IEEFA Indonesia: 2019 energy plan falls short

The much-anticipated Indonesian Electricity Supply Business Plan 2019 (RUPTL) was released last week—surprising the market both with its early delivery and façade of support for more renewables. At a press conference, Minister of Energy and Mineral Resources (MEMR) Ignasius Jonan framed a greener narrative for the new RUPTL, positioning it as an electricity plan that would benefit from having more renewable power generation in the mix. Unfortunately, what was presented looks more like a cut-and-paste planning exercise that does little to address fundamental problems with Indonesia’s over-reliance on coal-fired generation and the high cost of rigid capacity payment structures.

Jonan proudly announced an increase of 1.8 GW of installed renewable power capacity in the ten-year plan, bringing new renewable capacity to 16.7 GW as compared to 14.9 GW in the previous RUPTL. The Minister also emphasized that the 0.4 percentage point cut in the demand growth forecast to 6.4% for the 2019 to 2028 period answers critics’ concerns about the reliability of past RUPTL demand estimates. What is just as notable is that this 6% cut in demand seems to have provided the impetus for much bigger cutbacks in planned grid expenditures for transmission and distribution (T&D) including additions for network and distribution substations.

| Description | Unit | RUPTL 2018-2027 | RUPTL 2019-2028 | % of changes |

| Electricity Demand Projection | % | 6.86 | 6.42 | -6% |

| Additional Generation Capacity | MW | 56,024 | 56,395 | 1% |

| Total Transmission Plan | kms | 63,855 | 57,293 | -10% |

| Total Network Substations | MVA | 151,424 | 124,341 | -18% |

| Total Distribution Plan | kms | 526,390 | 472,795 | -10% |

| Total Distribution Substation | MVA | 50,216 | 33,730 | -33% |

| Energy mix target by 2025 | % | Coal 54.4 New and RE 23.0 Gas 22.2 Diesel 0.4 |

Coal 54.6 New and RE 23.0 Gas 22.0 Diesel 0.4 |

Experts study the RUPTL for a reason. It is a document that often hides consequential details in the fine print. The 2019 RUPTL is no exception. IEEFA found that, although the numbers that the Minister highlighted for the press were correct, the official narrative is not. This is certainly the case for the new demand growth forecast. It was indeed slightly lower than the previous plan, but in reality, electricity growth in 2018 was only 5.1%. The fact that demand growth in the last five years (2013-2018) averaged only 4.6% cannot justify the continued use of an overly ambitious assumptions used in the RUPTL. It would appear that MEMR is not addressing this persistent over-estimation because of reliance on forecasts based on a multiplier of GDP growth. This makes it impossible for state energy company PLN (Perusahaan Listrik Negara) to take energy efficiency into account when estimating demand growth—a decision that results in excessive baseload additions.

A similar lack of electricity system planning is seen in the forecast for the buildout of the grid. Projections for T&D and substations show no evidence of correlation between investment in T&D and in renewables energy generation. The decision to cut back investments in the system do not appear to reflect any system requirements to cater for more penetration of intermittent renewables in the future. Modernizing deteriorating grid infrastructure is key to securing improved grid flexibility on top of better grid management. Rather than learning from other countries’ experience in developing more flexible grids, the planning in the new RUPTL looks outdated and appears to lock in baseload coal with little ambition for adding greener alternatives.

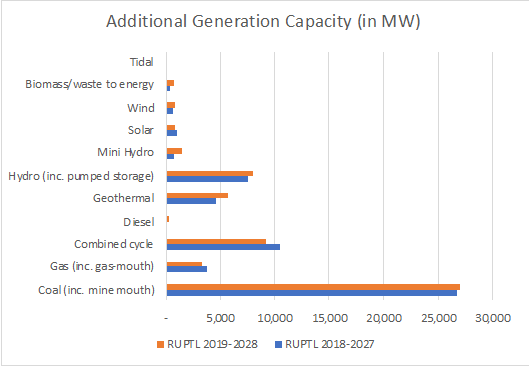

In terms of planning for additional generation capacity, the RUPTL remains anchored in old technology and is overly reliant on fossil fuels. As reflected in the graph above, the generation mix is still dominated by coal, and there are only minimal differences in the generation mix. What is more concerning is the fact that several mega coal power projects that were supposed to be suspended or cancelled by the government due to the depreciation of the rupiah and weakening demand in September 2018, seem to have re-appeared in the 2019 RUPTL. For example, PLTU Java-3, PLTU Java-9 and Java-10, are now back in the document, despite a claim the Minister made last year about not adding any new coal power plants on Java island.

Unsurprisingly, in terms of renewables, new RUPTL allocations are dominated by large-scale geothermal and hydro. However, it is worth noting that mini hydro is now forecast to grow more rapidly from a low base, with a sharp 90% increase compared to last year’s allotment. By contrast, solar which has proven to be cost-competitive in other Asian markets, is almost totally overlooked in the RUPTL and was cut back by 13% in the current plan. This translates into an expected increase of only 908 MW of solar within the next 10 years.

Given the trajectory of least-cost generating options in global markets, Indonesia appears to have embraced what can best be described as a contrarian understanding of power trends with the decision to add less than 1 GW of solar over the next decade. This coal-heavy diet contrasts with Vietnam’s ambitious plan to add 3 GW of solar just for the 2019-2020 period.

The final surprise in the RUPTL was Jonan’s suggestion that small-scale renewables and gas developers would be free to propose projects of less than 10 MW directly to PLN despite not being included in the RUPTL. According to Jonan, as long as PLN approves and the grid can dispatch the additional power, these projects could move forward on an as-needed basis. The idea here is to encourage more rapid additions of small-scale capacity.

If taken at face value, this proposal appears to be a step in the right direction. Unfortunately, although the nod toward smaller local projects will undoubtedly be well received in an election year, ad hoc negotiations between PLN and small developers will likely lack the much-needed transparency and accountability that are crucial for reforming the Indonesian electricity sector. Industry practitioners with experience of negotiating with PLN are generally cautious about PLN’s closed-door negotiations. Instead of encouraging innovative strategies for new capacity additions, this could result in a grab bag of sub-scale projects with the potential to distort the market. Leaving all the decision-making power to PLN, which can often be subject to local interests, is not something to be endorsed without a new policy on oversight.

In addition, by endorsing ad hoc renewables projects rather than committing to system-level market solutions, it seems likely that there may not be enough coordination with the T&D investments to provide the needed support for renewables. This will particularly be felt in places where solar or wind resources are plentiful and able to attract competitive projects, but the existing grid is too inflexible to absorb new capacity efficiently.

It has been suggested by many observers that the catalyst for MEMR’s new enthusiasm for small-scale renewables and biofuels projects is a reflection of the recent presidential debate. Given the upsurge in public interest in cleaner energy, it is understandable that the government is showing more enthusiasm for greener solutions. However, MEMR’s embrace of piecemeal strategies is likely to make the system’s current imbalances even worse. The electricity sector needs to move towards more transparency and accountability. This requires more coordination and integrated national planning that involves not only PLN and MEMR, but other relevant ministries as well, such as the Ministry of Industry, the Ministry for Public Works, Ministry of Finance, and Ministry of National Development Planning.

Jonan’s supportive words about clean energy are always welcome but the numbers in the RUPTL speak louder than words. The logic of the 2019 document is simply PLN’s business as usual scenario. As a result, Indonesians hoping for new energy solutions that are becoming the norm elsewhere in ASEAN will have to wait for the 2020 RUPTL to see if Indonesia can change course and keep pace.

Melissa Brown, IEEFA Energy Finance Consultant, [email protected]

Elrika Hamdi, IEEFA Energy Finance Analyst, [email protected]

Related Items

IEEFA report: Indonesia’s solar policies – designed to fail?

IEEFA update: Indonesia hits the reset button on PLN’s expansion plans

IEEFA Indonesia: The case for modernizing national energy policy