IEEFA: New Fortress Energy gas expansion presenting increased risks to investors

February 23, 2022 (IEEFA) – New Fortress Energy’s (NFE) development and expansion of natural gas projects around the world is “unnecessary, unwelcome and unaffordable,” according to an analysis of the company’s global projects by the Institute for Energy Economics and Financial Analysis.

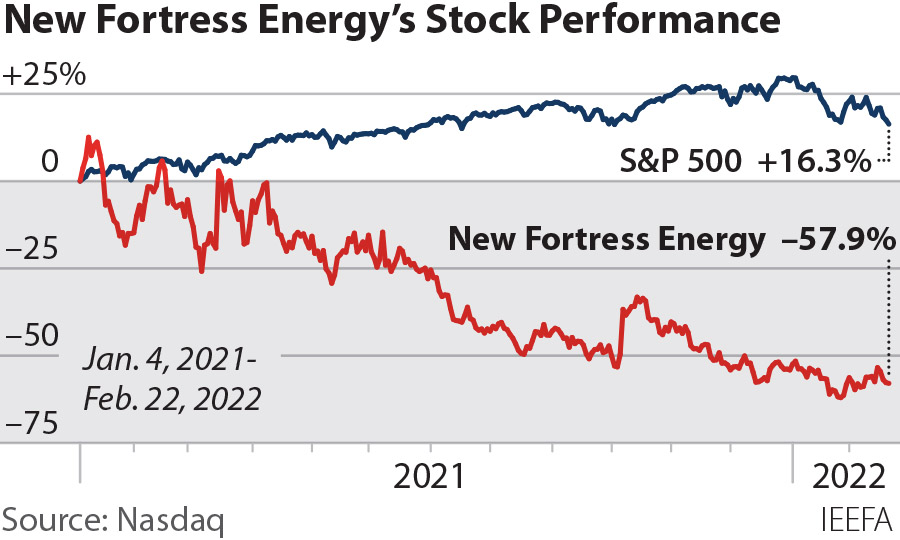

NFE’s short-term track record shows mixed results and the company lacks a compelling long-term rationale. New Fortress is overpromising and underdelivering the benefits of gas assets in various markets, presenting risks for investors and ratepayers who face being locked into expensive, carbon-intensive energy supplies.

“New Fortress Energy’s presence in the market creates a risky financial and dysfunctional economic dependence on gas as a future resource for host nations and communities,” said Tom Sanzillo, IEEFA’s director of financial analysis and the author of the report. “In most instances, its new projects expose ratepayers to higher electricity prices and undermine efforts to build cheaper, more reliable and environmentally sound energy.”

The analysis notes a number of New Fortress projects that present risks for investors:

- New Fortress made a core promise to investors that it would develop five to 10 new liquefaction facilities by 2024, but it only owns a small Miami plant, exposing the company and customers to market risks and price swings. The only other U.S. liquefaction project in development in Pennsylvania is stalled.

- In Jamaica and Puerto Rico, where the company has established operations, electricity prices tied to the price increases and volatility of gas threaten economic growth and the development of renewable energy in Puerto Rico.

- Community, environmental and elected leaders concerned about public health and safety and the climate in New Jersey, Pennsylvania, Puerto Rico, and Ireland have either delayed or jeopardized the future of New Fortress projects.

“NFE’s business investments are on a collision course with global policy and capital allocation trends that are moving away from fossil fuels,” Sanzillo said. “By pushing out the development of renewable energy investments in favor of gas, its customers and investors face dependence on a resource that exposes economies to inflation, volatile pricing and a high likelihood of stranded assets.”

Full Report: New Fortress Energy: Promises to Keep

Author Contact:

Tom Sanzillo ([email protected]) is IEEFA director of financial analysis.

Suzanne Mattei ([email protected]) is an IEEFA energy policy analyst.

Media Contact:

Vivienne Heston ([email protected]), +1 (914) 439-8921

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. IEEFA’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.