Anglo American fire demonstrates methane burden on coalmine production

Key Findings

Methane fires and risks have led to multiple mine closures, production disruptions and costs for mining operators.

This compounds other coalmine production risks, such as severe weather and flooding, which has cost A$5 billion in lost coal sales.

The Australian government warns there is a risk that another La Nina weather pattern in H2 2024 could severely affect coal supply.

Safeguard Mechanism reporting requirements and new climate reporting standards next year could embed methane and water costs in the sector.

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

Anglo American’s upcoming sale of its coalmining assets in Australia faces a setback after a methane ignition forced the closure of its Grosvenor mine in Queensland. The mine had only reopened recently after a two-year closure caused by a similar explosion in 2020.

It is not an isolated incident. A string of methane-related High Potential Incidences (HPIs) at underground coalmines were investigated by the Queensland Coal Mining Board of Inquiry in 2020-21. The Inquiry reviewed the 2020 Grosvenor accident, as well as 40 HPIs involving methane exceedances between 1 July 2019 and 5 May 2020.

Earlier this year, Russell Vale Colliery in NSW was shut down by the NSW Resources Regulator due to inadequate methane management. Peabody Energy plans to restart its North Goonyella mine – its only premium coking coal production in 2026, some $760 million and eight years after it was closed due to an underground methane ignition.

Coal-bed fires can occur in underground mines, unmined coal beds and in coal stockpiles. These fires can be costly and difficult to extinguish, disrupting production and destroying produced coal.

Methane a constant hazard for coalmining

Methane is found in most coal deposits. Effective pre-drainage of the highly toxic and volatile gas and its ongoing management is essential for coalmining – to reduce hazards and to minimise carbon emissions. As such, coalmining is associated with a high social and environmental risk.

Open-cut mining is the predominant type of coalmining in Australia. Open-cut mines also encounter methane, yet it is generally not hazardous to mining, and is readily released to the atmosphere during the mining process. Fugitive methane emissions pose an environmental impact with a global warming potential of 30 times that of carbon emissions, and addressing these is critical for Australia to meet its emissions reduction commitments.

Production disruptions from severe weather and flooding compound risks

If underground mines are affected by geological conditions and gas, production outages at open-cut mines are more frequently caused by wet weather. This has been the case for the 2021-2023 floods on the east coast of Australia, which hampered production at many coalmine operations and supply chains.

These events are becoming the new normal in the coalmining operating environment, and insurance for these risks is becoming harder to obtain and more expensive. Severe wet weather and flooding risks lead to direct costs to coalmining companies through decreasing production and increasing costs associated with contaminated water discharges. The increased frequency and severity of flooding and storms also means miners must manage higher levels of surface runoff, which must be controlled and treated, increasing water management costs. In 2011, Australia had the highest expenditure on mining-related infrastructure, accounting for 20% of the US$7.7 billion estimated spend globally. Globally, water infrastructure spending by the mining sector increased by 252% from 2009-2013 while mine production increased by only 20-52% in the same period.

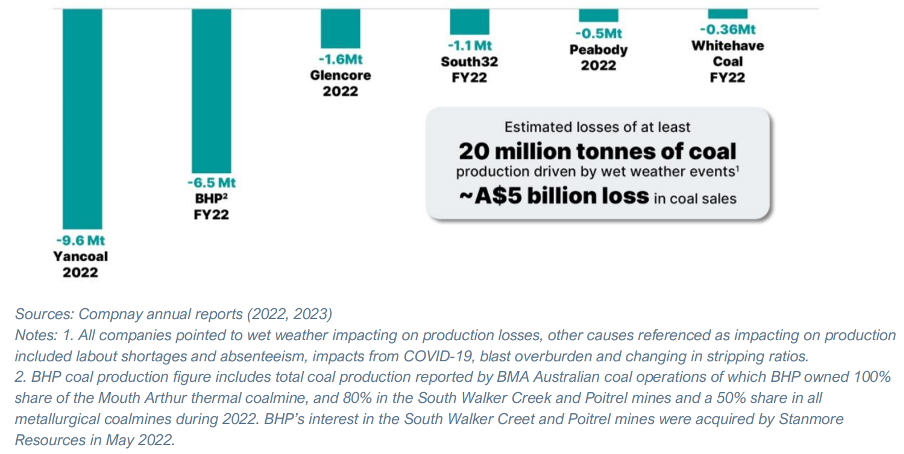

Previous analysis by IEEFA found that Australian coalminers lost more than 20 million tonnes in run-of-mine (ROM) coal production (approximately A$5 billion in potential coal sales) across the 2022 calendar and financial years, largely due to flooding and severe weather.

Figure 1: Reported losses in Australian coalmine production 2022 and FY22

The Bureau of Meteorology has forecast a 50% chance of a La Niña weather pattern developing in winter or spring this year. The Department of Industry, Science and Resource’s latest Resources and Energy Quarterly (REQ) warns that if La Niña were to develop, Australian miners may experience a repeat of the wet weather and the associated flooding of mines, transport routes and ports that hampered output in the 2021-2023 period, severely impacting coal supply.

Greenhouse gas emissions are becoming embedded in mining costs

In Australia, metallurgical (met) coalmines, including those with some thermal coal, account for about 70% of Australian coalmines’ methane emissions. Globally, financing of the met coal and iron and steel sectors continue to grow. Both sectors contribute significantly to global emissions of carbon dioxide (CO2) and methane.

Australian miners may experience a repeat of the wet weather and the associated flooding of mines, transport routes and ports that hampered output in the 2021-2023 period, severely impacting coal supply

The federal government's Safeguard Mechanism has yet to affect the sector significantly, with most coalminers still in the planning stages of methane mitigation and abatement. While underground mines have an imperative to drain methane from coal seams before and during mining processes, both open-cut and underground coalminers will need to consider methane drainage and abatement in their mine planning. Given the lengthy lead times involved in methane gas drainage, this could lead to production delays. Additionally, most coal mine methane abatement strategies plan to offset methane emissions by purchasing carbon credits through the Australian Carbon Credit Unit (ACCU) Scheme. This means that while coal mine methane risks are initially being felt through production losses or delays, the full methane emissions costs are yet to be felt by coalminers.

Moreover, calls for greater disclosure of water-related risks in Australian coalmining are increasing. Last year, 8,477 companies were requested to disclose water data by their investors or their business customers. At least 11 water-related disclosures are mentioned in the new framework published by the Taskforce on Nature Related Financial Disclosures (TNFD), meaning investors may expect more water-related data to be disclosed.

Overall, the impacts of the Safeguard Mechanism, changes to open-cut coal mine accounting methods under the National Greenhouse and Energy Reporting (NGER) scheme and the introduction of new climate reporting standards next year could embed additional risks and costs in the sector.

CORRECTION: This article was amended on 7 August 2024. Referring to an earlier explosion at the Grosvenor mine in Queensland, it originally stated this event happened in 2022; this has now been corrected to 2020.