Latest Divestment Research

See more >

Oregon marks climate risk milestone

July 16, 2025

Connor Chung, Dan Cohn

Insights

Spin-off or just spin? Adaro's bold plan to achieve net-zero

November 08, 2024

Mutya Yustika, Ghee Peh

Insights

Universal ownership: Decarbonisation in a hostile engagement environment

September 26, 2024

Alasdair Docherty

Report

Engagement and divestment: Shareholders transcend a false binary

September 12, 2024

Connor Chung, Dan Cohn

Briefing Note

IEEFA highlights rise of low-carbon, passive indexes that compare favorably with traditional funds

February 26, 2024

Tom Sanzillo

Insights

New York State Common Retirement Fund takes action to protect New Yorkers from further losses from oil and gas company investments

February 15, 2024

Tom Sanzillo

Insights

RBC net-zero engagement policy: A promising start that falls short on key element

February 13, 2024

Mark Kalegha

Report

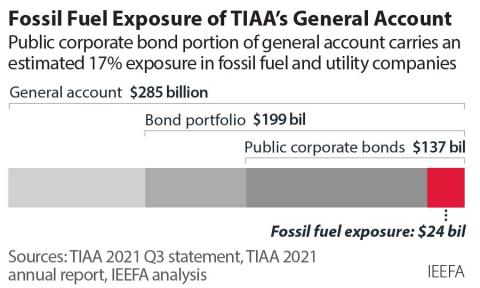

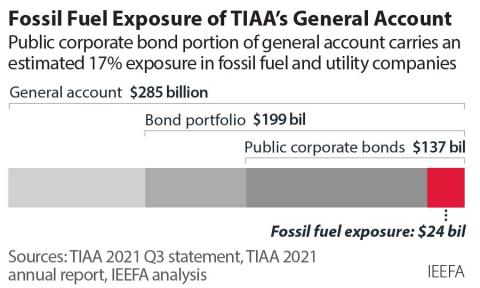

TIAA’s recent sustainability report raises more questions than it answers

February 12, 2024

Tom Sanzillo

Insights

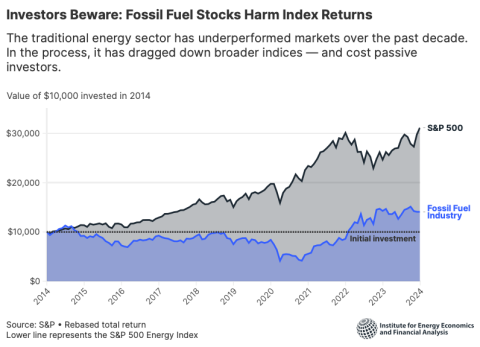

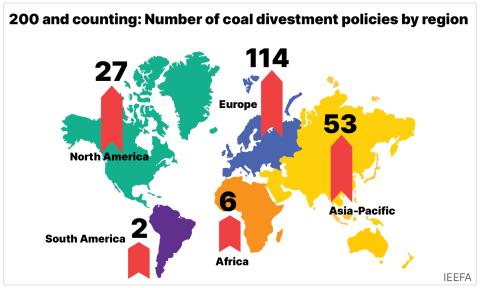

Passive investing in a warming world

February 08, 2024

Connor Chung, Dan Cohn

Report

Once seen as industry savior, petrochemicals losing financial appeal

January 23, 2024

Tom Sanzillo

Report

Oil and gas industry ends 2023 with a weak comeback and a negative outlook

January 12, 2024

Tom Sanzillo

Report

The Royal Bank of Canada’s climate policy has come under close scrutiny from its stakeholders

October 05, 2023

Mark Kalegha

Insights

Latest Divestment Reports

See more >

Universal ownership: Decarbonisation in a hostile engagement environment

September 26, 2024

Alasdair Docherty

Report

RBC net-zero engagement policy: A promising start that falls short on key element

February 13, 2024

Mark Kalegha

Report

Passive investing in a warming world

February 08, 2024

Connor Chung, Dan Cohn

Report

Once seen as industry savior, petrochemicals losing financial appeal

January 23, 2024

Tom Sanzillo

Report

Oil and gas industry ends 2023 with a weak comeback and a negative outlook

January 12, 2024

Tom Sanzillo

Report

Royal Bank of Canada: Falling short on climate change

August 29, 2023

Mark Kalegha, Tom Sanzillo, Suzanne Mattei...

Report

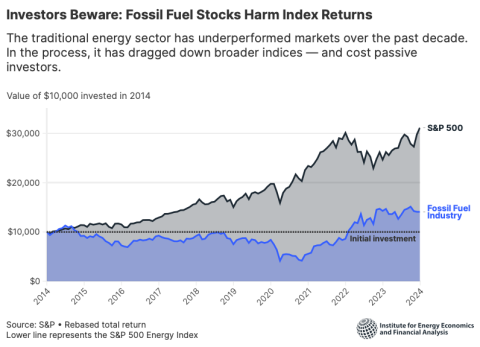

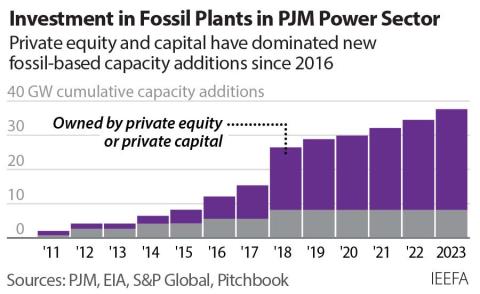

Private equity in PJM: Growing financial risks

August 22, 2023

Dennis Wamsted

Report

Asia-Pacific lags global oil and gas industry in shift from carbon

June 01, 2023

Christina Ng, Gaurav Ahuja, Cameron Fairlie...

Report

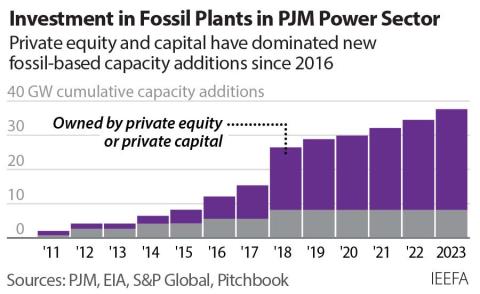

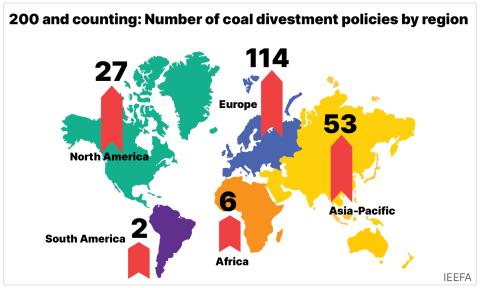

200 and counting: Global financial institutions are exiting coal

May 04, 2023

Saurabh Trivedi, Shantanu Srivastava

Report

A strategic fossil fuel divestment policy would strengthen the British Columbia Teachers' Pension Plan

March 17, 2023

Mark Kalegha, Tom Sanzillo

Report

TIAA fails clients on climate

November 16, 2022

Tom Sanzillo

Report

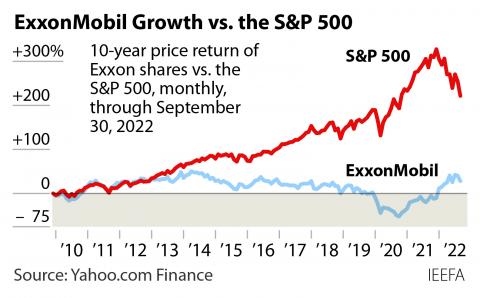

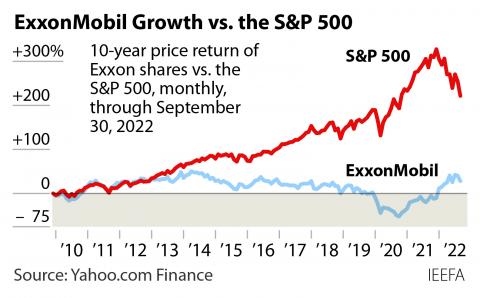

Two economies collide: Competition, conflict, and the financial case for fossil fuel divestment

October 13, 2022

Tom Sanzillo, Dan Cohn, Connor Chung...

Report

West Virginia goes after banks on fossil fuels

August 31, 2022

Tom Sanzillo, Suzanne Mattei

Report

Pension funds investing indirectly in Ohio’s Gavin coal plant are at risk as financial, environmental disadvantages mount

October 14, 2021

Dennis Wamsted, Seth Feaster, Tom Sanzillo...

Report

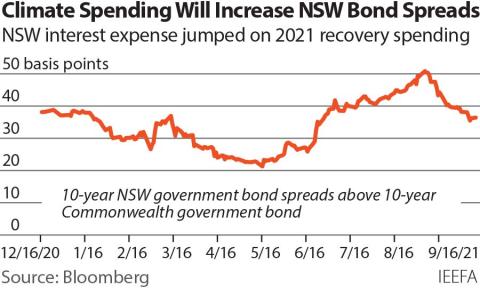

Climate risk and the cost of capital in NSW

October 01, 2021

Trista Rose

Report

Latest Divestment Press Releases

See more >

Institutional investors increasingly pair engagement and divestment to address climate-related financial risk

September 12, 2024

Press Release

IEEFA Canada: Royal Bank of Canada falls short on client engagement strategy

February 13, 2024

Press Release

IEEFA U.S.: Petrochemical producers remain on a business as usual path in the face of international criticism

January 23, 2024

Press Release

IEEFA Canada: Royal Bank of Canada is falling short on climate change pledges

August 29, 2023

Press Release

IEEFA U.S.: Decade of strong growth is over for PE gas plant developers in PJM

August 22, 2023

Press Release

APAC oil and gas firms risk financing challenges as they trail global peers in diversification

June 01, 2023

Press Release

200 and counting – Global financial institutions committed to coal divestment has doubled in three years

May 04, 2023

Press Release

Divesting is the correct path for the British Columbia Teachers’ Pension Plan

March 20, 2023

Press Release

IEEFA U.S.: Financial services giant TIAA has a long way to go to become a climate leader

November 16, 2022

Press Release

IEEFA U.S.: Two economies collide: Competition, conflict, cooperation and the financial case for fossil fuel divestment

October 13, 2022

Press Release

TIAA climate policy gaps erode potential strength of $1.4 trillion fund

May 16, 2022

Press Release

IEEFA U.S.: Experts offer testimony on Maine fossil fuel divestment planning

February 28, 2022

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.