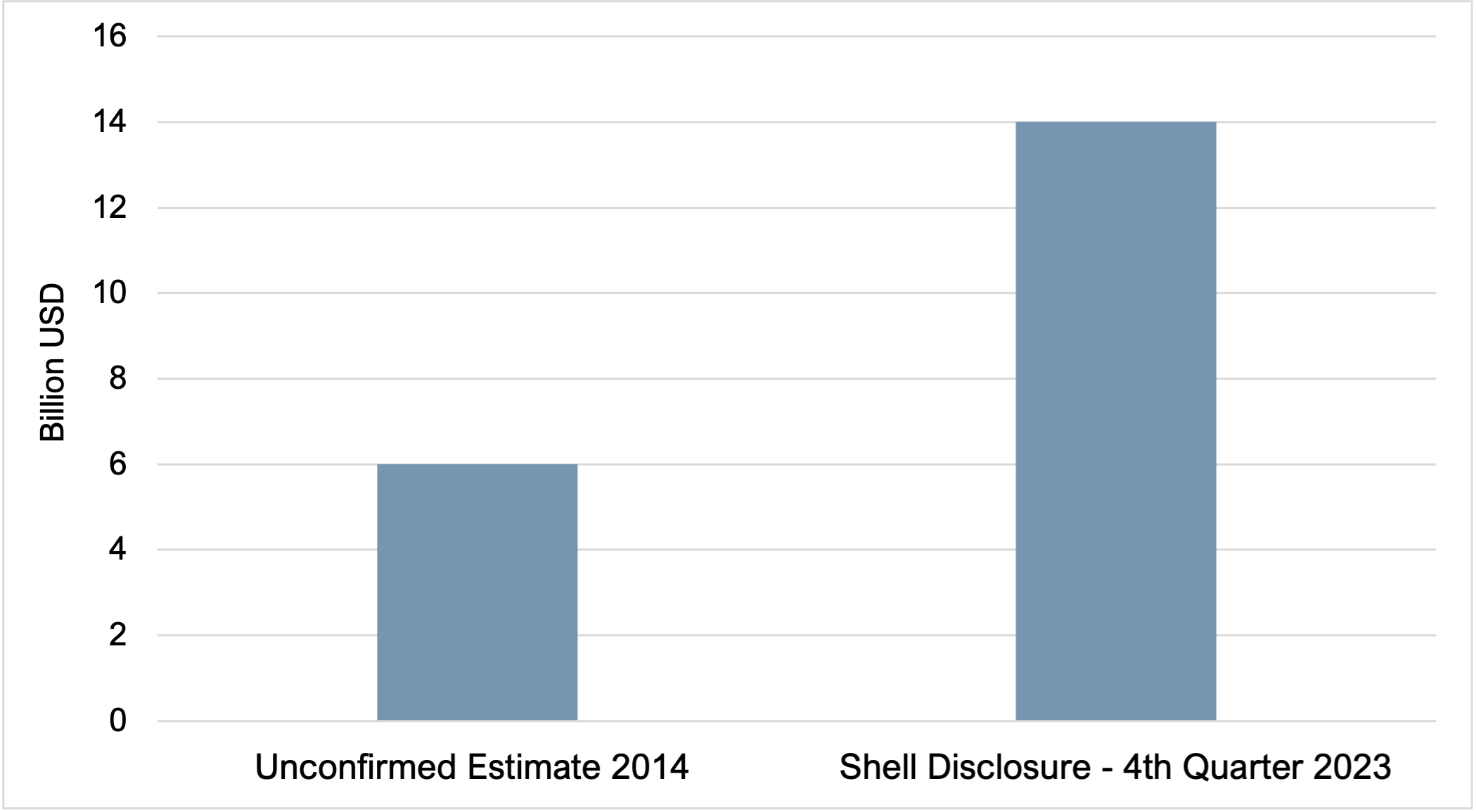

Shell acknowledges $14 billion price tag for petrochemical plant, more than double street estimates

Key Findings

Construction costs for Shell’s petrochemical plant in Pennsylvania were more than double the street-estimated cost.

The plant, which opened in late 2022, has had a troubled operational and financial history.

Problems with the Shell plant highlight the risks of investing in large petrochemical projects.

The costs of a Royal Dutch Shell petrochemical plant have soared 130% past an original ballpark estimate, the company said in its recent fourth-quarter earnings call.

Although the company had been tight-lipped about the expected construction cost, reports surfaced that a Shell-funded analysis initially put the cost at roughly $6 billion. But Shell reported during the call that the actual construction cost of the plant was $14 billion—even higher than the $10 billion that both IEEFA and IHS had estimated in the absence of a confirmed disclosure by Shell.

IEEFA has written extensively about the economic unviability of the plant and why the project should not have come to fruition. Poor plant economics, capital destruction, and competition from recycling made the plant a risky bet for investors, local and state governments, and Pennsylvania residents. Plastics News, which has covered the plant during its development phase and operations, noted that the higher construction cost figure indicates the company faces more of a challenge than previously known to recoup its investment on the project.

Construction Cost of Shell Petrochemical Plant in Pennsylvania

The company also indicated on its earnings call that it would undertake fewer megaprojects in the future, touting “small and replicable is beautiful,” and sending a strong message that big fossil fuel-based projects are financially risky. Noting an October 2021 Standard and Poor’s warning about the risks to petrochemical megacomplexes, IEEFA had suggested in early 2022 that the Shell plant might be the “last hurrah” for major petrochemical development in the United States.

Shell made a final investment decision on the plant in June 2016, and it became operational in November 2022. Since then, the Pennsylvania plant has had a short and troubled operational history. The company was fined for violating air permit requirements, including exceeding emission limits for carbon monoxide, nitrogen oxides and volatile organic compounds, as well as violating restrictions on flaring. The plant was closed temporarily in 2023 to remedy technical issues, and one of its units reportedly has not yet been put into service, although the plant is expected to fully ramp up operations in the spring.

Shell had initially expected $1 billion to $1.5 billion in profits from the plant but now expects it won’t reach its target until 2025-26, adding more setbacks and uncertainty to an already poor economic profile.

The company’s announcement is the most recent evidence of escalating construction costs plaguing the industry. Rising construction costs have been a factor in the delay of Formosa’s proposed petrochemical megacomplex in Louisiana. In 2022, Sasol shareholders successfully sued the company for failing to disclose the increased costs of construction at its petrochemical plant in Lake Charles, La.