Key Findings

About 21% of Russian LNG currently received by EU ports would not be affected by the bloc’s aim to be independent of Russian fossil fuel imports by 2027, as envisioned in the REPowerEU plan.

Of all the Russian LNG that was received by Belgium and France between January and September 2023, 37% was transshipped, of which the majority went to non-EU markets.

The EU terminals that have received the most LNG from Russia’s Yamal project in 2023 are Zeebrugge, Belgium, followed by Montoir-de-Bretagne, France, and Bilbao, Spain.

From January to September 2023, the volume of LNG from Yamal that arrived at Belgium’s Zeebrugge terminal was almost double the volume of Yamal LNG imports, due to Zeebrugge still allowing tran

Since Russia’s invasion of Ukraine, the European Union (EU) has aimed to wean itself from Russian gas and liquefied natural gas (LNG). But figures have shown an increase in Russian LNG imports, with some European countries even allowing their terminals to transship and/or re-export Russian LNG. The transshipped cargoes arriving at LNG terminals in Europe are often not included in official import figures and thus ignored by policymakers.

Imports

Spain is the leading importer of Russian LNG among EU countries, with 5.21 billion cubic metres (bcm) imported from January to September 2023, followed by France (3.19 bcm) and Belgium (3.14 bcm).

Although France reduced its imports of Russian LNG from January to September 2023, Spain and Belgium increased theirs by 50% compared to the same period in 2022. The EU imported 18.5 bcm of Russian LNG in 2022 and 13.98 bcm from January to September 2023, according to Kpler.

The EU terminals that have received the most LNG from Russia’s Yamal project in 2023 are Zeebrugge, Belgium, followed by Montoir-de-Bretagne, France, and Bilbao, Spain.

Of the Russian LNG imported into Belgium from January to September 2023, 87% came from the Yamal LNG terminal and the rest from the Vysotsk LNG plant, which also exported LNG to Greece and Turkey.

All of France’s Russian LNG imports between January and September 2023 came from Yamal, with 81% imported at Montoir-de Bretagne and the rest at the Dunkerque terminal.

All imports of Russian LNG into Spain during this same period came from Yamal.

Transshipments

From January to September 2023, the volume of LNG from Yamal that arrived at Belgium’s Zeebrugge terminal was almost double the volume of Yamal LNG imports (2.73 bcm) to the terminal. This is due to Zeebrugge still allowing transshipment of Yamal LNG. This contrasts with the Netherlands, which has stopped offering transshipment services for Russian LNG, and the UK, which has banned Russian imports of the fuel altogether.

About 90% of the LNG from Yamal transshipped at Zeebrugge since 2021 has been sent to non-EU countries, according to Kpler.

Transshipments refer to the transfer of LNG between two ships, with or without the intermediate transfer of the LNG into terminal tanks. The types of transshipments are: Direct ship-to-ship transshipment between two LNG carriers berthed at the same time at two separate jetties of a given terminal, or a ship unloading to a storage facility before the LNG is reloaded on another ship. The latter includes all the actions and technical interventions needed to berth, unload a ship, store the LNG in a tank and reload (partially or totally) the LNG into a ship in a given moment. Zeebrugge is the only EU terminal offering this service to cargoes from Yamal.

In commercial terms, a transshipment is called a re-export when the LNG is bought by an energy company to be later reloaded and sold to other countries. While re-exports are included in official import figures, transshipments are often not. Sometimes, transshipments involving a ship unloading to a storage facility before the LNG is reloaded on another ship are considered imports despite the gas not entering a country’s network.

In 2015, Belgian natural gas transmission system operator Fluxys signed a 20-year contract with Yamal LNG for the transshipment of as much as 8 million tonnes per annum (mtpa)—about 11 bcm—of Yamal LNG, with the first loading taking place in 2019. In December 2019, Zeebrugge LNG commissioned its fifth storage tank to support year-round LNG deliveries from Yamal, mainly for shipment to Asian markets.

Besides Zeebrugge, the Montoir-de-Bretagne terminal is also transshipping Yamal LNG via the ship-to-ship process.

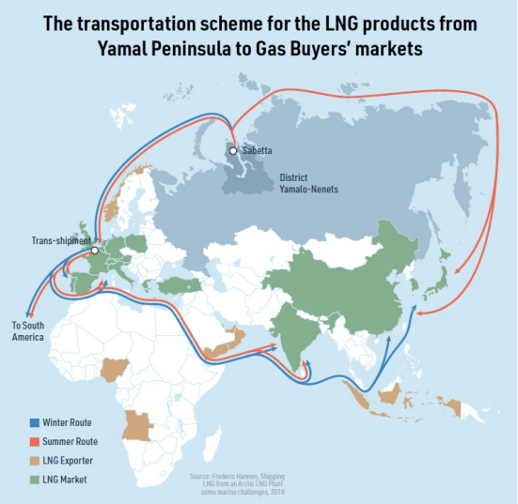

LNG from Yamal that is transshipped at Zeebrugge or Montoir-de-Bretagne is owned by Yamal LNG, which uses these European terminals to transfer the fuel between vessels. The purpose of the transshipments is to transfer LNG from icebreaker LNG carriers coming from the production terminal in Sabetta, in Russia’s Yamal peninsula, to conventional LNG carriers to be sent to other markets. Yamal LNG mainly uses this route between November and June when ice in the Arctic Ocean can make it impossible for tankers to reach Asian markets through the Bering Strait.

Source: Natural Gas World. Project Spotlight: Arc 7 LNG Carriers [LNG Condensed]. 13 January 2021

Yamal LNG’s shareholders are: Russia’s Novatek (50.1%), France’s TotalEnergies (20%), China National Petroleum Corporation (CNPC) (20%) and China’s Silk Road Fund (9.9%). Yamal LNG buyers are: CNPC (3 mtpa), Gazprom Marketing & Trading (2.9 mtpa for 20+ years, at the Zeebrugge transshipment point), Spain’s Naturgy Energy Group (2.5 mtpa), Novatek (2.5 mtpa) and TotalEnergies (4.0 mtpa).

LNG producers also sell to portfolio players, which buy the fuel from a wide range of suppliers globally. Novatek’s portfolio buyers are: Gunvor, with 0.5 mtpa; and Shell and TotalEnergies, with 0.9 mtpa and 1 mtpa, respectively, sourced from Yamal and transshipped at Montoir.

From January to September 2023, volumes of Yamal LNG sent to Montoir-de-Bretagne were 50% more than reported import figures due to transshipments to other countries. About 76% of the LNG from Yamal that has been transshipped at Montoir-de-Bretagne in 2023 is destined for non-EU countries, increasing significantly from about 50% in 2021.

Of the Russian LNG that was received by Belgium and France between January and September 2023, 37% was transshipped, either abroad or to other domestic terminals. The two countries imported 6.32 bcm of LNG from Yamal from January to September 2023, but an additional 3.78 bcm of Yamal LNG was sent to their terminals to be transshipped to other countries.

From January to September 2023, flows of LNG from Russia’s Yamal, Vysotsk and Portovaya terminals totalled 17.77 bcm. About 21% of all Russian LNG flowing to the EU are transshipments. This means that Russian LNG could still be present in EU ports after 2027, by which time the bloc aims to be independent of Russian fossil fuel imports under the REPowerEU plan.

Re-exports of Russian LNG

While France and Belgium continue allowing their LNG terminals to transship Russian LNG to other markets, Spain has significantly increased its Russian LNG imports this year, jumping from a total of 4.99 bcm in 2022 to 5.21 bcm in the first nine months of 2023. Russia is the second-biggest exporter of LNG to Spain, after the U.S.

The origin of Spain's LNG re-exports is unclear, meaning a significant amount could come from Russia. The country re-exported 1.05 bcm of LNG between January and September 2023, during which time its re-exports of LNG to Italy almost doubled year-on-year.

EU expenditure on Russian LNG

The EU’s expenditures on Russian gas and LNG in 2022 more than doubled from the previous year, with payments for LNG tripling to €16.1 billion.

If the EU paid €6.2 billion for imports of Russian LNG between January and September 2023, that begs the question of how much non-European countries are paying for the Russian LNG being transshipped at the Zeebrugge and Montoir-de-Bretagne LNG terminals.

IEEFA would like to thank Angelos Koutsis of Bond Beter Leefmilieu for his contribution to this commentary.