IEEFA Indonesia: PLN’s fractured finances require real leadership

(HONG KONG) – It’s time to pay the piper. That is the message delivered loud and clear by the 2018 accounts that Indonesia’s state-controlled power company finally released this week. Unfortunately for the Indonesian Government, there really are no easy choices left for Perusahaan Listrik Negara (PLN), Indonesia’s power monopoly.

(HONG KONG) – It’s time to pay the piper. That is the message delivered loud and clear by the 2018 accounts that Indonesia’s state-controlled power company finally released this week. Unfortunately for the Indonesian Government, there really are no easy choices left for Perusahaan Listrik Negara (PLN), Indonesia’s power monopoly.

In the past month, PLN’s 2019 has gone from bad to worse. Not only has Sofyan Bashir, PLN’s president director, been detained in connection with a corruption investigation related to a controversial mine-mouth coal IPP, but PLN, the company he has led since 2014, just released a much-delayed set of results that makes it clear that Indonesia’s power sector policies do not add up—even with generous amounts of window-dressing.

PLN showed an unwillingness to tell Indonesian voters that tariffs would need to rise over the next year

WHO WILL PAY FOR BUSINESS AS USUAL? In May 2018, IEEFA released a report analyzing PLN’s financials (PLN’s Coal IPP Funding Gap Suggests Tariffs Must Rise in 2020) . It explored how the company’s reckless coal IPP (Independent Power Producer) strategy could be reconciled with its unwillingness to tell Indonesian voters that tariffs would need to rise by as much as 10 to 20% over the next year to keep PLN solvent enough to avoid scaring international bond investors. Despite the threat to PLN’s credibility, however, senior PLN officials spent the past year claiming that the company’s operations are going smoothly and that any financial shortfall only reflected non-cash foreign exchange movements.

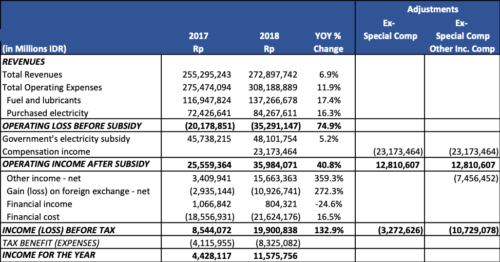

The 2018 results tell a different story. After three warnings from the Indonesian stock exchange, where many of PLN’s bonds are listed, the company has finally released a set of accounts that show more rapid deterioration than anyone had expected. In fact, the numbers tell such a bad story that PLN had to seek special compensation from the Treasury in order to avoid reporting a pre-tax loss. With its debt burden rising, the company also opted for some not-very-subtle window dressing, using an unexpected asset revaluation to take pressure off deteriorating balance sheet metrics.

PLN’s growth strategy risks committing Indonesia to a misguided over-reliance on coal

FIX THE FUNDAMENTALS – Despite all the cosmetic handiwork, PLN’s financials make it clear that the company’s problems reflect a runaway growth strategy that risks committing Indonesia to a misguided over-reliance on high-cost coal IPPs while leaving PLN unprepared to benefit from deflationary new renewable technologies. The list of problems for the next president director should start with fixing PLN’s flawed financial fundamentals.

Structural operating losses – PLN is adding new coal IPP generating capacity with fixed costs at a pace that the company cannot pay for, even with a generous subsidy from the Treasury. Electricity purchases from IPPs rose 16% in 2018. Higher fuel costs also punished PLN in 2018. What was the net result? Last year, PLN’s operating loss pre-subsidy grew 75% versus 2017 as fuel and new IPP payments outpaced slow unit sales growth. The revenue picture was further undermined by the impact of the politically popular tariff freeze in 2017. Without dramatic action, PLN’s operating losses are set to accelerate over the next two years as another round of new coal IPP capacity comes online.

Unsustainable subsidies – Indonesia gained investment grade status in 2017 through the hard work of well-regarded Finance Minister Sri Mulyani, who forged a consensus about the importance of unwinding a long legacy of damaging fuel subsidies. PLN’s annual subsidy fell in line with this policy in 2015 and was held in check until this year when the normal subsidy had to be supplemented with a special compensation payment, effectively increasing the subsidy 56% versus 2017. What was the sticker price for the Indonesia Treasury? The total bill came in at a staggering IDR 71.3 trillion or USD 5 billion. This will be a red flag for the credit ratings agencies. In 2018, PLN’s credit rating was backstopped by assurances that the government would come to PLN’s aid if its financial performance continued to deteriorate. Bondholders may be content with this bailout for the moment, but it signals distress, not stability. PLN and the Ministry of Energy and Mineral Resources (MEMR) will have to expect tough questions about how PLN can regain credibility.

PLN has proven tone-deaf to public concerns and has done little to motivate politicians who will have to manage public frustration

How will needed tariff increases be justified? Now that the hole in PLN’s 2018 financials has been plugged by the taxpayers, it’s only natural to wonder how they will be able to generate some modicum of public support for higher power tariffs. Newly re-elected President Joko Widodo’s strong commitment to infrastructure has public support, but PLN is unpopular in many parts of the country and the rising middle class will want to hear about reforms before being asked to pay more. So far, PLN has proven tone-deaf to public concerns and has done little to motivate politicians who will have to manage public frustration. With new coal IPP costs surging, this is the right time to review the new project pipeline and step back from controversial projects like Jawa 9&10 and mine-mouth projects that bear a resemblance to the corruption-plagued Riau 1 project. Creating a truly transparent and competitive market for new capacity with more reliance on clean energy would be an obvious first step.

Time to break the black box – One of the hallmarks of the Indonesian power sector is that far too many numbers are opaque. Worse still, too many of these opaque numbers play a huge role in shaping policy and PLN’s financials. At the top of our list for a comprehensive review, would be the calculation and use of the BPP (Indonesian acronym for cost of generation) which is the reference price for the average cost of power in different regions. The BPP is used arbitrarily as a proxy for the policy price of future power, with no regard to the reality of subsidies, externalities, or grid and system design considerations. Making decisions about trillions of rupiahs’ worth of future power commitments calls for the best analytics as well as insight into the clean technology options that will shape future power costs. That is not the BPP!

Melissa Brown is an IEEFA energy finance consultant, [email protected]

RELATED ITEMS:

IEEFA Report: Indonesia at the Tipping Point: will it be Coal Lock-in or a Clean Future?

IEEFA Indonesia: 2019 energy plan falls short

IEEFA update: Indonesia hits the reset button on PLN’s expansion plans