Stakeholder concerns about British Columbia Investment Management Company (BCI)’s fossil fuel investments do not appear to be letting up anytime soon

Key Findings

For the second consecutive year, the B.C. Teachers Federation (BCTF)—a key pension fund client—voted overwhelmingly in favor of a resolution directing the union to push for full divestment of its $38 billion pension plan from fossil fuels.

British Columbia Investment Management Co. (BCI) is being sent a message. Will they respond?

For the second consecutive year, the B.C. Teachers Federation (BCTF)—a key pension fund client—voted overwhelmingly in favor of a resolution directing the union to push for full divestment of its $38 billion pension plan from fossil fuels.

The March vote marked the second such resolution passed by BCTF members in as many years. At its 2022 annual meeting, a similar resolution was passed calling for the union to promote divestment and allocate a greater portion of investments using environmental, social and governance (ESG) criteria.

But a lack of progress after the 2022 vote likely led to the teachers going a step further. The latest resolution sets a 2028 deadline for divestment implementation; suggests that BCTF appoint trustees responsive to the financial risks of climate change; and requests union leadership provide quarterly updates on divestment progress.

B.C teachers are not the only pension plan clients of BCI that have expressed concern about the firm’s multibillion-dollar fossil holdings in recent years.

The Union of B.C Municipalities (UBCM)—whose members are beneficiaries of a $74 billion pension plan that’s also managed by BCI—called for a report in 2015 to re-evaluate the long-term financial sustainability of their pension fund in light of risks associated with its fossil fuel investments.

A report was presented, but BCI justified its investment in fossil fuels and continued investing billions of the municipal union’s assets in fossil infrastructure and companies. Dissatisfied with the status quo, UBCM (which represents 400,000 local government employees in B.C.) followed up in 2020, with another resolution calling for a plan to fully divest the pension plan from fossil fuels.

The resolutions send a clear message to BCI and union leadership that their members and pension beneficiaries are serious about the divestment of their pensions and intend to hold those in charge accountable.

Although these resolutions may make their position clear, the structure of the public pension system in B.C is such that trustees and investment managers are not mandated to act solely in accordance with the wishes of clients. Being bound by fiduciary law, trustees must take other factors into consideration – foremost of which is whether such initiatives are aligned with the best financial interest of beneficiaries.

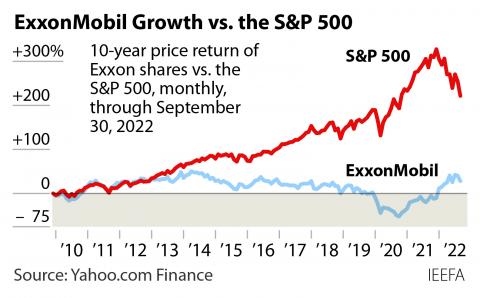

IEEFA has conducted extensive research on this topic and released a number of reports showing that divestment and decarbonization initiatives are in the best financial interests of beneficiaries. With more than $40.51 trillion committed to divestment strategies worldwide, it appears that more than a few people agree.

IEEFA suggests that BCI introduce a line of fossil-free funds across each asset class to complement its existing offerings. This straightforward solution would give individual pension plan clients the freedom to allocate assets into fossil-free pools as required and decarbonize at their own pace. This alternative is easily implementable, cost-efficient and would likely satisfy the current wishes of union membership.

BCI’s case is by no means unique. Financial institutions in Canada and elsewhere are increasingly being met with demands from stakeholders to take a more proactive approach to tackling the climate change problem. Asset managers, lenders and insurers are being asked to move beyond merely reducing their operational footprint but to hold their clients and investees responsible for their emissions.

While engagement with companies is a logical first step, institutions must also demonstrate a willingness to withdraw service or capital from operators that do not follow through—or are structurally incapable of following through—with emission reduction pledges and climate commitments.

In the journey towards achieving net zero, management and trustees who ignore stakeholder requests and decline to re-evaluate their dealings with the fossil fuel industry will likely continue to feel the heat.