IEEFA report: Financial risks loom for Shell’s Pennsylvania petrochemicals complex

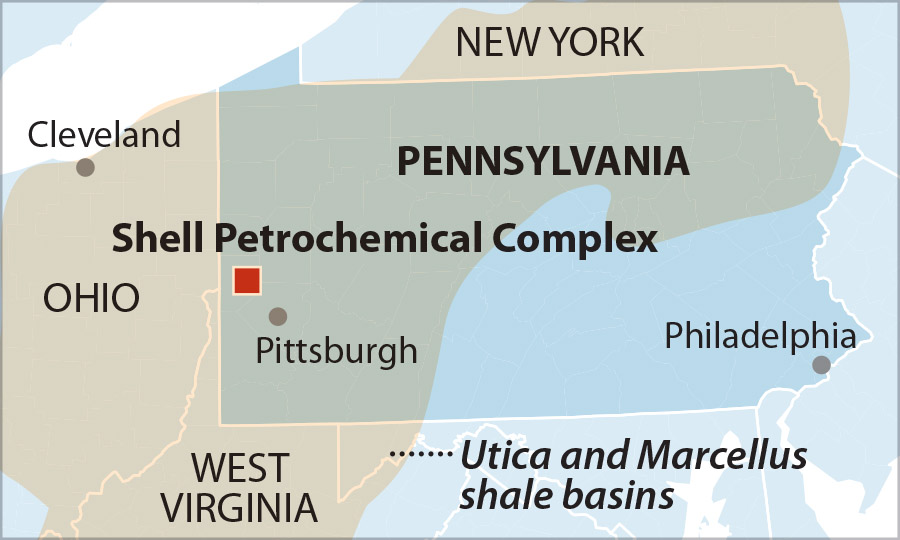

June 4, 2020 (IEEFA U.S.) – The Shell Pennsylvania Petrochemicals Complex being built in Beaver County, PA faces a combination of risks that weaken its anticipated financial performance. Given the critical importance of the complex to the host communities and the state, Shell has an obligation to acknowledge the project’s potential shortfalls. Its public partners, who have opened their doors and provided numerous incentives to bring it to fruition need an explanation, according to a report released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

“The current economic climate poses additional risks for this investment. When the complex opens, its operating environment will test Shell’s partnership with its public partners. This complex will not be as profitable as originally presented. This was true even before the coronavirus pandemic and has significant implications for jobs, taxes and economic spinoffs,” said Tom Sanzillo, IEEFA’s Director of Finance, “Only increased public disclosure by Shell can ensure that problems are faced squarely and with common sense.”

Plans for the complex were formally decided upon in 2016. As the project proceeded through the development process, risks emerged that weaken its financial prospects, including:

- The price of plastics in 2012-2016 was in the $1 per pound range. Today, plastics prices are in the 40 to 60 cents per pound range. This decline poses risks to Shell’s revenues.

- Shell is part of a global effort by large public and private companies to build out production capacity for ethane/ethylene crackers and plastics manufacturing. The buildout has created an oversupply and contributed to lower prices. Industry analysts suggest that the oversupplied market will take several years to adjust, if at all.

- Shell is entering the plastics petrochemical market in resin pellet production, an area where it has no market share. The company can expect stiff competition from companies with market share and weak outlooks. ExxonMobil, LyondellBasell, Dow and Chevron as well as its neighbor, NOVA Chemicals, are all in competition.

- Even before the coronavirus pandemic, the U.S. and the global economy were expected to grow at a slower rate than would be needed to absorb excess supply in a timely manner. Pre-pandemic, IHSMarkit and ICIS, two leading analysts, suggested that the companies involved with capacity expansions would have to cancel projects or reduce profits.

- Over the long term, most plastics investments assume a 3% to 4% annual growth rate in demand. There is also a risk that a substantial portion of new growth will be absorbed by recycled plastics. McKinsey business consultants have placed the growth rate for virgin plastics, like those produced at the Shell complex, to be only 1% over time.

“The profitability of the complex is weakened not by a few negative trends, but by a cumulative set of missed revenue and profit targets, as well as an oversupply of plastics, unpredictable costs, lost market share, diminished growth, and increased competition,” said Kathy Hipple, IEEFA financial analyst and report co-author. “These risks are analytically distinct, but taken together, raise significant red flags that the complex will be less profitable than originally presented. ”

Royal Dutch Shell, the Netherlands-based sponsor, has been experiencing a decade-long decline in profitability. Shell’s market capitalization has declined by almost half and its workforce reduced by 18,000. Since 2013, the company wrote off $33 billion. As this report was being completed, Shell cut its dividend, sold Appalachian gas assets and made plans to cut more jobs.

The report also highlights the problems encountered by Sasol, a South African company that built a similar complex in Lake Charles, Louisiana. Market forces and mismanagement drove up the construction cost forcing expected profits to decline. Recently, a similar project by PTTGC in eastern Ohio, has been put on indefinite hold by the parent company in Thailand.

The IEEFA analysts noted that relevant third-party reports prepared under the auspices of Shell and a booster organization were withheld. These reports support proponent claims of economic benefits. As presented, the limited information from the full reports is misleading.

Limited disclosures from Shell leave the public and investors without basic information, such as how much the plant will cost.

“Boosterism for a project that promises substantial economic benefits is a good sign,” Sanzillo said, “but the information should be credible, available for outside review, and agreed to by the sponsoring company. Unfortunately, these advocacy reports overstated expected profits, understated costs and did not have the full support of Shell.”

Full report: Shell’s Pennsylvania Petrochemical Complex: Financial Risks and a Weak Outlook

A previous version of this report incorrectly stated the source of a news report noting that a $6 billion plant construction cost estimate was never confirmed by Shell. The correct source is the Beaver County Times.

Authors

Tom Sanzillo ([email protected]) is IEEFA’s director of finance.

Kathy Hipple ([email protected]) is an IEEFA financial analyst.

Media contact

Vivienne Heston ([email protected]) +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.