IEEFA: Renewables continue to break records despite COVID-19

8 June 2020 (IEEFA Australia): Despite the devastating impact of COVID-19, during the months of April and May, renewable energy continued to break records, according to the Institute for Energy Economics and Financial Analysis (IEEFA).

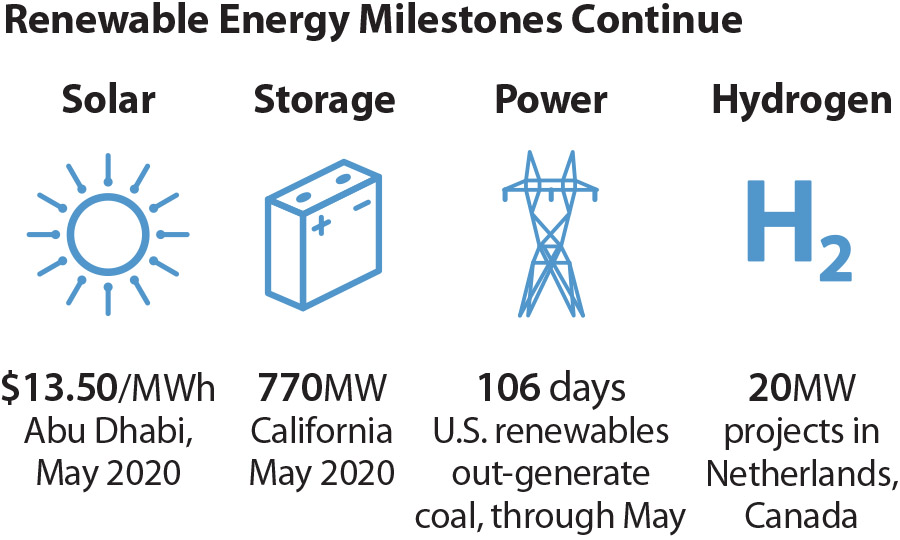

Most strikingly, April 2020 saw the Emirates Water and Electricity Company (EWEC) award a 1.5 gigawatt (GW) solar tender to French energy group EDF and Chinese solar company JinkoPower. The consortium offered US$13.50/MWh for the power generated at Al Dhafra, Abu Dhabi.

This result is 13% below a January 800 megawatt (MW) solar award by the Qatar General Electricity and Water Corp (Kahramaa) at a then record low of US$15.60/MWh to Total and Marubeni Corp, highlighted in the report Renewables Continue to Break Records Despite COVID-19 Impacts.

Author Tim Buckley, IEEFA’s director of energy finance studies South Asia says one of the most relevant impacts of COVID-19 has been the collapse of interest rates in global developed markets collapse.

Renewable energy continued to break records

“For solar, the tariff required is a direct function of the solar resource, the capital cost of installation, and the required rate of return for debt,’ says Buckley.

“With dramatic falls in the capital cost of solar (driven by a 20% fall in solar module costs in the last year) and dramatic falls in the cost of funding, the two most important inputs into the solar tariff have fallen hugely relative to even two years ago.

IEEFA foresees increased stranded thermal asset risks.

“As such, the months of April and May saw developments in a number of major renewable energy projects. These range from California awarding seven projects totalling 770MW of battery storage to Siemens Gamesa announcing its launch of a new record 14MW offshore wind turbine, for commercial deployment in 2024.”

As renewable and battery costs continue to decline, IEEFA foresees increased stranded thermal asset risks.

Unsurprisingly, available capital has continued to restrict, with six new or tightened coal exit policies announced by globally significant financial institutions over April to May, taking the 2020 to-date tally to 37 announcements.

Additionally, BlackRock completed its thermal coal miner divestment in May 2020 and put KEPCO on notice over the inconsistency of the Korean utility retaining plans to invest in new coal-power plants.

‘Despite, or maybe in acknowledgement of, the global pandemic, April and May 2020 have seen global momentum toward energy transition continue apace,” says Buckley.

Read the report: Renewables Continue to Break Records Despite COVID-19 Impacts.

Media Contact: Kate Finlayson [email protected] +61 418 254 237

Author Contact: Tim Buckley [email protected] +61 40 8102127

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org