ArcelorMittal: Green steel for Europe, blast furnaces for India

Download Full Report

View Press Release

Key Findings

ArcelorMittal has a 2050 net zero emissions target and is planning to shift from blast furnaces to green hydrogen-based steelmaking in Europe and Canada, but is still building coal-consuming blast furnaces in India.

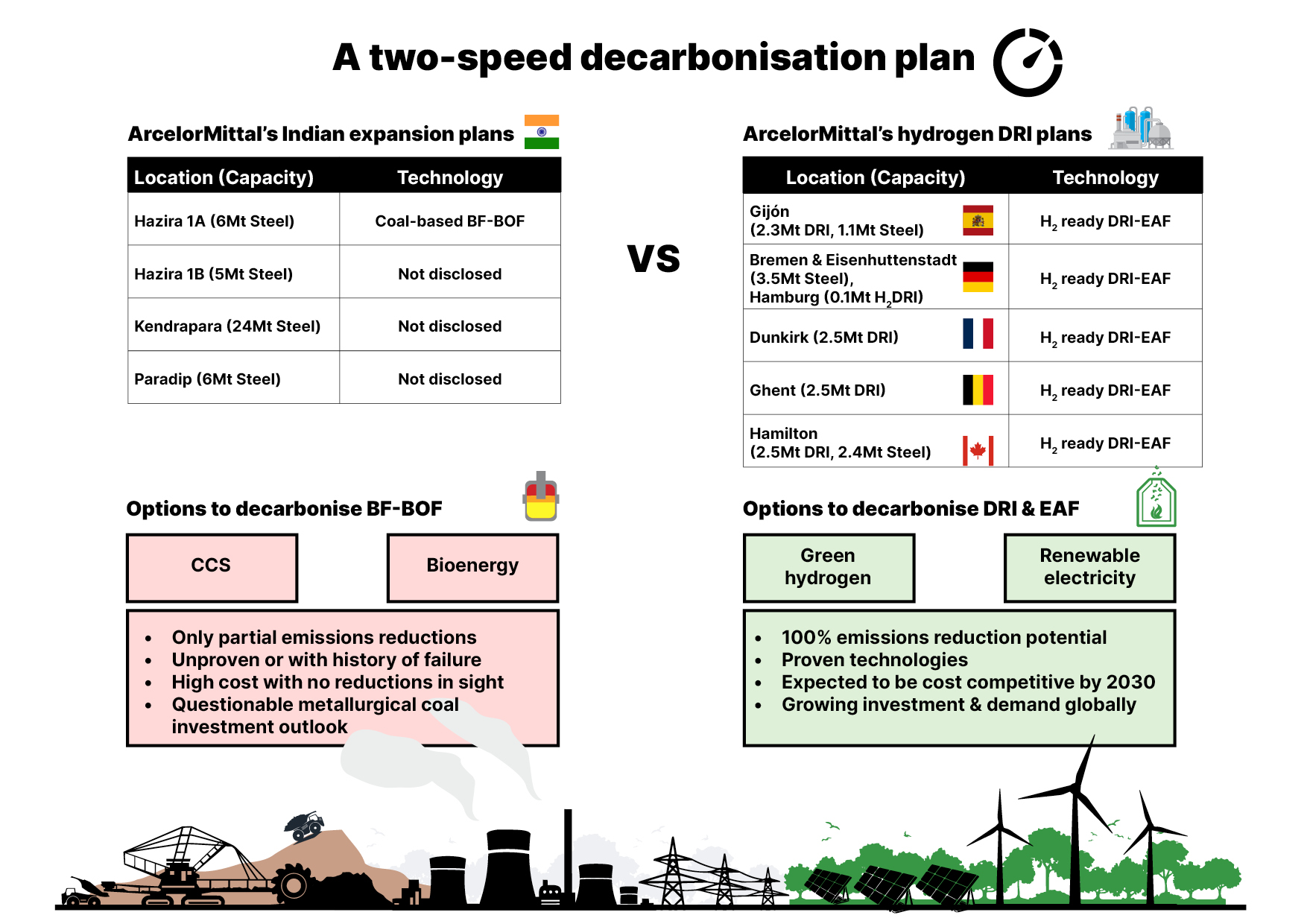

ArcelorMittal appears to be planning a two-speed decarbonisation with ready-to-deploy DRI technology to be installed overwhelmingly in developed nations while the developing Global South is on the slower pathway involving more blast furnaces and as yet unproven CCUS technology.

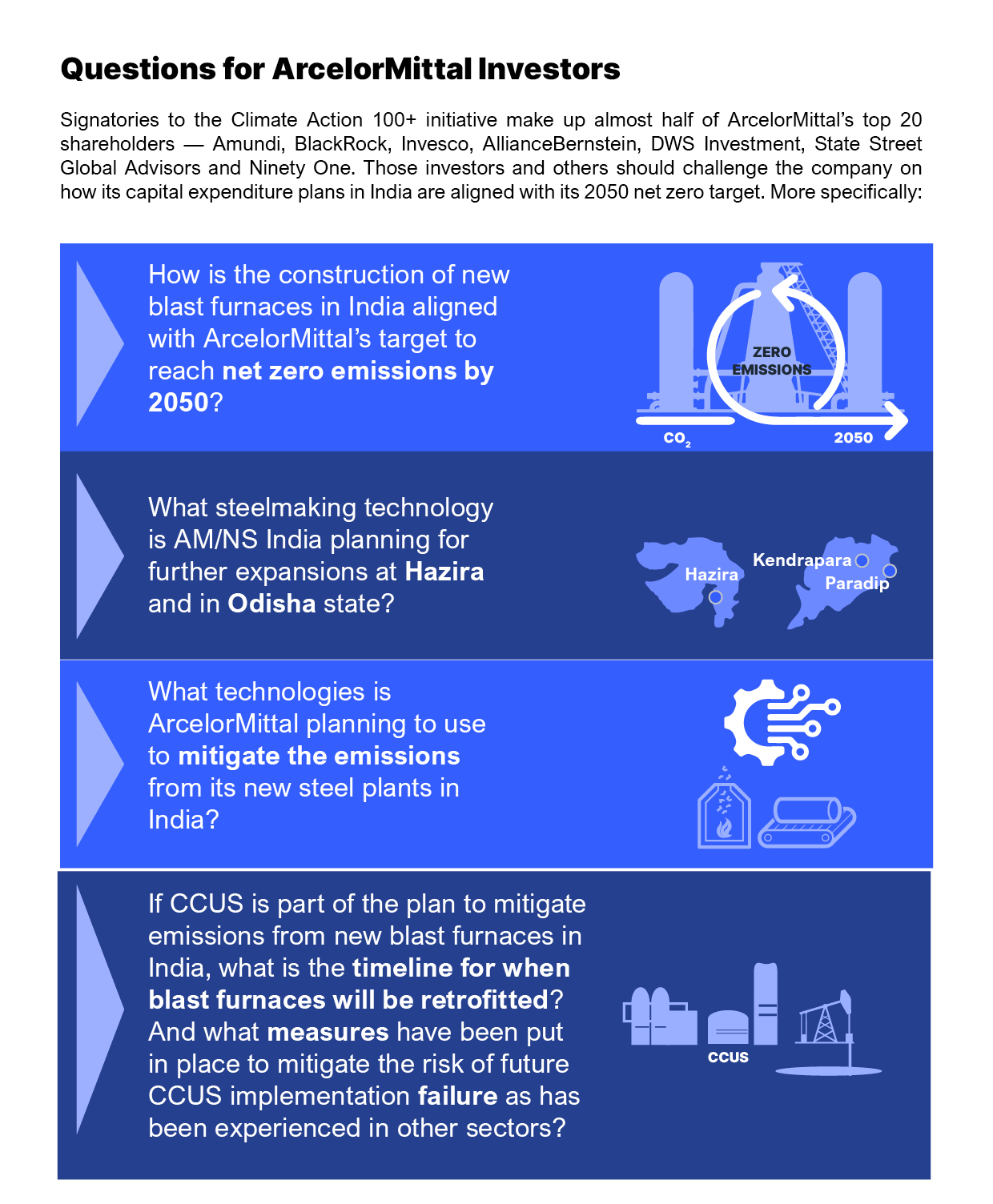

With no major breakthrough in CCUS for coal-based steelmaking on the horizon, investors should be asking questions about ArcelorMittal’s Indian expansion and how it’s compatible with a 2050 net zero emissions target.

Executive Summary

Global steelmaking giant ArcelorMittal has committed to reach net zero emissions by 2050 yet it is building new coal-consuming blast furnaces in India. With no major breakthrough in carbon capture utilisation and storage (CCUS) for coal-based steelmaking on the horizon, investors should be asking questions that challenge ArcelorMittal about its Indian expansion, the technology choices being made and how that aligns with the company’s 2050 net zero emissions target.

Luxembourg-based ArcelorMittal has entered the Indian steel market via a 60:40 joint venture with Nippon Steel of Japan — ArcelorMittal Nippon Steel India (AM/NS India). AM/NS India has now begun construction of two new blast furnaces at Hazira, Gujarat, is planning a further expansion of capacity to 20 million tonnes per annum (Mtpa) as well as new integrated steel plants at Kendrapara (24Mtpa) and Paradip (6Mtpa) in the state of Odisha. The steelmaking technology under consideration for these new sites has not been disclosed.

A Two-Speed Decarbonisation Plan

ArcelorMittal’s plans for more coal-based steelmaking in India contrasts markedly with its developments in Europe and Canada, where the company is planning a transition away from blast furnaces to direct reduced iron (DRI)-based steelmaking using green hydrogen under its ‘Innovative DRI’ decarbonisation pathway. In October 2022, ArcelorMittal broke ground on its US$1.3 billion transition to DRI-based steelmaking in Ontario, Canada, and it has similar plans in Spain, France, Belgium and Germany.

ArcelorMittal’s plans for more coal-based steelmaking in India contrasts markedly with its developments in Europe and Canada, where the company is planning a transition away from blast furnaces.

As a result, ArcelorMittal appears to be planning a two-speed decarbonisation with hydrogen-ready DRI technology to be installed overwhelmingly in developed nations while the developing Global South is on the slower pathway involving more coal-consuming blast furnaces and as yet unproven CCUS technology under its ‘Smart Carbon’ decarbonisation pathway.

Proposed CCUS and bioenergy technologies being considered by the company to reduce emissions from blast furnaces under its ‘Smart Carbon’ pathway are not being used at scale. ArcelorMittal’s “flagship” CCUS project will capture only a small fraction of the emissions at its Belgian operation. In IEEFA’s opinion, there is a risk to the company that the ‘Smart Carbon’ pathway could be perceived as “greenwash”, used to justify the continued installation of new blast furnaces in developing nations. This risk has heightened since the COP27 climate conference in November 2022 where the United Nations warned that company net zero emissions commitments often amount to little more than greenwashing while recommending new standards to hold companies to account.

Figure source: IEEFA

A 2021 report by think tank E3G and the U.S. Department of Energy’s Pacific Northwest National Laboratory found that any blast furnaces without CCUS will need to be phased out by 2045 for the global steel sector to be on an orderly 1.5°C pathway and no more new blast furnaces without CCUS should come online after 2025 to avoid stranded assets. AM/NS India’s expansion plan will see two new blast furnaces — without CCUS — brought online in 2025 and 2026 with the likelihood that further blast furnaces are being planned for the greenfield sites in Odisha.

Carbon Capture Technology Has a Long History of Failure

As major iron ore miner BHP noted in October 2022, “There are no full scale operational CCUS facilities in blast furnace steelmaking operations at present, with only a limited number of small capacity carbon capture or utilisation pilots underway or in the planning phases globally.”

As well as virtually no track record in the steel sector, the history of CCUS in other sectors is not impressive. A September 2022 IEEFA report found that underperforming carbon capture projects considerably outnumber successful projects globally, and by large margins. With hydrogen-based DRI projects now shifting from announcements to investment decisions and construction, CCUS in the steel industry faces being left behind in the same way it was in the power sector as wind and solar power became ever cheaper, increasingly widespread and far more financially viable.

Future Coking Coal Availability and Cost in Question

Concerns are also rising about the future availability and cost of coking coal due to a lack of investment in new mining capacity. In November 2022, the CEO of BHP — the world’s largest shipper of coking coal — stated that the company has no “growth capital” allocated to coking coal. South32 also made clear in 2022 that it will not be investing in any new coking coal projects and will wind down its coal business as existing mines are depleted.

In a significant development, HSBC announced an updated energy policy in December 2022 which prohibits it from providing finance for new coking coal mines. It can be expected that other banks will now follow suit — similar to how thermal coal finance restrictions rolled out across banks globally — as it becomes increasingly clear that alternatives to coal-based steelmaking are viable.

With increasing questions over the long-term future of coking coal production in Australia, ArcelorMittal’s joint venture partner in India is considering making more coking coal investments in Australia itself in order to shore up supply. Steelmakers are coming under increasing pressure to decarbonise their operations. This pressure will only escalate if they start to increase their own investment in coking coal mines as incumbent miners and financiers exit the sector.

Green Hydrogen a Promising Alternative

While reliance on coking coal has the potential to cause India a further energy security headache, green hydrogen could conceivably provide a solution for a nation highly dependent on fossil fuel imports. A June 2022 report by Indian public policy think tank NITI Aayog and RMI found that growing global momentum on the transition towards green hydrogen is a good fit for India given its energy security, emissions reduction and development concerns.

Growing global momentum on the transition towards green hydrogen is a good fit for India given its energy security, emissions reduction and development concerns.

The cost of green hydrogen could fall to approximately $1.60/kg by 2030 and $0.70/kg by 2050 according to NITI Aayog and RMI, which could see hydrogen and DRI-based steel production becoming cost competitive with natural gas-based DRI by 2027. By 2030, they see green hydrogen-based DRI being the most cost-competitive steelmaking route in India, cheaper than blast furnace-based operations.

In November 2022, the International Energy Agency stated that “hydrogen-based steelmaking has picked up significant momentum”, highlighting the tripling of the number of steelmakers’ announcements to use such technology over the prior 12 months. The second half of 2022 saw a number of steelmakers move from green steel announcements and pilot projects towards commercial-scale investment decisions and construction, that will see new, low-carbon installations operational in just 3–4 years and ready-to-use green hydrogen to reduce emissions further.

In January 2023, the Indian government approved a US$2 billion plan to promote domestic green hydrogen production and utilisation.

A Critical Market

Major international steelmakers like ArcelorMittal are keen to enter the Indian market because it is the key steel growth market globally, with a planned doubling in capacity this decade alone.

Europe is already starting to shift away from reliance on coal-based steelmaking but efforts to bring the global steel sector towards net zero emissions will not be achieved if India relies on new coal-based steelmaking to meet demand growth. The technology pathway that India chooses for its capacity expansion will to a large extent define the success or failure in achieving net zero emissions in the steel sector worldwide.