Key Findings

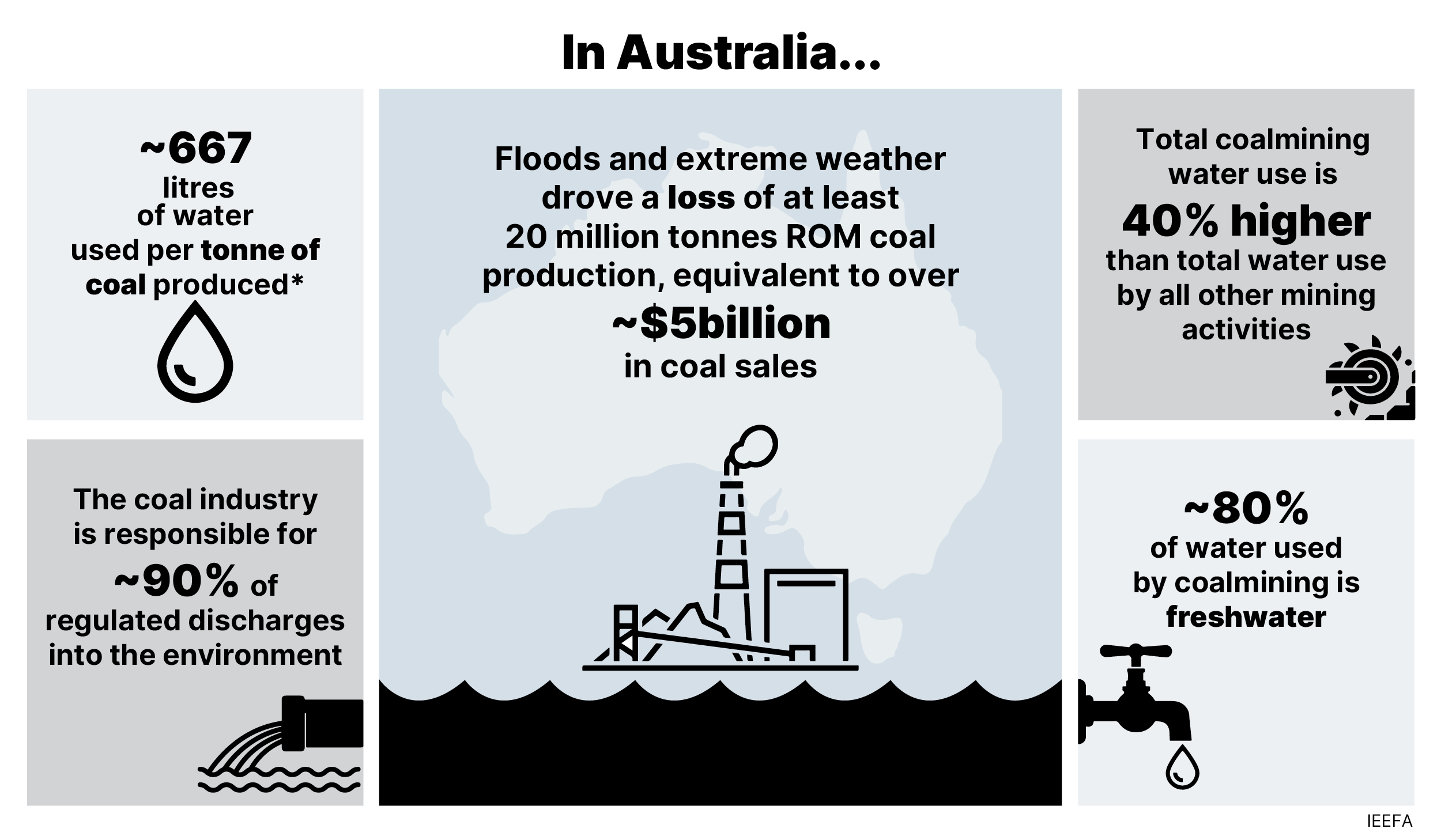

Australian coalminers lost more than 20 million tonnes in run-of-mine (ROM) coal production (approximately AU$5 billion in potential coal sales) across the 2022 calendar and financial years, largely due to flooding and severe weather.

Increasing scrutiny from governments on water-related issues in mining are causing delays or cancellations of mining approvals, in some cases driven by community opposition.

Coalmining consumes about 667 litres of water per tonne of coal produced – yet its total water take is unknown due to a lack of reporting, monitoring and transparency.

As water-related risks in Australian coalmining increase with the impacts of climate change, tighter regulatory frameworks and increased community opposition, the subsequent costs will become more material to investors and shareholders over time.

Executive Summary

Coalmining is the most water-intensive mining process in Australia. Coalmines face higher water-related risks than other mine types, and there is no viable alternative for water use in coalmine production processes. As water-related risks in Australian coalmining increase with the impacts of climate change, tighter regulatory frameworks and increased community opposition, the subsequent costs will become more material to investors and shareholders over time.

Investors need to better understand water-related risk exposure

Environmental, social and corporate governance (ESG) data screening and disclosure requirements are beginning to highlight the exposure to climate-related risks for investors, but water-related risks are frequently overlooked and underreported. These risks can no longer be overlooked. Over the past 10 years water risk factors have led to cases of stranded assets in the coal, energy, metals and mining, and oil and gas sectors.

Water-related natural disasters are also the leading cause of loss of life and damages globally, making up 74% of natural disasters between 2001 to 2018. Global losses from natural disasters in 2023 were valued at US$250 billion and in 2022 US$270 billion. Australian coalminers are estimated to have lost more than 20 million tonnes in run-of-mine (ROM) coal production (~AU$5 billion in potential coal sales) driven by flooding and severe weather across the 2022 calendar and financial years.

The top water-related risks in Australia are:

- Water access and increasing water costs

- Severe weather, flooding and operational disruption

- Contamination, salination and pollution

- Community opposition

- Tighter regulation and approval processes

- Rehabilitation and legacy issues

Sources: IEEFA analysis - Average water use per tonne of coal produced calculated from companies’ annual reports; CSIRO. Water in mining and Industry. 2011. Chapter 10. Page 138 - Regulated discharges; IEEFA analysis – Calculation of ROM coal production losses and estimated costs; Overton. I (2020) The Conversation coal mining water use comparison to other mining types; Overton. I (2020) Water for Coal report, page 3 – percentage of freshwater used.

Australia is the driest inhabited continent on earth, prone to major flooding and drought events that are forecast to increase in both frequency and severity. Coalmining’s watering requirements cannot adapt smoothly to changes in water supply in wet and dry periods. Coalmines pose the highest risk to ecosystem service degradation, and face higher reputational water risks, flooding and water-quality risks than other mine types.

Climate change is worsening drought events when they occur. Because Australian coalmines are concentrated in only a few regions, they face exacerbated risk of water shortages or substantially higher water prices during water shortages. There is evidence that water allocation prices in Australia are increasing, independent of climatic conditions, but increased instances of water scarcity and drought in the future will also drive increases in water prices for miners. Water entitlements across NSW have increased in value from more than AU$29 billion in 2021 to an estimated AU$34 billion in 2023. This is a 17% increase in just two years.

Climate change is increasing the impact of flooding and severe wet weather events, which disrupt coalmine operations and the entire coal supply chain. These events are becoming the new normal in the coalmining operating environment, and insurance for these risks is becoming harder to access and more expensive. Severe wet weather and flooding risks lead to direct costs to coalmining companies through decreasing production and increasing costs associated with contaminated water discharges. The increased frequency and severity of flooding and storms also means miners must manage higher levels of surface runoff, which must be controlled and treated, increasing water management costs. In 2011, Australia had the highest expenditure on mining-related infrastructure, accounting for 20% of the US$7.7 billion estimated spend globally.Globally, water infrastructure spending by the mining sector increased by 252% from 2009-2013 while mine production increased by only 20-52% in the same period.

Coalmines are subject to ongoing water-related risks associated with rehabilitation requirements. Water-related problems are the most common environmental impact when closing coalmines. Contamination risks from surface water tailings persist hundreds of years after coalmine closures – increasing rehabilitation costs and residual risks to operators, and creating intergenerational impacts on water sources for future domestic and industrial use. The real scale of mine rehabilitation risks is still unknown given that no large open-cut coalmine in Australia has completed rehabilitation and been fully relinquished.

The coal industry is more likely than other mining types to incur costs from water pollution and water discharges. It is responsible for almost all (~90%) of regulated water discharges to the environment from mining activity in Australia. Over the past 10 years, there have been at least 60 cases of illegal contaminated water discharges where legal action was taken or financial penalties issued to companies in Australia’s coal industry, exceeding AU$7.6 million (listed in Appendix. A). With stronger monitoring and enforcement, the financial consequences for these contamination events will increase over time.

There is also risk associated with the reliance on licence and work approval exemptions to access water. If government agencies tighten regulations, such as setting stricter volumetric limits on take or specifying purposes of use, mining operators would be required to source additional water for use onsite under an access licence or works approval at a higher cost.

Increasing scrutiny from governments on water-related issues in mining are causing delays or cancellations of mining approvals, in some cases driven by community opposition based on water-management concerns.This is affecting development timelines for coalmine projects in Australia.

Overall, there is significant underreporting of water use and risks. Existing water data is commonly based on estimations using water modelling techniques that do not incorporate the impact of climate change or exclude extreme wet and dry periods.

While improving company disclosure standards on greenhouse gas (GHG) emissions is imperative for investors to understand their exposure to climate change risk, water-related risks must also be incorporated into standardised disclosure frameworks. From 2018-2022, there was an 85% increase in corporate water disclosure through the Carbon Disclosure Project (CDP), with a 16% increase in 2022 alone. Greater transparency on water use and impacts from coalmining companies is critical. In 2023, 8,477 companies were requested to disclose water data by their investors or their business customers.

Overall, the trend is one of steadily increasing water-related costs for coalmines, greater scrutiny and oversight, tighter regulations and controls, and growing community opposition. This is against a backdrop of delays or cancellations of mine approvals, water licence restrictions, inflationary pressures, commodity price fluctuations, increasing rehabilitation requirements and production disruptions due to intensifying weather events caused by climate change. All of which call into question coalmines’ long-term viability for operators and investors.