Appalachian frackers spill red ink in third quarter - again

Download Full Report

Key Findings

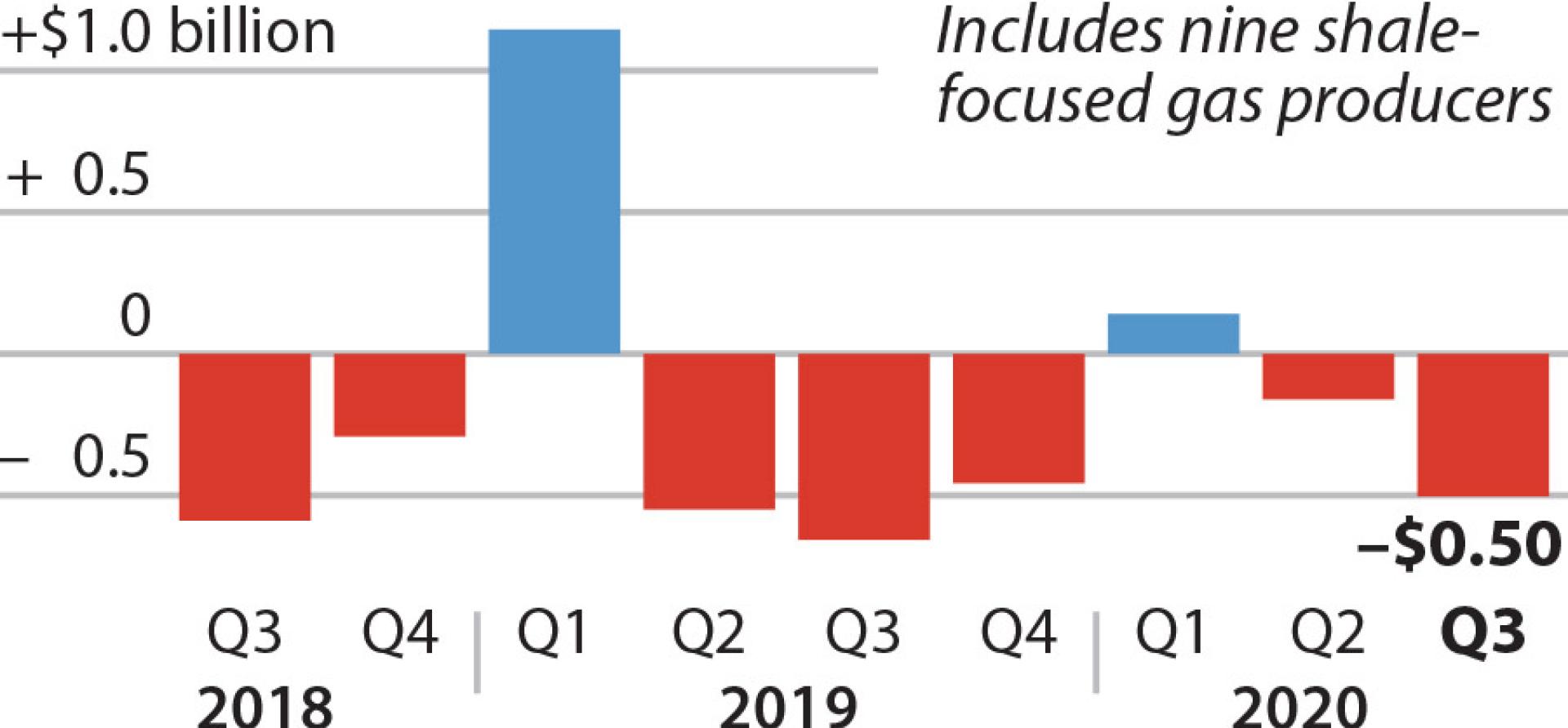

Nine fracking-focused gas companies in Appalachia reported $504 million negative free cash flow in Q3 2020

In aggregate, capital spending was $1.8 billion in the quarter, a 34% year-on-year drop

Capital investments during the quarter were the lowest in at least six years

Hedging provided significant sources of cash

Summary

An IEEFA analysis reveals that nine shale-focused gas producers in Appalachia slashed their capital expenditures (capex) in the third quarter by more than one-third compared to the prior year.

Despite the cuts, the nine companies spent $504 million more on drilling and other capital projects during the quarter than they generated by selling oil and gas, with six companies reporting negative free cash flows.

These results follow a dismal decade for the Appalachian frackers, culminating in bankruptcies for two key players. Gulfport Energy filed for bankruptcy protection in November. Chesapeake Energy, which had filed for bankruptcy earlier in the year, is currently restructuring its $7 billion debt.

All told, the nine companies in IEEFA’s sample made $1.8 billion in capital expenditures for the quarter—a 34% year-on-year drop, and the lowest quarterly total in more than six years.

Eight of the nine companies in the IEEFA sample slashed capital spending from the prior year’s level. Range Resources, for example, cut its quarterly capex to $72 million, down from $178 million in the third quarter of 2019.

Despite bullish statements from executives, EQT slashed its quarterly capex through the third quarter by more than 40% compared to the prior year. Only National Fuel increased its capital spending in the quarter, primarily as a result of acquiring Shell’s dry gas assets in July.