Financial case for pensions to dump fossil fuels in California is strong despite resistance

Key Findings

Information from two giant California pension funds, CalSTRS and CalPERS, has been unreliable, with distorted claims.

Pulling money from fossil investments has not hurt the pension funds, even amid a temporary rise in oil and gas prices caused by war in Ukraine.

The California Legislature should be provided with reliable information to make an informed vote on pension fund divestment from fossil fuels.

A new legislative session will see renewed debate on pension fund divestment from fossil fuels—a policy issue that the California Public Employees’ Retirement System (CalPERS) and the California State Teachers’ Retirement System (CalSTRS) have an ongoing fiduciary duty to consider.

CalPERS and CalSTRS, which have historically opposed strong divestment policy whether mandated or not, will again be asked to take a position. Previous debates were littered with distorted assertions from the two funds that divert attention from divestment facts. The public and fund beneficiaries deserve better.

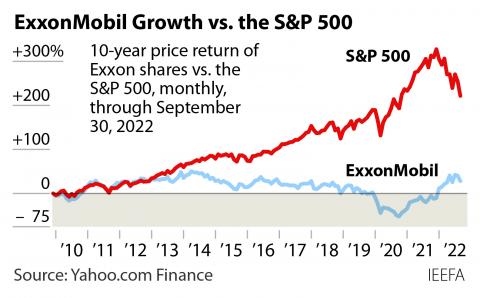

The oil and gas industry has been experiencing a long-term downward trend. Fossil fuels made up 29% of the Standard & Poor’s 500-stock index in 1980. Today, they account for 5%, after falling to 2% in 2020.

Although Russia’s invasion of Ukraine drove up oil prices, the disruption provides no prudent basis for long-term investment in the fossil fuel industry.

Despite an unprecedented rise in oil prices and banner industry profits in 2022, the industry fell back to last place in the stock market after annual earnings were announced in early February.

Meanwhile, fossil-free versions of stock indexes, like the MSCI All Country World Index, have outperformed the all-in index over the last decade.

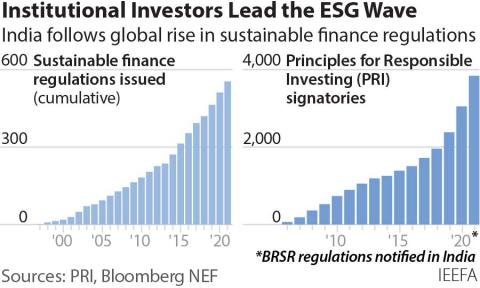

Facts like these have led more than 1,500 investment funds worth $40 trillion—including global investors such as BlackRock, Harvard University, New York State’s pension funds, and insurance giants Zurich and MetLife—to adopt fossil fuel exclusion policies. Excluding fossil fuels has become so mainstream that the international standard setting body for insurance company regulation sees it as an essential piece of any effective strategy to manage climate risk.

Yet misinformation persists. At a CalPERS stakeholder forum in January, officials claimed without evidence that fossil fuel divestment would somehow require disposing of $160 billion, or about one-third of the fund’s portfolio. CalPERS’s initial estimate of the impact of divestment at the level proposed in pending Senate Bill 252 was that only $9.3 billion of its fossil fuel investments would be subject to divestment.

Pension officials erroneously claimed last year that prior divestments have lost money for the funds. Yet the 2017 divestment from selected thermal coal companies (California’s only legislated fossil fuel divestment to date) has had positive impacts thus far.

Meanwhile, the energy transition is generating competition in key fossil fuel market segments.

Gasoline and diesel comprise the market for 65% of every barrel of oil drilled, but ExxonMobil CEO Darren Woods now expects all new passenger vehicles to be electric by 2040. The electric utility industry is investing six times more in wind and solar than in gas or coal power plants over the next five years. Petrochemicals are seen as a growth market for oil and gas, but single-use plastic bans proliferate. Countries from Asia to Europe have adopted decarbonization plans to reduce the use of fossil fuels in petrochemicals.

CalSTRS and CalPERS have each haltingly acknowledged the industry is in decline. Last August, CalSTRS reallocated $24 billion—about 20%—of its significant public equities portfolio, to a low-carbon index. One of CalPERS’s recently hired managing investment directors described in January how Kaiser Permanente, his previous employer, stopped making new private investments in fossil fuels in 2019.

The debate on fossil fuel divestment would be improved if CalSTRS and CalPERS published a transparent accounting of their fossil fuel exposure, as well as reasonable scenarios forecasting financial returns based on decreasing exposure to fossil fuels over time. A practical, fact-based approach to the topic of fossil fuel divestment would be in the best interest of the funds and their beneficiaries.