Pennsylvania

Latest Pennsylvania Research

See more >

Shell's EBITDA target for Monaca facility under threat

October 29, 2024

Abhishek Sinha, Tom Sanzillo, Suzanne Mattei...

Briefing Note

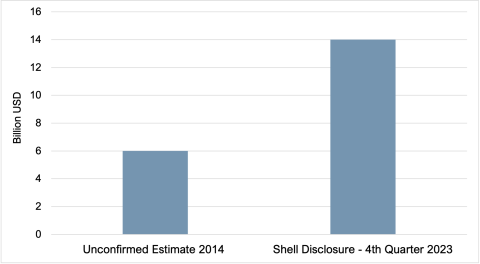

Shell acknowledges $14 billion price tag for petrochemical plant, more than double street estimates

February 08, 2024

Abhishek Sinha, Tom Sanzillo, Suzanne Mattei...

Insights

IEEFA U.S.: Shell Pennsylvania likely to be last hurrah for big petrochemical complexes

March 01, 2022

Tom Sanzillo

Insights

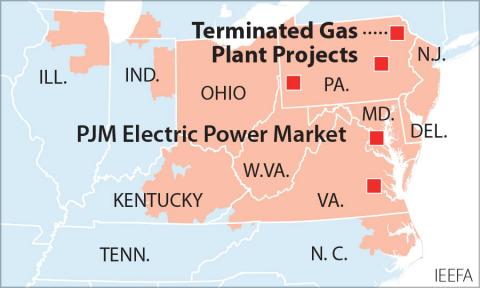

Rapidly Changing Investment Climate Challenges Planned PJM Gas Plants

November 01, 2021

Dennis Wamsted

Report

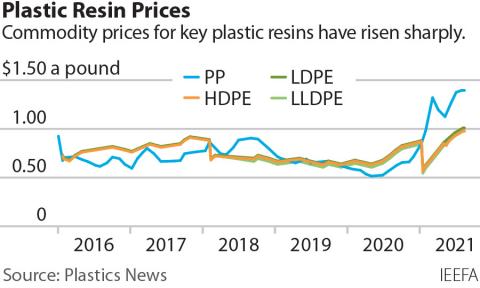

Why external review of price-setting mechanism for plastic resins is warranted

October 01, 2021

Tom Sanzillo, Suzanne Mattei

Report

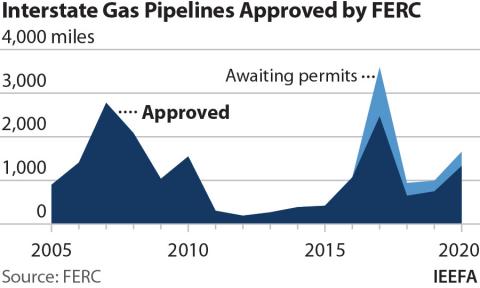

IEEFA U.S.: Another big pipeline project bites the dust—and FERC should take notice

September 29, 2021

Suzanne Mattei

Insights

IEEFA: Keystone XL project became another pipeline to nowhere

June 14, 2021

Suzanne Mattei, Tom Sanzillo

Insights

IEEFA U.S.: ‘New Promise Act’ would help communities transition from coal-based economy

April 02, 2021

Tom Sanzillo, Cathy Kunkel

Insights

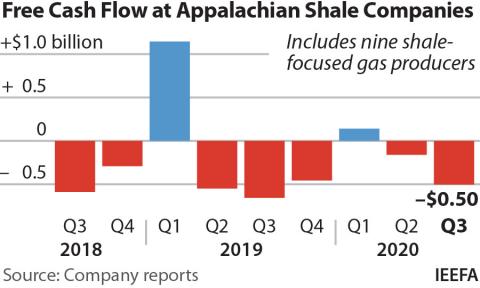

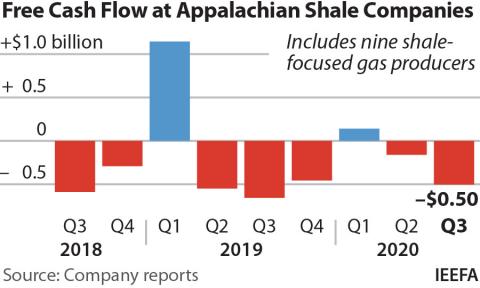

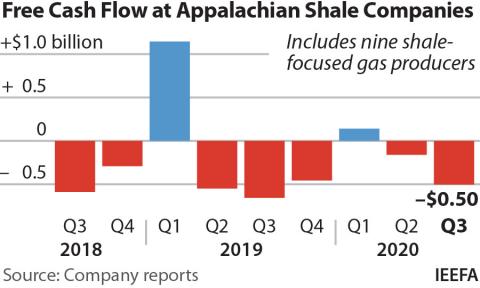

Appalachian frackers spill red ink in third quarter - again

December 01, 2020

Clark Williams-Derry, Tom Sanzillo, Kathy Hipple...

Report

IEEFA U.S.: Coal plants close as renewable energy construction rises

November 20, 2020

Dennis Wamsted

Insights

Risks outweigh rewards for investors considering PJM natural gas projects

October 05, 2020

Dennis Wamsted, Bryndis Woods

Report

IEEFA Energy Finance Conference 2020 roundup: Local leadership, global change

July 31, 2020

Frank Bass

Insights

Latest Pennsylvania Reports

See more >Rapidly Changing Investment Climate Challenges Planned PJM Gas Plants

November 01, 2021

Dennis Wamsted

Report

Why external review of price-setting mechanism for plastic resins is warranted

October 01, 2021

Tom Sanzillo, Suzanne Mattei

Report

Appalachian frackers spill red ink in third quarter - again

December 01, 2020

Clark Williams-Derry, Tom Sanzillo, Kathy Hipple...

Report

Risks outweigh rewards for investors considering PJM natural gas projects

October 05, 2020

Dennis Wamsted, Bryndis Woods

Report

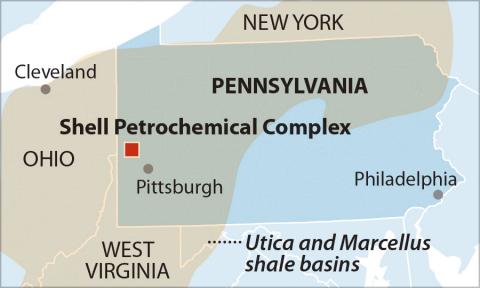

Shell's Pennsylvania petrochemical complex: Financial risks and a weak outlook

June 04, 2020

Tom Sanzillo, Kathy Hipple

Report

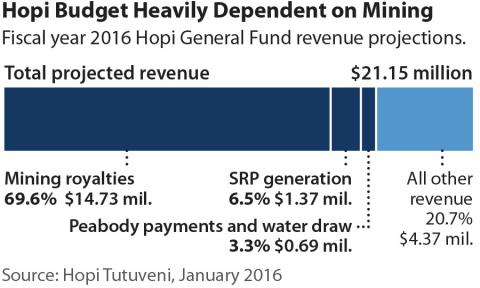

As coal economy collapses, imminent public budget crisis confronts Hopi-Navajo tribes

May 01, 2019

Karl Cates, Pam Eaton

Report

Bailout Bill a bonanza for FirstEnergy solutions, but a boondoggle for Ohio consumers

May 01, 2019

David Schlissel

Report

The seven technology disruptions driving the global energy transition

October 01, 2018

Seth Feaster

Report

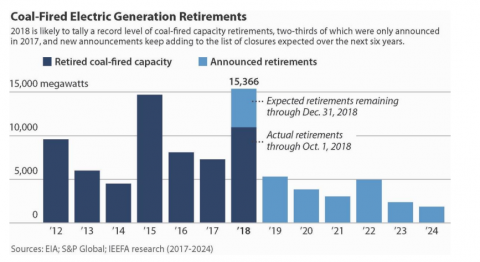

Record drop in U.S. Coal capacity likely in 2018

October 01, 2018

Seth Feaster

Report

2017 U.S. coal outlook

January 01, 2017

Tom Sanzillo, David Schlissel

Report

FirstEnergy seeks a subsidized turnaround

October 01, 2014

Tom Sanzillo, Cathy Kunkel

Report

No evidence of a turnaround at Prairie state

September 01, 2014

David Schlissel

Report

Latest Pennsylvania Press Releases

See more >

Shell’s Pennsylvania petrochemical plant is unlikely to meet financial targets

October 29, 2024

Press Release

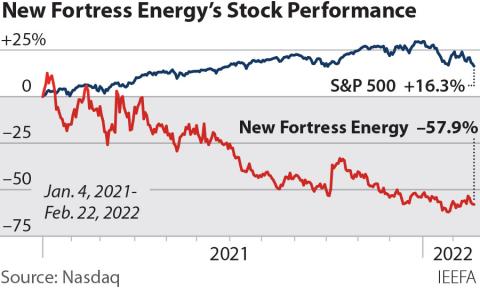

IEEFA: La expansión del gas de New Fortress Energy presenta mayores riesgos para los inversores

February 23, 2022

Press Release

IEEFA: New Fortress Energy gas expansion presenting increased risks to investors

February 23, 2022

Press Release

IEEFA U.S.: Gas-fired power plant cancellations and delays signal investor anxiety, changing economics

November 18, 2021

Press Release

IEEFA U.S.: Skyrocketing plastics prices a major concern for public health, economy

October 18, 2021

Press Release

IEEFA U.S.: FERC gives blank check approval to pipeline builders, while investors and consumers pick up costs

December 17, 2020

Press Release

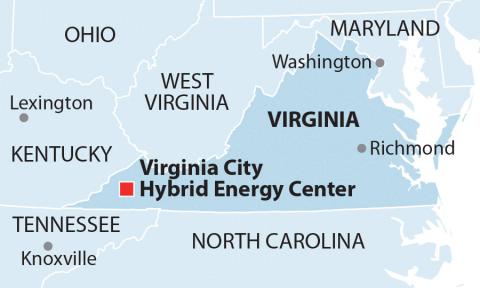

IEEFA U.S.: Virginia coal plant’s future isn’t bright: preparation for transition should commence now

December 16, 2020

Press Release

Appalachian Frackers Spill Red Ink

December 04, 2020

Press Release

IEEFA U.S.: Investors in gas-fired projects in largest regional power system face substantial risks

October 05, 2020

Press Release

IEEFA: Ohio cancels permits for controversial Mountaineer storage facility

September 28, 2020

Press Release

IEEFA report: Financial risks loom for Shell’s Pennsylvania petrochemicals complex

June 04, 2020

Press Release

IEEFA U.S.: Imminent Hopi-Navajo budget crisis as coal industry collapses

May 30, 2019

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.