Russia

Latest Russia Research

See more >

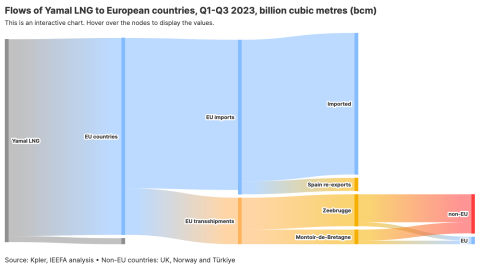

EU turns a blind eye to 21% of Russian LNG flowing through its terminals

November 29, 2023

Ana Maria Jaller-Makarewicz

Insights

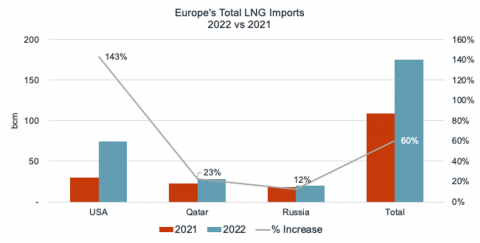

As Europe tries to cut Russian ties, dependence on imported LNG deepens

January 10, 2023

Ana Maria Jaller-Makarewicz

Insights

Oil and gas profits driven by Ukraine conflict, not financial skill

November 01, 2022

Tom Sanzillo, Suzanne Mattei

Insights

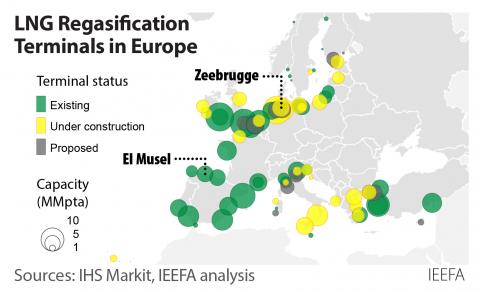

Smarter use of LNG infrastructure is crucial for a future without Russian gas

October 28, 2022

Ana Maria Jaller-Makarewicz

Insights

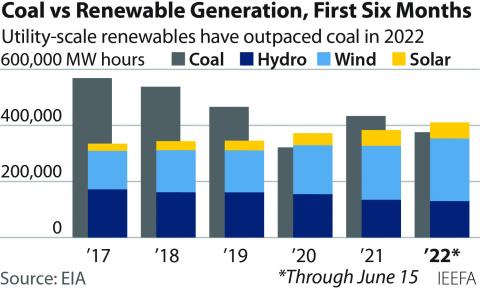

Delayed U.S. coal plant closures are bumps in the road, not U-turns for energy transition

July 21, 2022

Dennis Wamsted

Insights

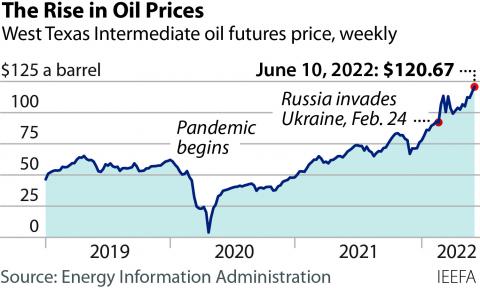

Russian oil volumes down, but revenues soar sky-high due to prices

June 13, 2022

Tom Sanzillo

Insights

High coal prices - the other side of the coin

May 31, 2022

Simon Nicholas

Insights

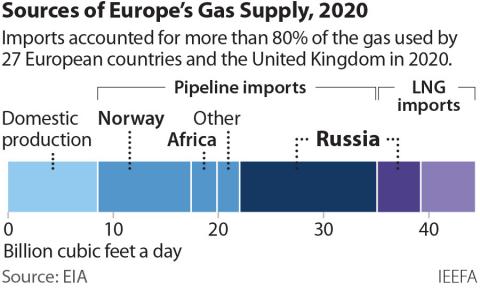

Ukraine impact on European gas markets has exposed biases in network design

May 19, 2022

Arjun Flora

Report

Presentation: Europe’s dependency on Russian gas

May 19, 2022

Ana Maria Jaller-Makarewicz

Slides

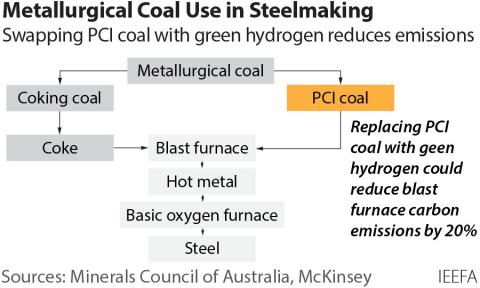

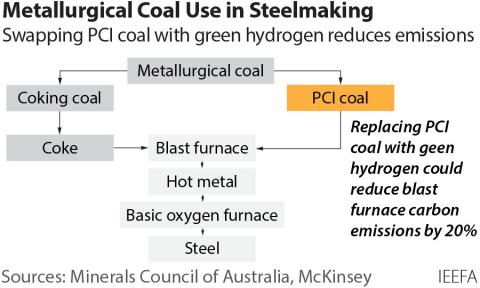

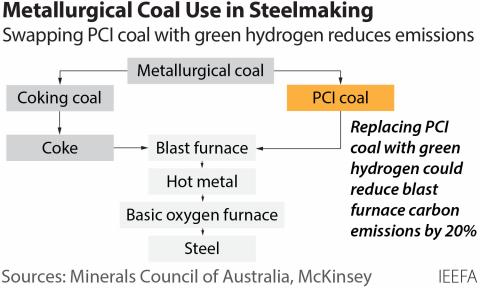

PCI coal for steelmaking the first metallurgical coal grade to be impacted by decarbonisation

May 10, 2022

Simon Nicholas, Soroush Basirat

Report

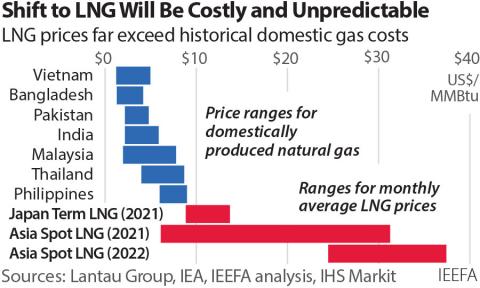

Bangladesh: Invest in renewable energy, not imported LNG

April 13, 2022

Simon Nicholas

Insights

IEEFA: Fuel price crisis should accelerate India’s energy transition

March 28, 2022

Vibhuti Garg

Insights

Latest Russia Reports

See more >Ukraine impact on European gas markets has exposed biases in network design

May 19, 2022

Arjun Flora

Report

PCI coal for steelmaking the first metallurgical coal grade to be impacted by decarbonisation

May 10, 2022

Simon Nicholas, Soroush Basirat

Report

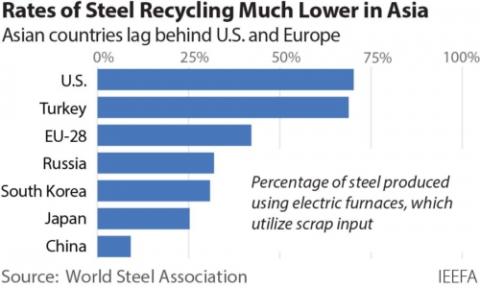

New from Old: The Global Potential for More Scrap Steel Recycling

December 01, 2021

Simon Nicholas

Report

ExxonMobil: Permian leader or just another fracker?

June 10, 2021

Clark Williams-Derry, Tom Sanzillo

Report

New Mexico’s risky reliance on oil revenue must change

October 01, 2020

Tom Sanzillo, Suzanne Mattei

Report

Major oil companies’ ongoing struggle to pay shareholders out of cash flows from operations accelerates in dismal second quarter

August 01, 2020

Clark Williams-Derry, Tom Sanzillo, Kathy Hipple...

Report

Emerging markets lead global investment in renewables

November 01, 2016

Tim Buckley

Report

The New Development Bank and its role in BRICS renewable energy targets

October 01, 2016

Jai Sharda

Report

Latest Russia Press Releases

See more >

IEEFA experts trace the fallout from Russia’s invasion of Ukraine on global liquefied natural gas markets

May 20, 2022

Press Release

TIAA climate policy gaps erode potential strength of $1.4 trillion fund

May 16, 2022

Press Release

PCI coal for steelmaking soon to be impacted by decarbonisation

May 10, 2022

Press Release

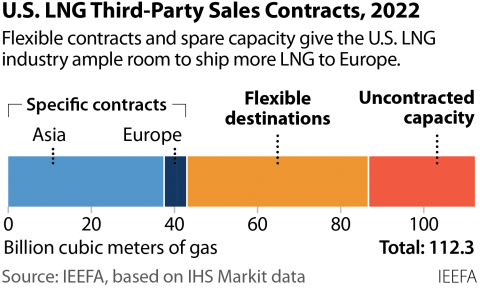

Analysis finds U.S. can increase LNG shipments to Europe without building new facilities

April 06, 2022

Press Release

For price-sensitive LNG buyers in Asia, now is not the time to build new LNG import terminals

March 31, 2022

Press Release

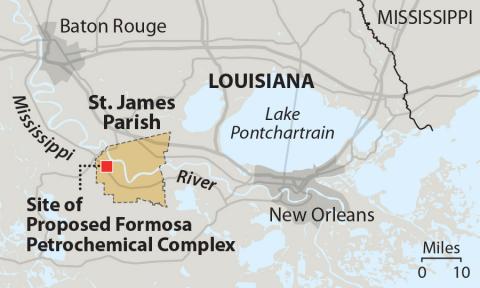

Problems have mounted over last year for proposed Formosa petrochemical plant

March 24, 2022

Press Release

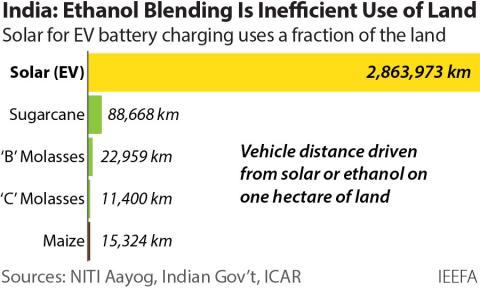

IEEFA: Solar recharging of electric vehicles is a far more efficient use of land than ethanol crops for blended fuel in India

March 23, 2022

Press Release

IEEFA Europe: Zeebrugge terminal serves as hub for transport of Russian gas to non-European markets

March 21, 2022

Press Release

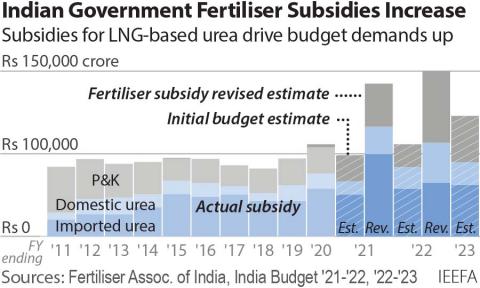

IEEFA: Soaring LNG prices likely to drive up India’s Rs1 trillion (US$14 billion) fertiliser subsidy

March 14, 2022

Press Release

IEEFA: EU gas – Diversity of supply or diversity of routes?

February 24, 2022

Press Release

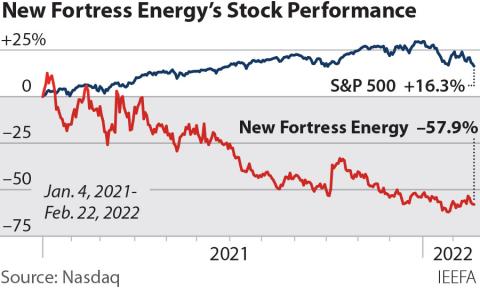

IEEFA: La expansión del gas de New Fortress Energy presenta mayores riesgos para los inversores

February 23, 2022

Press Release

IEEFA: New Fortress Energy gas expansion presenting increased risks to investors

February 23, 2022

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.