IEEFA U.S.: Two economies collide: Competition, conflict, cooperation and the financial case for fossil fuel divestment

As investors search for stability and profitability, the case for divestment offers both.

Key Takeaways:

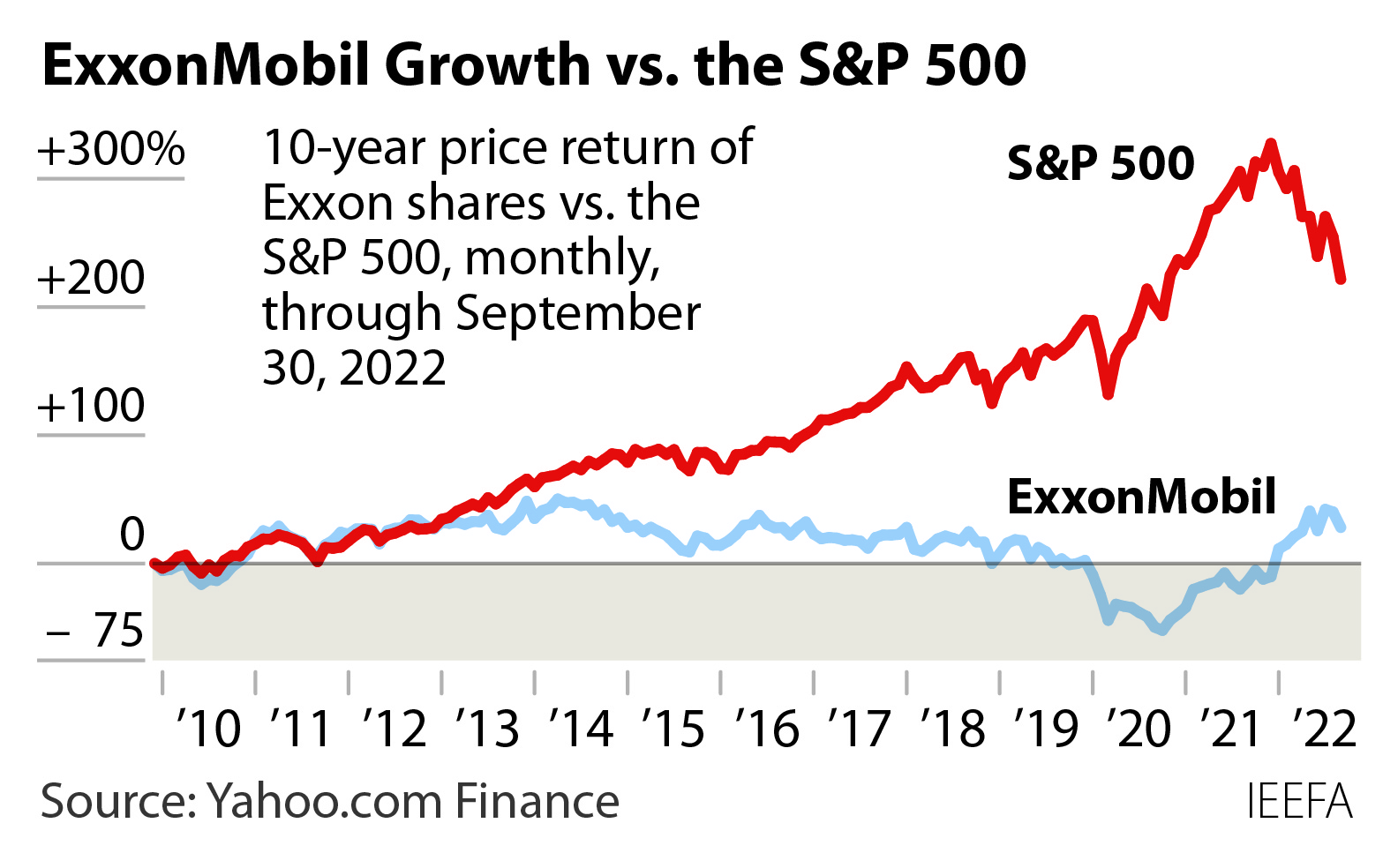

Despite recent global developments, the case for fossil fuel divestment is still strong. Sustainable economics are proving their financial reliability and long-term ability as a sound investment.

The fossil fuel industry faces long-term headwinds from unprecedented global competition across all major end-markets. The fossil fuel sector is also significant legal, regulatory, and market risk, making long-term investments undesirable.

Climate change is increasingly acknowledged and seen as a financial risk –this fact in addition to global competition should have institutional investors questioning the need to invest in fossil fuels at all.

October 13, 2022 (IEEFA)— Once a sound investment strategy, the coal, oil and gas sectors have lost their financial rationale while the case for divestment has proven financially sound and a path for effective climate action, according to a new Institute for Energy Economics and Financial Analysis (IEEFA) report.

Competitive forces inside and outside the industry have undermined this once-mighty economic force. Thanks to cost efficiencies, innovation, and profits, trillions of dollars are moving to alternatives. Additionally, the cause of Russia’s attack on the Ukrainian people is evidence of fossil fuels’ financial failure, and the need of oil and gas industry leaders to resort to extreme political means to inflate its bottom line. At the same time, an increasing number of destructive weather events is a constant reminder of the risks associated with climate change.

Following up on the 2018 report, The Financial Case for Fossil Fuel Divestment, the latest report offers a detailed, point-by-point rejoinder to arguments against fossil fuel divestment. Facts and rational analysis update and extend the content of that report. At the time, opponents of divestment made a simple case that divestment would lose money. It was not true then, and is less true now as hundreds of funds adopting various paths of divestment have recorded positive financial results. The arguments against fossil fuel divestment have grown in size but are largely unsupported and increasingly linked to blatant power politics.

“Divestment is a defensive move to prevent the loss of share value. It works. Opponents of divestment continue to make the false argument that it will lose investors’ money,” said Tom Sanzillo, IEEFA director of financial analysis and co-author of the report. “When that argument fails, industry leaders have turned to unprincipled and arbitrary punitive policies, a worrying trend for investors who are seeking blue-chip stability at this time of turbulence.”

Put simply, climate risk is a financial risk. When a fiduciary acknowledges a risk, they are obligated to act. Many investment funds are unwilling to consider life with a fossil-free portfolio. They prefer to dismiss divestment based on an unfounded fear of financial loss and a willingness to embrace unproven solutions. This is a significant fiduciary lapse and ignores evidence that this defensive measure to protect value is a sound one.

“Today, we are told that the oil and gas industry is on its way back. The last few quarters have left the industry flush with cash, stock prices are rising, and management is said to have finally learned the secret of capital discipline,” said Sanzillo. “An unsustainable military intervention is at the root of the recent price spikes. Market fundamentals for oil and gas are weak because disarray within the industry and competition threatens the industry’s growth plans. For investors seeking a steady, stable investment, fossil fuels are unreliable. Today and going forward, fossil fuel companies offer volatility, spurious innovations and political calamity.”

Full Report: Two Economies Collide: Competition, Conflict and the Financial Case for Fossil Fuel Divestment

Author Contact

Tom Sanzillo ([email protected]) is IEEFA director of financial analysis

Dan Cohn ([email protected]) is an IEEFA global energy transition researcher

Connor Chung is an IEEFA research assistant

Media Contact

Susan Torres ([email protected]), +1 908-565-3451

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. IEEFA’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.