2023 Year in Review: Accelerating the Global Energy Transition

Throughout the year, IEEFA worked to accelerate the transition to a more diverse, sustainable and equitable energy economy, at the local, regional and global levels. Here are some highlights:

Global | Americas | Asia | Australia | Europe | South Asia | Energy Finance Conference 2023 | In the News | IEEFA People

GLOBAL

IEEFA's first ever Global LNG Outlook, a collaborative project by ten analysts across four continents, warned of an LNG infrastructure overbuild in Europe, Asia and North America that would likely lead to a gas glut as more facilities come online over the next three to four years. This report was our most widely read, with over 50,000 pageviews since its release in February. Initially, IEEFA was a lone voice among energy experts however, a shift in perspective gradually took place culminating in the International Energy Agency’s 2023 Global Energy Outlook in October that mirrored our analysis.

IEEFA's work globally has provided much needed scrutiny and fact-based opposition to the exaggerated claims being made by proponents of Carbon Capture and Storage (CCS) technology. IEEFA experts were invited to brief EU and other delegates on CCS in preparation for COP28 in Dubai. Countering widespread misinformation about fossil fuels and carbon capture, as well as advancing the business case for solutions that rely on solar, wind and battery storage, will continue to be top priorities for IEEFA in 2024.

AMERICAS

In 2023, we warned against expanding LNG infrastructure and demonstrated how U.S. LNG exports cause domestic natural gas prices to rise. Our analysts also shed light on the shortcomings of blue hydrogen as a climate strategy. An in-depth IEEFA report established that the technology cannot meet the U.S. Department of Energy's own definition of "clean" hydrogen and would be a waste of taxpayer dollars.

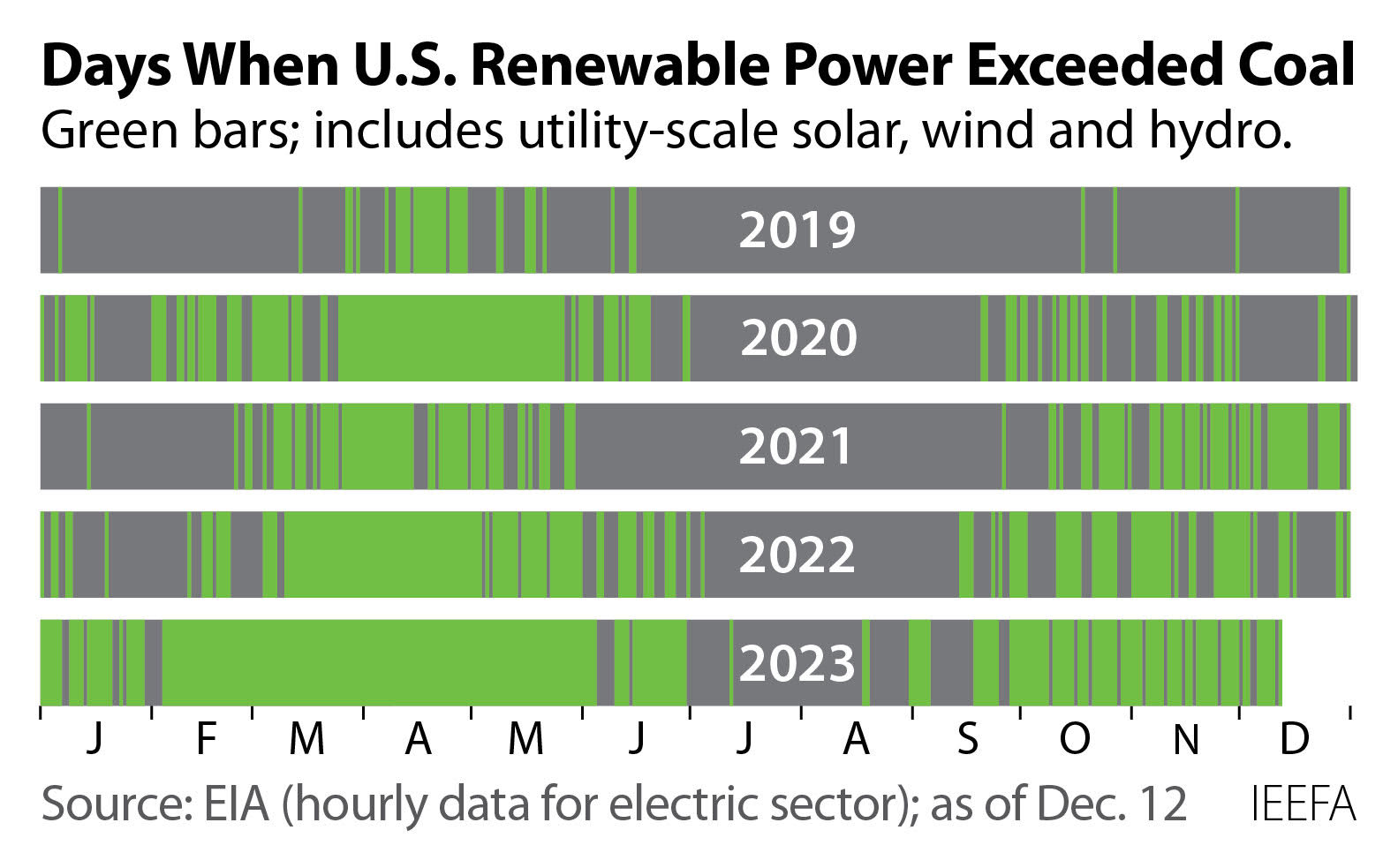

In the U.S. power sector, IEEFA underlined the unreliability of fossil fuel-generated power, which became obvious during major winter storms in 2022-23. We also illustrated the important role solar power played in meeting electricity demand in Texas during its record-breaking summer heat wave. On the nuclear front, our research showed how costly the planned NuScale small modular reactors (SMRs) would be, which ultimately contributed to a major project's cancellation.

IEEFA provided accessible research to fortify the business and fiduciary case for divesting from fossil fuels. We analyzed the Royal Bank of Canada’s inadequate policies to address climate impact, and our report was submitted to Canada’s Competitive Business Bureau in connection with an investigation into alleged greenwashing practices. Also, IEEFA produced an analysis of the benefits of divestment that was circulated to the British Columbia Teachers’ Federation, whose members passed a resolution in favor of divesting their pension fund from fossil fuels.

In Puerto Rico, the Financial Oversight and Management Board (FOMB) finally recognized what IEEFA has been saying for the past decade, namely, that the publicly-owned utility cannot support repayment of $9 billion in legacy debt. As we noted in a commentary, a new proposal for $2.5 billion, although an improvement, should be reconsidered since it will also raise rates and place an unsustainable burden on ratepayers. Puerto Rican households are adding solar energy to their rooftops at a remarkable rate of 2,500 per month, and we recommended increased investment in solar which will save billions and provide more reliable electricity for island residents.

ASIA

IEEFA Asia conducted various analyses highlighting the challenges and risks associated with continued reliance on fossil fuels and demonstrating the potential of renewable energy in the region.

After a series of unsuccessful attempts to fund a major solar energy project in Pakistan, IEEFA recommended raising the benchmark tariff range. The National Electric Power Regulatory Authority agreed to set higher rates in future auctions, although not until the country had achieved greater economic stability and debt management, as recommended by IEEFA.

In the Philippines, the energy transition is being held back by plans to build new LNG infrastructure and other fossil fuel-based projects, even though the country was rated fourth in the world for solar energy potential by BloombergNEF.

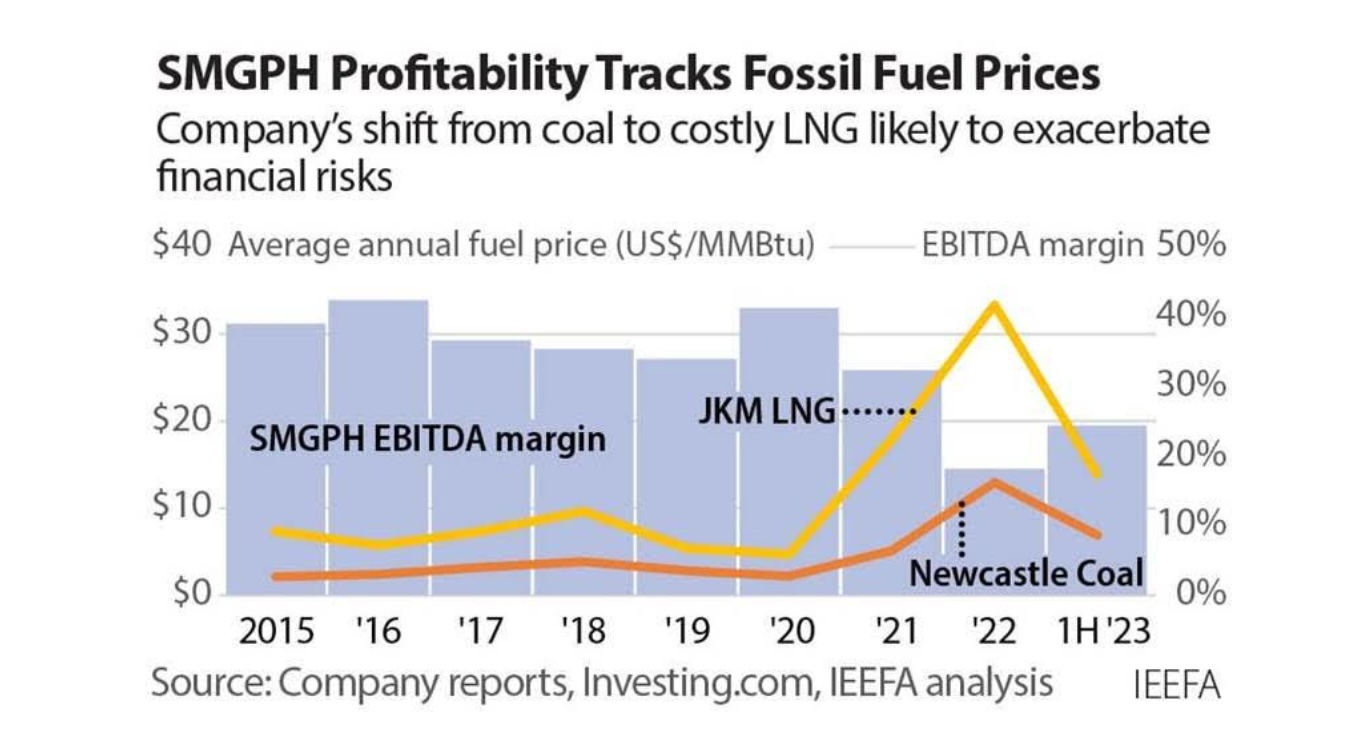

IEEFA urged San Miguel Global Power Holdings Corporation (SMGPH), the country’s largest power provider, to diversify away from coal and gas and invest more in renewables. We produced a fact sheet to amplify these recommendations and make them more accessible. SMGPH said it was planning to invest more in renewable energy, including a network of 32 battery storage stations totaling 1,000 MW.

In Indonesia, we produced a wide range of analyses focused on the country's coal transition and related policies, and our team has been engaged directly with negotiators and government participants from the International Partners Group; private sector participants from the Glasgow Financial Alliance for Net Zero (GFANZ) and financial institutions; philanthropies; and with Indonesian government representatives from the Just Energy Transition Partnerships (JETP), both in groups and in one-on-one discussions. This work has addressed key hurdles to reaching agreement, the role of multilateral development banks in transition plans, and the means and methods for mobilizing private sector investment and financing in JETP projects.

AUSTRALIA

Analysts from IEEFA’s Australia team showed how steelmakers from around the world can decarbonize production processes by using green hydrogen rather than relying on metallurgic coal and problematic carbon capture, usage, and storage (CCUS). Our analysis of the technology choices faced by steel and mining giant ArcelorMittal was covered widely by media. We also showed how Australia's export market for coal—now the largest in the world—is likely to decline as the steel industry adopts greener technology. Our research was referenced in Reclaim Finance’s report on metallurgical coal financing. In addition, Banktrack launched a call to banks to cease financing metallurgical coal.

Team Australia’s work on distributed energy resources (DER) spurred a stronger focus on DER in the country’s power sector. We published a commentary that showed the potential for saturation DER to decrease energy costs for consumers by transforming the whole system’s load profile. We later published comprehensive DER policy recommendations that were shared in 15 briefings with energy ministers' advisors and government officials. This research was also presented at six conferences and webinars. The Federal Government is now planning to create a DER roadmap, a DER expert taskforce, and to consider how to address DER technical standards.

IEEFA’s in-depth report on the costs and adverse impacts of a proposal to develop a large natural gas field and promote petrochemical operations in Northern Australia helped spur the Senate to launch an investigative inquiry into the project. IEEFA has produced testimony for the docket of the investigation.

EUROPE

IEEFA’s European LNG tracker was updated in November and received wide media coverage across the continent, including articles in Le Figaro, Tagesspiegel and La Vanguardia. The main message was that Europe is overbuilding LNG import infrastructure, which will likely far outstrip demand. Our LNG demand forecast for Europe was also validated in the IEA’s 2023 energy outlook, with their scenarios confirming our analysis.

IEEFA recently highlighted that more Russian LNG is passing through Europe, especially via Belgium and France (covered by the Financial Times, among others). As a result, Ukraine added Belgian gas operator Fluxys to its list of “international sponsors of war." This issue was first identified by IEEFA back in March 2022.

In the runup to COP28, IEEFA was brought in alongside other experts to brief EU and other delegates on carbon capture and storage (CCS). This invitation recognized IEEFA's cutting-edge research in the area, which was expanded this year by multiple CCS reports, e.g. on the risks and uncertainties of storage and the realities behind two CCS "poster child" projects in Norway. Our research was referenced in this policy briefing by the German Environment Agency.

IEEFA added two new analysts over the summer to cover sustainable finance issues in Europe. Already the team has had its research covered in trade publications and has been involved in multiple standards-setting consultations. We also published an interactive EU regulation explainer on the IEEFA website for people less familiar with the topic.

We published some key reports on the energy transition in Europe’s power sector, including two highlighting that German coal utility STEAG was quietly reneging on its climate commitments while transferring the company to foreign private equity ownership, and another raising the issue of weak oversight of Finland's state-owned energy company, Fortum, whose acquisition of Uniper ultimately cost Finnish taxpayers 1,700 euros per household. The latter was covered by Finland's top four newspapers (by circulation) and on social media, as well as state-owned media company YLE.

SOUTH ASIA

IEEFA’s South Asia team engaged with the Ministry of Finance as part of India's G20 presidency. A report co-authored by IEEFA, Building Capacities to Accelerate Sustainable Finance and Manage Climate and Sustainability Risks, was accepted as a key input paper for India's G20 Presidency, and we organized several roundtables.

The Reserve Bank of India (RBI) in its recent monthly bulletin referred to IEEFA's article on Sustainability Linked Green Bonds (SLGB), which was also published by the World Economic Forum. The RBI article discussed our proposed solution in detail. This solution was also cited by GFANZ (a coalition of financial institutions) in their report on Financing the Managed Phaseout of Coal-Fired Power Plants in Asia Pacific.

IEEFA's report, Charting an electricity sector transition pathway for Bangladesh, was cited several times in research into Bangladesh's electricity sector by a public university and also in a policy brief on the renewable energy transition prepared by the Youth Policy Forum.

In November 2023, the Indian government announced mandatory blending of compressed biogas in segments of the city gas distribution network (CGD). IEEFA in its report, Biogas: A Possible Solution for India’s Energy Security and Decarbonisation Goals, noted that if incremental blending is introduced in the CGD, India could save up to US$29 billion by 2030 (for background, see Argus Media article).

ENERGY FINANCE CONFERENCE 2023

IEEFA's annual energy finance conference, Pathways to Accelerate the Global Energy Transition was held in San Francisco, California (June 20-22) bringing together over 360 campaigners, advocates, philanthropists and journalists from 34 countries to participate in a series of panels, meetings and side events. Speakers explored the current outlook for oil, gas/LNG, CCS, hydrogen and renewables and the status of the energy transition across regions. There were breakout sessions on green steelmaking, agrichemicals, blue hydrogen, coal, and SMRs as well as on the state of the energy transition in emerging economies. A concluding plenary took a deep dive into financing green energy solutions. Panelists agreed that despite a rising backlash against environmental-social-governance (ESG) investment, particularly in the United States, banks and global financing institutions will continue to offer an increasing number of greener, more sustainable energy investment products and opportunities.

IN THE NEWS

In 2023, average monthly pageviews on the IEEFA website increased 213% over the same time period in 2022. By September, newsletter subscriptions had increased by 24% over the previous year. IEEFA also introduced four new regional newsletters: two focused on South Asia’s power sector (POWERUp and PowerPulse), and newsletters covering Asia and Australia. Our LinkedIn followers increased by 38% (20,169) and X (formerly Twitter) by 9% (13,155).

IEEFA's reports and content are covered extensively and our analysts are cited frequently by mainstream, trade and environmental news outlets across the globe. For highlights of this coverage, visit the In the Media page of our online newsroom.

IEEFA PEOPLE

Our organization continues to flourish and we expanded our team of energy finance analysts in 2023 by hiring talented and experienced professionals to increase our impact across the globe, including in Bangladesh, India, Singapore, Korea, Indonesia, U.K., Australia, Canada, and Europe. Areas of expertise included topics such as energy transition policy, renewable energy finance, oil and gas infrastructure and markets, and power sector dynamics. In addition, we’ve strengthened our communications and support teams, increasing organizational effectiveness, outreach, and research dissemination to those best able to leverage it. See our Who We Are page for a complete listing of staff bios. We are grateful to the board members of IEEFA and our affiliate IEEFA Australia for their leadership and unflagging commitment to our mission.