IEEFA U.S.: Shell Pennsylvania likely to be last hurrah for big petrochemical complexes

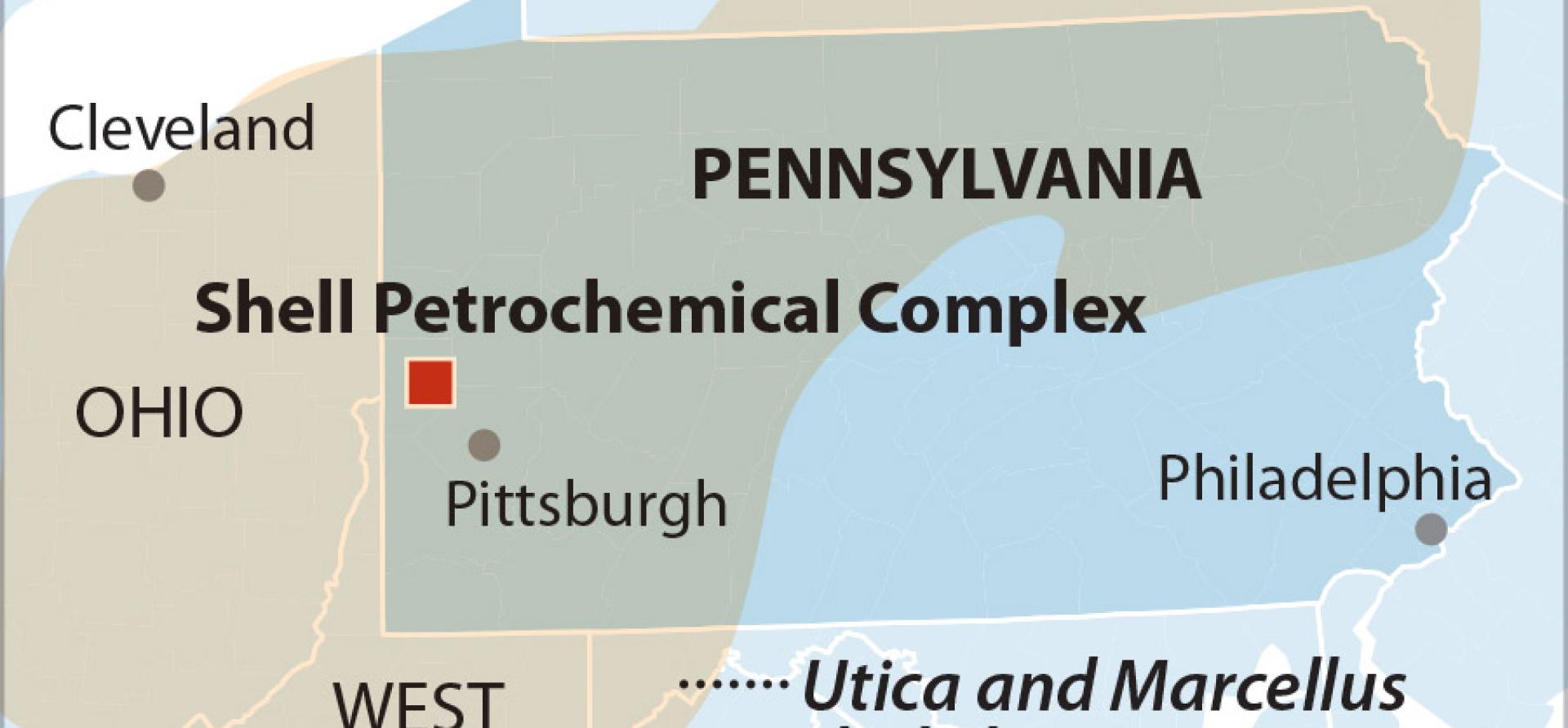

Royal Dutch Shell is completing construction on a huge petrochemical complex in western Pennsylvania.

Over the better part of the last decade, the project has garnered the support of local governments, unions, state and local officials, chambers of commerce and citizen associations. The broader vision for the project spurred talk of a petrochemical hub, using Shell as a catalyst to link together the existing petrochemical companies and natural assets from the region.

As the complex went up, IEEFA has observed several trends that suggests this will be the last petrochemical complex for the foreseeable future.

Here’s why:

Shell’s lack of transparency in Pennsylvania is unlikely to be tolerated again. Shell’s project lacked transparency. It never confirmed to investors how much the plant would actually cost. Although the costs haven’t been disclosed, we know that the project is late. It remains to be seen whether it went over its budget. With the delays caused by the pandemic, investors have no way of knowing whether Shell is meeting its original internal rate of return targets, and if the project was well-managed or not.

Is Shell meeting a reasonable return or will it have to scramble?

Investors, for example, were surprised at Sasol’s budget problems and construction delays at a Lake Charles, La., petrochemical complex, which was finished in 2020. The company made an admirable disclosure, but the problems were by then too big and reported too late to avoid stock losses and a class-action lawsuit.

By contrast, Shell reported almost nothing about the finances of its Pennsylvania plant. A June 2020 IEEFA report concluded that the estimated operating margins would not be at the level supported by some third-party analysts, and even they thought the price issues in the market would trim initial estimates. This kind of hidden finance model—particularly for fossil fuel projects—is not going to be easily repeated.

Plastic resin price fluctuations have been extraordinary over the last few years. Prices in 2021 skyrocketed as the pandemic and other market forces sent prices soaring. As prices are now abating, Shell and other industry stakeholders are considering prices that settle at a new normal that is higher than the very low pre-pandemic prices. The question, which is likely to be a well-kept secret at Shell, is whether rising prices during the construction period go up higher and faster than the prices that will be in play when the doors open in Beaver County. In other words, is Shell meeting a reasonable return or will it have to scramble?

The facility also adds to the parade of new cracker openings since 2017. Although there was minimal discussion about the plans for exporting plastics produced at the Shell plant, it was largely assumed to meet domestic demand. If that is still the case, then the plant’s opening is likely to affect prices and put a little more pressure on early year margins.

The growing mobilizations of citizens and nations taking action to reduce greenhouse gas emissions are clouding the horizon for future mega complexes. Companies are faced with the strong warning by the International Energy Agency not to pursue more oil and gas production. The European regulatory discussion over a new taxonomy for the economy suggests a substantial amount of plastics demand will be reduced. Plastics produced in the future are likely to be made with fewer fossil fuels. Similar exercises driven by climate concerns and the opportunities offered by new technologies are driving investments throughout the world, and all eyes are on China.

Worldwide forces are likely to diminish the market potential for large petrochemical projects

What really struck home, though, was a recent credit analysis by Standard and Poor’s (S&P) on the Formosa Plastics plan to open a new mega complex in Louisiana. S&P noted that the project delays and perhaps even the cancellation would be beneficial to Formosa’s credit rating. Having downgraded the company last year in part because of the plant, it also noted the cumulative impact of rising construction costs, unstable tariff policies, regulatory pressure, public opposition and tight labor markets. Taken together, it makes it all but impossible to move forward with a megacomplex.

The opinion did not limit its analysis to Formosa in Louisiana. The forces that are likely to diminish the market potential for more large petrochemical processes are worldwide. “We believe the four companies (Formosa) will find it increasingly challenging to pursue mega expansion projects in the commodity chemical field because of surging global pressure to reduce carbon emissions as well as chemical and plastic pollution worldwide, just as Formosa Petrochemical has already experienced in the U.S.,” analysts wrote.

The S&P view follows a September 2020 analysis offered by Moody’s, which reminded investors that new fossil fuel projects—pipelines and broader development plans—are not credit positive at the development phase because of growing policy and market uncertainty. The rationale for a project can quickly disappear as market forces, regulators and community concerns combine to undermine what was once seen as a promising opportunity.

Tom Sanzillo ([email protected]) is IEEFA director of financial analysis.

Related items:

IEEFA. IEEFA U.S.: S&P pushes Louisiana project cancellation as credit boost for Formosa

IEEFA. Why External Review of PriceSetting Mechanism for Plastic Resins Is Warranted

IEEFA. Shell’s Pennsylvania Petrochemical Complex: Financial Risks and a Weak Outlook