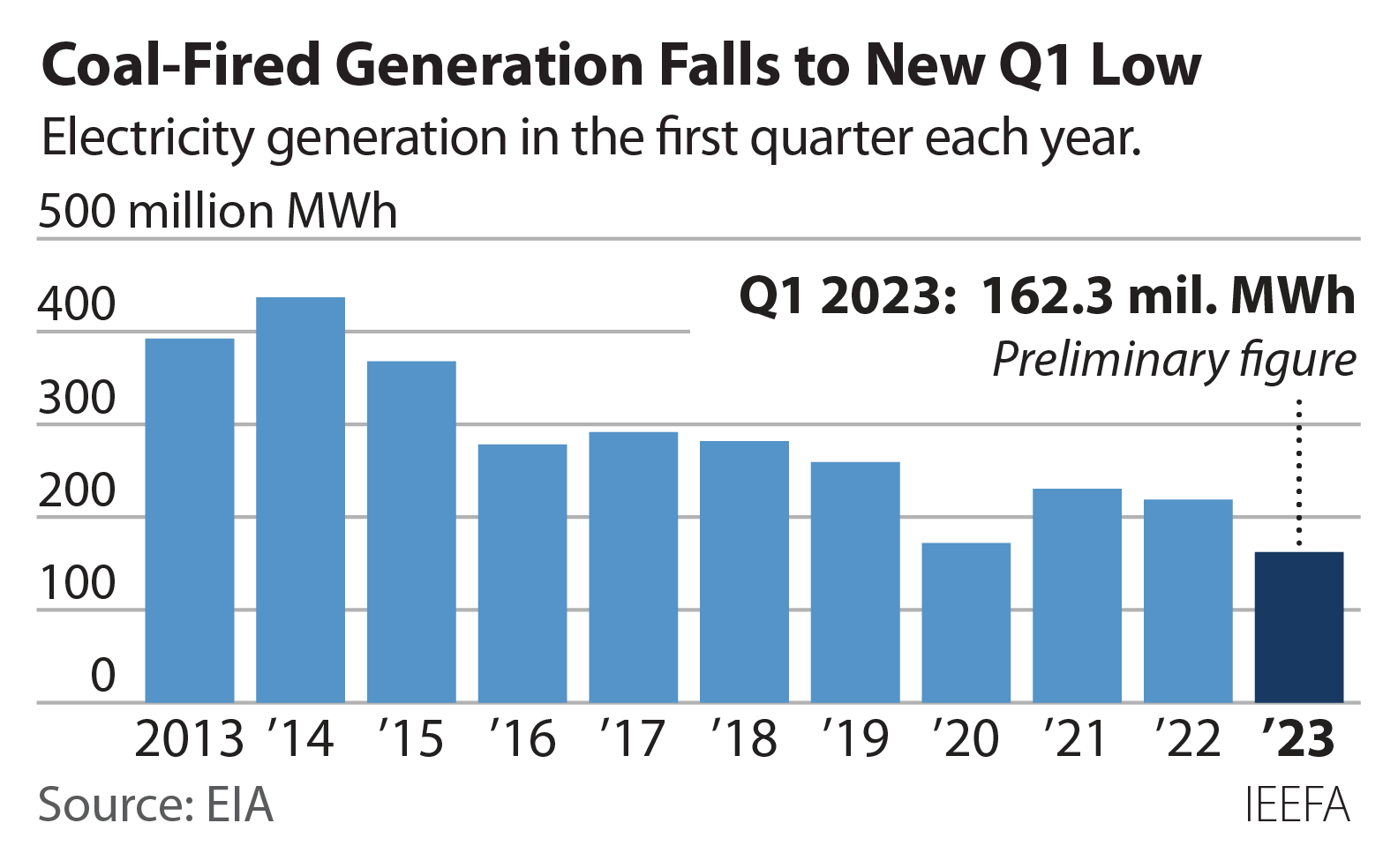

U.S. coal generation falls to record first-quarter low

Key Findings

Coal-fired electricity generation in the U.S. for January, February, and March was down more than 25%, and pushed the fuel’s share of the power market below 17%, versus more than 22% in the same quarter of last year.

In contrast, renewable generation (wind, utility-scale solar and hydropower) grabbed 22.5% of the overall electric market, highlighting the different trajectories for the two energy resources.

This collapse in coal generation was a national development, with significant decreases in the PJM power market, ERCOT, the SPP and MISO regions, and the Southern Company balancing area.

Continued renewable growth is a threat to existing coal, and coupled with forecasts for low gas prices and uncertain electricity growth, it is shaping up to be a truly difficult year for coal-fired generators.

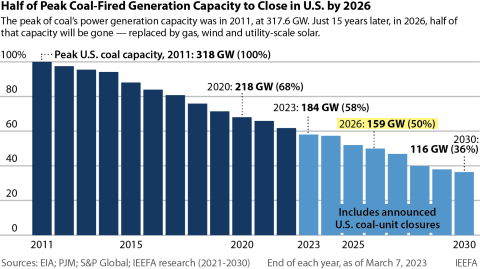

It was a brutal first quarter for U.S. coal-fired power plants. Electricity generation from the fuel totaled 162.3 million megawatt-hours (MWh) for January, February, and March—down more than 25%, or 56.7 million MWh, from the same period in 2022, according to data from the Energy Information Administration (EIA). The decrease is a record low for the three-month winter period, and pushed coal’s power-market share below 17%, versus more than 22% in the same quarter of last year.

In contrast, renewable generation (wind, utility-scale solar and hydropower) grabbed 22.5% of the overall electric market, highlighting the different trajectories for the two energy resources.

This collapse in coal generation was a national development. In the PJM power market, which supplies electricity from New Jersey to Illinois, coal generation tumbled 40%, dropping by more than 20 million MWh, and the fuel’s market share fell to just 15%. Ten years ago, coal’s market share was well above 40% in the region.

The rough quarter undoubtedly played a role in the decision to close the Homer City coal-fired power plant in Pennsylvania. The three-unit, 1,915-megawatt (MW) facility has been under financial pressure for years. It went through two bankruptcies in the 2010s as cheaper gas-fired power generators ate into its market share. The plant’s average capacity factor (the amount of power produced compared to the maximum possible amount) fell from 64% between 2012 and 2014 to 21% between 2020 and 2022. Its private equity owners had warned last year that the plant might be forced to close, and then announced on April 3 that they had filed a deactivation notice with PJM to shutter the plant on July 1.

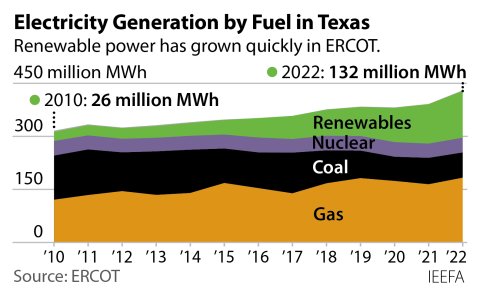

Coal’s problems were also evident in the Electric Reliability Council of Texas (ERCOT), the operator of the grid supplying 90 percent of electricity in Texas. There, a massive, ongoing buildout of wind and solar generation has sharply cut demand for coal-fired power even as system-wide demand has grown. In the first quarter in 2014—just nine years ago—coal was still the leading generation resource in the system, accounting for 39.2% of total demand. Wind, in contrast, supplied 12% of the system’s electric needs and solar was so small that its generation wasn’t independently identified. In the first quarter of 2023, wind and solar were the leading sources of power, together supplying 39.3% of total electric demand, and taking the top spot from gas-fired generation. In the quarter, coal generation fell 37%, more than 6.5 million MWh, and its market share dropped to less than 12%.

The strong renewables growth pushed ERCOT to another milestone in the first quarter: With the addition of the system’s two nuclear facilities, more than 50% of its electricity came from carbon-free resources—an impressive feat for the largest and fastest-growing electricity market in the U.S.

Coal generation also fell sharply in the Southwest Power Pool (SPP) and the Midcontinent Independent System Operator (MISO) regions, traditionally coal-heavy areas in the central part of the country. In MISO, which is the largest source of coal generation in the U.S., falling regional demand and cheaper gas prices pushed coal output down more than 15 million MWh, a drop of 27%. In SPP, where wind is a major generation resource, cheaper gas prices further cut into coal generation, which dropped more than 21%, just under 5 million MWh, and pushed its market share to less than 27%.

The story was the same in the Southeastern U.S., areas still served by vertically integrated utilities such as Southern and Duke. In the Southern Company balancing area, which includes most of Georgia and Alabama, coal generation fell 40%, some five million MWh, pushing its market share down to 13.7%, even though three of the largest coal plants in the country are located in the region.

Generation from the largest coal plant—the four-unit, 3,232MW Bowen plant—was only 30% of its potential for all of 2022, and only 21.5% of its potential in January, according to the latest plant-specific data available from the EIA. Yet even that low usage is likely to decline further, because two new nuclear units at Southern’s long-delayed and vastly over-budget Vogtle plant, totaling 2,234 MW, are nearing completion. Unit 3 began sending electricity to the grid on April 1 and Unit 4 could be online in early 2024. They will run as much as possible, enabling Southern and the plant’s other owners to collect production tax credits and revenue from electricity production. Coal plants in the region are almost certain to see their generation cut as a result.

The continued rise in solar generation is another threat to existing coal. National solar output has doubled since 2019 and is set to grow even faster in the years to come as already-planned projects are built and added to the grid. Now, the long-term extension of the production and investment tax credits included in the 2022 Inflation Reduction Act are poised to drive even faster growth.

As the windy spring season takes over and the days lengthen, renewable generation should increase significantly in what is its strongest quarter. And with the number of new renewable projects coming online, it is likely to continue posting year-over-year increases for the foreseeable future. Coupled with forecasts for continued low gas prices and an uncertain outlook for electricity growth, it is shaping up to be a truly difficult year for coal-fired generators.