially for smaller developers, as investors remain cautious of the sector’s early-stage risks and long payback periods.

Looking ahead, India’s Standalone ESS market stands at a critical inflection point. With the right mix of sustained policy support, streamlined regulatory processes, and targeted investments in domestic manufacturing and supply chains, the sector can overcome early-stage barriers and unlock its full potential. As energy storage becomes integral to renewable integration and grid resilience, Standalone ESS will play a defining role in shaping a reliable and flexible energy system.