ArcelorMittal’s path to net zero emissions under scrutiny as new coal-based blast furnaces in India contrasts with low-carbon steelmaking in Europe and Canada

Investors should question why high emissions projects are still being built in developing countries

(IEEFA AUSTRALIA): Luxembourg-based ArcelorMittal should prepare for difficult questions in its upcoming AGM in May about how the company intends to reach Net Zero by 2050, as the company builds new coal-powered blast furnaces in India in a joint venture with Nippon Steel of Japan (AM/NS India).

In a new IEEFA report, Green Steel for Europe, Blast Furnaces for India, energy finance analysts Simon Nicholas and Soroush Basirat outline the company’s development plans and highlight the very different technology and emissions approaches being taken in India and Europe.

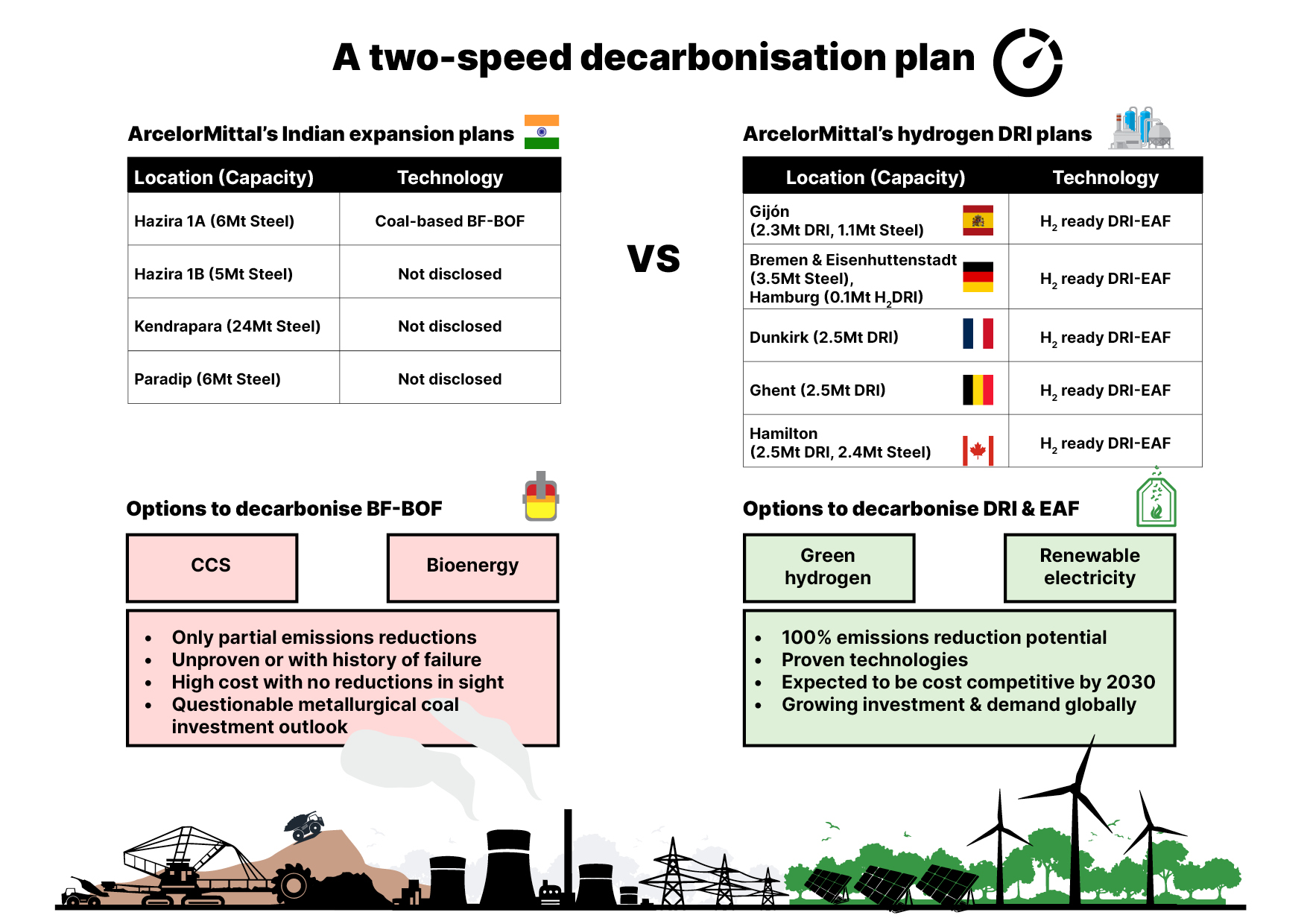

Simon Nicholas, IEEFA’s Lead Steel Analyst, said, “ArcelorMittal, the world’s second-largest steelmaker, appears to be planning a two-speed decarbonisation, with hydrogen-ready, direct reduced iron (DRI) technology to be installed overwhelmingly in developed nations while building more coal-consuming blast furnaces in the developing Global South.”

In October 2022, ArcelorMittal broke ground on its US$1.3 billion transition to DRI-based steelmaking in Ontario, Canada, and it has similar plans in Spain, France, Belgium and Germany.

AM/NS India has now begun construction of two new blast furnaces at Hazira, Gujarat, is planning a further expansion of capacity of 5 million tonnes per annum (Mtpa) as well as new integrated steel plants at Kendrapara (24Mtpa) and Paradip (6Mtpa) in the state of Odisha. The steelmaking technology being planned for the very large Odisha expansions has not been disclosed.

The blast furnace expansions under construction at Hazira totalling 6Mtpa of capacity will increase carbon emissions by approximately 2 tonnes per tonne of crude steel produced — that is, around 12 million tonnes of additional carbon dioxide equivalent emissions if running at full capacity. The further expansions being planned for Odisha would add much more if they are also based on blast furnaces.

A 2021 report by think tank E3G and the U.S. Department of Energy’s Pacific Northwest National Laboratory found that blast furnaces without CCUS will need to be phased out by 2045 for the global steel sector to be on an orderly 1.5°C pathway and no more new blast furnaces without carbon capture utilisation and storage (CCUS) should come online after 2025 to avoid stranded assets. AM/NS India’s expansion plan will see two new blast furnaces — without CCUS — brought online in 2025 and 2026.

IEEFA Steel Analyst Soroush Basirat said, “There are no full-scale CCUS facilities for blast furnace-based steelmaking operational anywhere in the world and only a few, small pilot projects underway or planned.”

“In addition to a very limited track record in steel, CCUS has had a problematic and disappointing history in other sectors like power generation and gas production.”

“We’ve observed an acceleration in hydrogen-ready DRI technology rollout recently that is leaving CCUS technology even further behind,” added Nicholas.

“With no major breakthrough in CCUS for coal-based steelmaking on the horizon investors should be asking questions that challenge ArcelorMittal about its Indian expansion, the technology choices being made and how that aligns with the company’s 2050 net zero emissions target.”

Signatories to the Climate Action 100+ initiative make up almost half of ArcelorMittal’s top 20 shareholders — including Amundi, BlackRock, Invesco, AllianceBernstein, DWS Investment and State Street Global Advisors.

In its most recent benchmark assessments in October 2022, Climate Action 100+ found that ArcelorMittal currently fails to meet a number of criteria, including that it has no short-term (2025) greenhouse gas emissions reduction target, its medium-term (2026–2035) target is not aligned with the goal of limiting global warming to 1.5°C and it has failed to decarbonise its capital expenditures.

Major international steelmakers like ArcelorMittal are keen to enter the Indian market because it is the key steel growth market globally, with a planned doubling in capacity this decade alone.

Europe is already accelerating its shift away from reliance on coal-based steelmaking by developing new hydrogen-based steelmaking plants, including plans by ArcelorMittal itself. But efforts to bring the global steel sector towards net zero emissions will not be achieved if India relies on new coal-based steelmaking to meet its very high forecast demand growth.

Read the report: ArcelorMittal: Green Steel for Europe, Blast Furnaces for India — Questions for Investors Over Ability to Meet 2050 Emissions Targets

Media contact: Amy Leiper Email: [email protected] Ph: +61 (0)414 643 446

Author contacts: Simon Nicolas: [email protected]; Soroush Basirat: [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)