IEEFA Coal Outlook 2020: Market trends are pushing U.S. industry to a reckoning

March 30, 2020 (IEEFA U.S.) — A report published today by the Institute for Energy Economics and Financial Analysis (IEEFA) sees the U.S. coal industry continuing to decline through 2020 and beyond.

March 30, 2020 (IEEFA U.S.) — A report published today by the Institute for Energy Economics and Financial Analysis (IEEFA) sees the U.S. coal industry continuing to decline through 2020 and beyond.

The report, U.S. Coal Outlook 2020: Market Trends Are Pushing Industry Ever Closer to a Reckoning, details issues that will likely persist in driving coal producers—beaten down badly by market forces over the past few years—into further distress:

- Long-term low gas prices and capacity expansion by both the solar and wind sectors will continue to take market share from coal;

- Current levels of production capacity are unsustainable;

- Coal-industry financing is increasingly difficult to secure, raising the price of insurance and making it difficult to meet bonding requirements;

- Investor-owned utilities continue to move away from coal;

- Cooperative and municipal utilities (co-ops/munis) are reconsidering their historical support for coal-fired generation; and

- Exports, particularly of steam coal, are likely to fall as other countries move toward cleaner sources of generation.

“In other words, coal’s importance will continue to decline, as market erosion gains momentum across the industry,” said Dennis Wamsted, an IEEFA analyst/editor and lead author of the report, which has coal’s percentage of the U.S. power-generation market approaching and potentially collapsing into single digits by 2025.

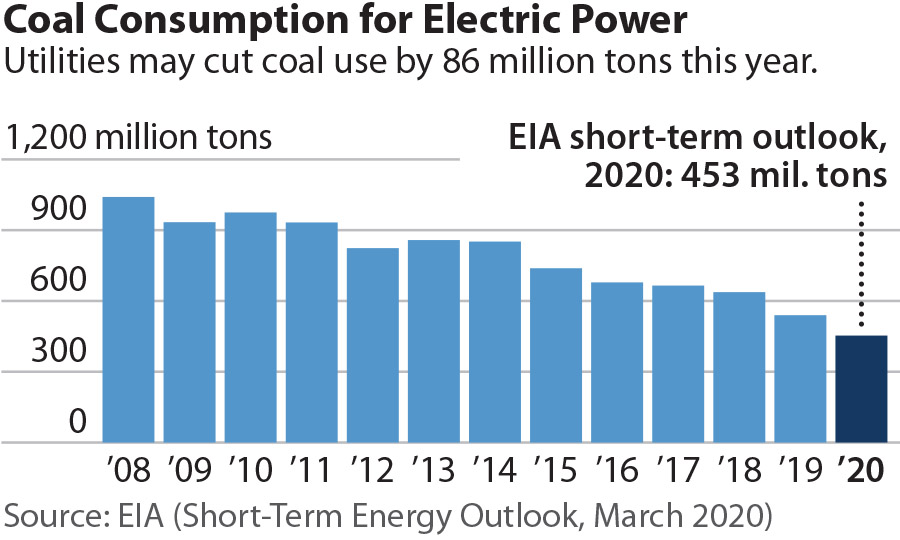

“While it can be difficult to appreciate the speed of the decline of the U.S. coal industry, the numbers speak for themselves,” the report notes. “In 2014, coal supplied 38.6% of the nation’s electricity needs. By 2019, that figure had dropped to 23.4%.”

The report notes also that the Energy Information Administration has the Henry Hub price for gas averaging $2.11 per mmBtu through 2020, the lowest price in 20 years, and that as of the end of 2019, 176.8 gigawatts of highly competitive zero-fuel-cost wind and solar resources were online with an additional 89 gigawatts in development.

In detailing growing pressure for industry consolidation, the report cites an expanding list of coal company bankruptcies and includes commentary from within the industry itself around production overcapacity. It describes a “fast-growing threat” on the finance side of the industry, as well, where insurance is increasingly difficult to secure, where access to capital is receding, and a divestment movement driven by environmental, social and governance (ESG) initiatives is having a rising impact.

The report also documents a widening movement among co-ops and municipal power companies to distance themselves from coal in favor of cheaper and cleaner forms of generation, and it shows how industry hopes for developing export markets stand little chance of success.

“Short-term economic uncertainty caused by the coronavirus pandemic and the recent collapse in oil prices may slow this transition slightly, but the trend is clear,” the report concludes. “Coal is being driven to the brink by continued low gas prices and steady additions of wind and solar.”

Full report: U.S. Coal Outlook 2020: Market Trends Are Pushing Industry Ever Closer to a Reckoning

Author Contacts:

Dennis Wamsted, [email protected] (703) 862-9324

Seth Feaster, [email protected] (917) 670-4025

Karl Cates, [email protected] (917) 439-8225

Media Contact

Vivienne Heston, [email protected] (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts global research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.