DISCOMs continue to exceed their 3% fiscal deficit limit, highlighting need for state oversight

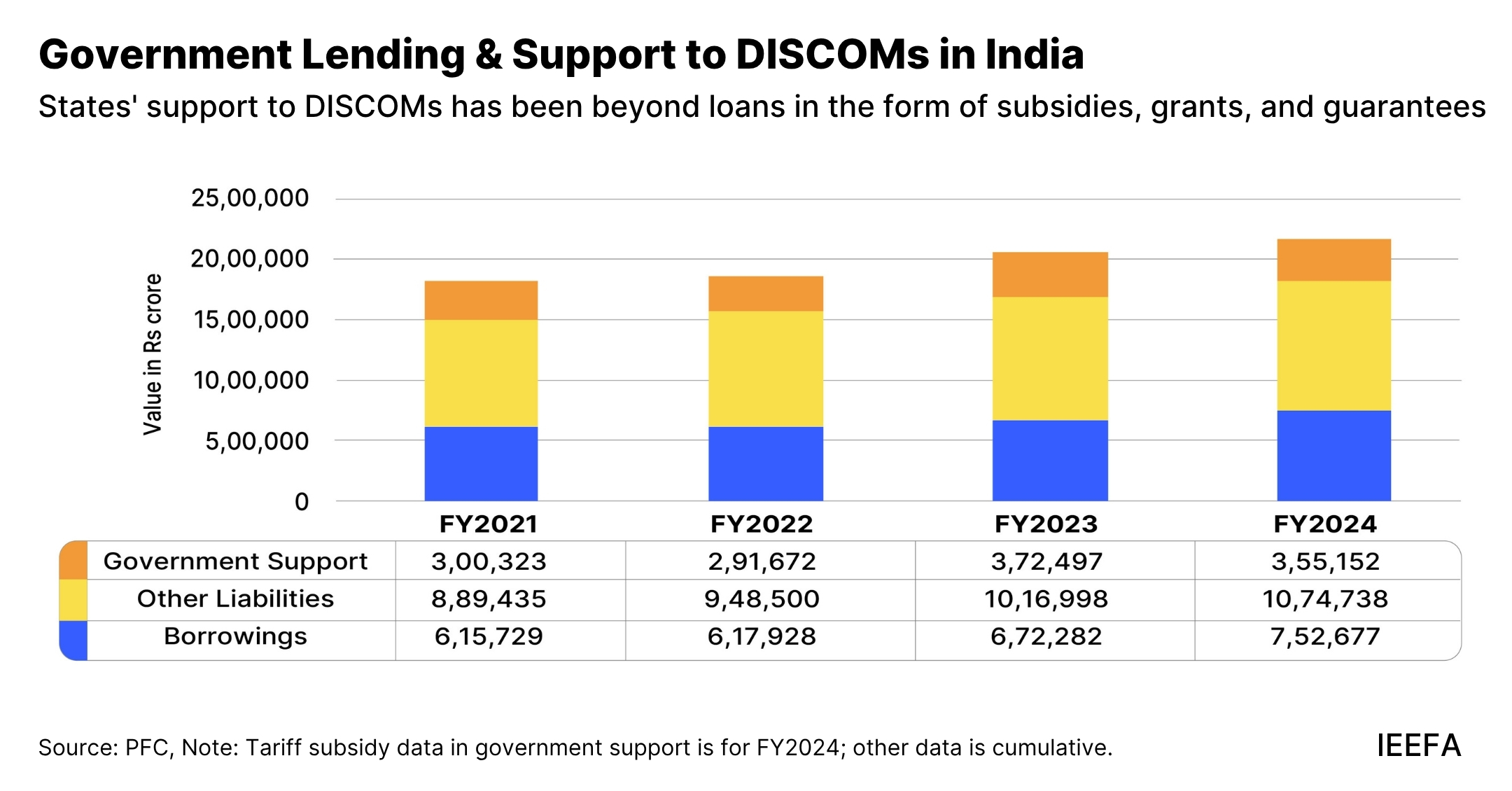

Besides direct lending, states continue to fund DISCOMs through grants and subsidies, but ongoing financial losses suggest the need for enhanced fiscal discipline and operational oversight.

Key Takeaways:

According to the recommendation of the 15th Finance Commission, states are required to maintain their fiscal deficit within 3% of their Gross State Domestic Product, and an additional fiscal deficit limit of 0.5% is allowed if reforms are undertaken in the power sector. In FY2025, the combined fiscal deficit of Indian states was 3.2%, with 11 states exceeding the 3% limit.

Energy—the sixth largest sector—accounts for around 5% of state spending, most of which goes towards subsidies and grants for DISCOMs. Yet, a sustainable business model remains elusive, eroding state accountability, and resulting in mounting losses and debt.

Subsidies should be limited to the power sector, unless coupled with reforms that address structural issues leading to technical, commercial and financial losses in DISCOMs.

Consolidating all DISCOM lending and other financial support—includingloan guarantees, bailout packages, grants and subsidies—while ensuring timely reporting of data and accounts can bring in greater transparency and strengthen accountability.

30 September 2025 (IEEFA South Asia): An analysis of state finances reveals that many state governments in India are facing a revenue gap, which has been increasing over the years, states a new briefing note by the Institute for Energy Economics and Financial Analysis (IEEFA).

The note highlights that while fiscal deficit for states has been capped at 3% of the Gross State Domestic Product (GSDP), as per the recommendation of the 15th Finance Commission, many states have overshot this limit due to several reasons, including hidden debts, guarantees, and subsidies to DISCOMs.

As of June 2025, DISCOMs owed generators Rs581,330 crore (US$6.78 billion), creating a severe liquidity crunch for independent power producers, and in turn, stifling credit flows into the sector.

The economic slowdown in FY2020 and FY2021 dragged the revenue receipts of states, which pushed them to increase market borrowing. The outstanding liabilities of states stood at 27.6% of the GSDP by the end of FY2024, much higher than the prescribed limit of 20% by the Fiscal Responsibility and Budget Management Committee. In FY2023, the combined outstanding guarantee of 27 states stood at 3.9% of their GSDP.

“Clear accounting of these liabilities and stricter fiscal discipline is important to hold the states accountable and plan sustainable investment,” says Vibhuti Garg, Director – IEEFA South Asia and a co-author of this briefing note.

The note emphasises the need for state governments to lead reforms and be directly accountable for improving the flow of finance in the power distribution sector.

“Stronger oversight and consequences for non-performance by DISCOMs may also be necessary. Government funding needs to be tied to compliance and, as a condition precedent, for the release of any central government funds,” says Labanya Prakash Jena, consultant, IEEFA, and one of the authors of this note.

“A borrowing limit for the power sector should be determined based on the overall share of GSDP after accounting for all forms of state support. Power sector financing burden on the state due to unviable tariffs and operational inefficiencies are crowding out funds for infrastructure and socio-economic development,” says Gaurav Upadhyay, energy finance analyst and a co-author of this note.

The authors emphasise that for monitoring and evaluating state DISCOM finances and lending by the state government to the power sector, improving transparency, and timely reporting of data and accounts are important.

“Timely data transparency, in line with Indian Accounting Standards, will allow state governments to take prompt action to limit their exposure to loss-making sectors and utilise funds in other sectors that help the government advance social, economic and equity goals,” notes Garg. Measures such as Direct Benefit Transfer for electricity subsidies could further reduce revenue gaps, prevent subsidy arrears and improve transparency.

“The government can consider linking states’ fiscal borrowing and access to central funds to the performance ratings of their DISCOMs. An index of loans, guarantees, and subsidies can track each state’s exposure, and better-performing utilities would get more fiscal space,” says Jena.

Adopting “green budgeting” could also let states re-direct subsidies and budget support from inefficient power distribution operations towards clean energy, grid modernisation, and demand management, the note highlights.

Although there is no silver bullet to improve the financial sustainability and viability of DISCOMs, strengthening state-level regulations and prioritising transition plans can accelerate the shift to cleaner electricity.

Read the briefing note: Increasing State Government Accountability: Financial Transparency is Key

Media contact: Prionka Jha ([email protected]); +91 9818884854

Author contacts: Vibhuti Garg ([email protected]); Labanya Prakash Jena ([email protected]); Gaurav Upadhyay ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)