Renewables offer a win-win solution for Indonesia to achieve financial sustainability in its power sector and meet climate commitments

Indonesia’s national electricity utility, PT Perusahaan Listrik Negara (PLN), can overcome its financial struggles by accelerating solar and wind deployment while reducing coal reliance

Indonesia has less than seven years to fulfill its Paris Agreement commitments, and its national electric utility, PT Perusahaan Listrik Negara (PLN), can play a leading role in decarbonizing the country’s energy sector and developing renewable energy projects.

“Our new report illustrates the financial case to gradually retire coal-fired power plants and scale up the development of more financially sustainable renewable energy, especially solar and wind power plants,” says Mutya Yustika, the report’s author and an Energy Finance Specialist at the Institute for Energy Economics and Financial Analysis (IEEFA).

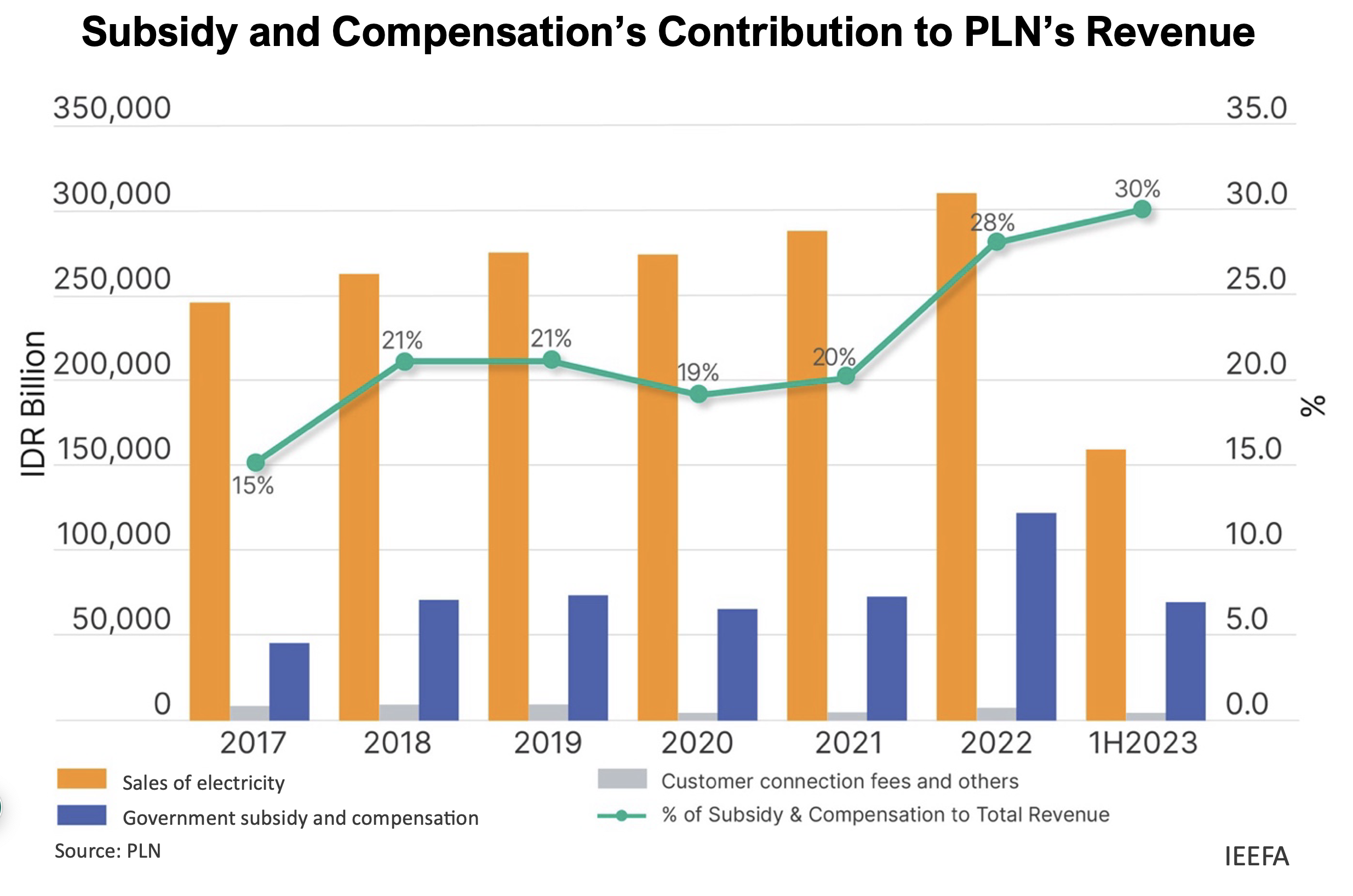

Over the years, PLN’s financial challenges have led to substantial subsidies and compensation from the Government of Indonesia (GOI) to support operation and maintenance expenses. In 2022 alone, PLN received about Indonesian Rupiah (IDR) 123 trillion (US$ 8 billion) from the GOI.

“Subsidies and compensation for PLN have become a significant burden on the government’s budget and will remain so for the foreseeable future,” says Yustika. “The gradual retirement of these coal-fired power plants offers benefits such as decreasing exposure to coal price volatility and reducing the significant maintenance costs.”

“With the continuing decline in costs for developing renewable energy and the increasing operating costs of coal-fired power plants, now is the time for Indonesia to accelerate the retirement of coal-fired power plants and the deployment of renewables.”

Retiring coal-fired power plants can ease PLN’s burden

Despite the goal to improve PLN’s financial performance, the GOI’s three Fast Track Programs from 2006 to 2015 drove a massive expansion of coal-fired power plant capacity, which increased PLN’s financial burden due to high operating and maintenance costs and the contractual obligations imposed by power purchase agreements.

According to the Ministry of Finance (MOF), the gap between the average basic cost of generating electricity (BPP) and the electricity tariff determines the subsidy provided by the GOI.

“Given that an electricity tariff adjustment could trigger negative public sentiment, PLN will need to first lower the BPP to reduce its subsidy reliance. The BPP includes fuel and lubricant costs, such as coal purchasing,” says Yustika.

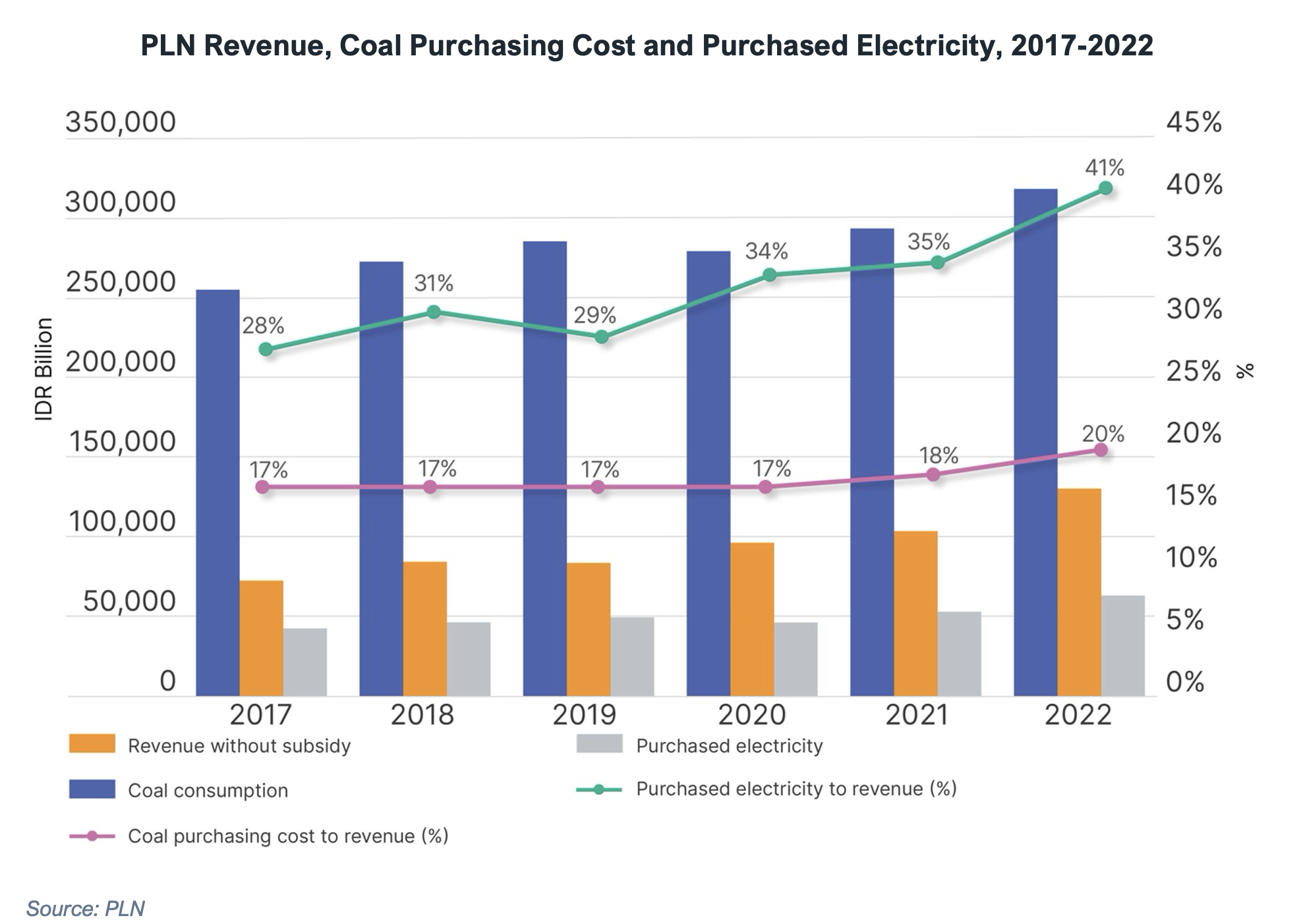

Having reviewed PLN’s financial statements, Yustika found that its coal purchasing cost has increased significantly since 2020. However, this did not translate to greater coal-fired electricity generation, indicating potential energy production inefficiency.

In addition to subsidies, the GOI also pays compensation income to PLN for the non-subsidized tariff, which has not increased since 2017. According to the Ministry of Energy and Mineral Resources (MEMR), the four factors that can influence adjustments of the non-subsidized tariff are the inflation rate, the coal benchmark price, the Indonesian Crude Price, and the US$ exchange rate against IDR.

“PLN still struggles with coal prices due to the exchange rate between US$ and IDR. PLN’s exposure to US$-denominated coal prices necessitates careful management, considering both market dynamics and currency fluctuations,” says Yustika.

As of December 2023, PLN has around 20.4 gigawatts (GW) of coal-fired power plants, 23% of which have been operating for more than 20 years.

“The gradual retirement of old coal-fired power plants would reduce the significant maintenance costs as the economic benefits of old plants decrease with age,” says Yustika.

Cheaper renewables offer multiple benefits

Indonesia has set an ambitious target of 23% renewable energy by 2025. However, renewables only contributed 13.1% of the country’s electricity mix in 2023, according to MEMR.

In the new report, Yustika says that Indonesia is set to miss its renewable energy target because of PLN's mistaken notion that large-scale development of renewable energy is costly. However, technological advancements in renewables have led to more efficient energy production, lower capital and operational and maintenance costs, and sustainable infrastructure.

“Globally, the cost of renewable energy, especially solar and wind, has fallen over the past five years and has become cheaper, compared to fossil fuels, and the cost of photovoltaic (PV) cells is expected to decrease further,” says Yustika.

“In Indonesia, while the Local Content Requirement (LCR) regulations set by the GOI to use the domestic inputs in industrial production increases the cost of investment in renewables, the Levelized Cost of Electricity (LCOE) of solar and wind remains competitive compared to coal and is expected to become cheaper by 2030,” adds Yustika.

“Another advantage is renewable energy projects, especially solar and wind, can be built significantly faster than fossil fuel power plants. As renewables become much cheaper than coal, reducing Indonesia's coal dependence and accelerating renewable energy deployment will help fulfill the country’s Paris Agreement commitments and its financial goals.”

Read the report: Pathways to financial sustainability for PLN through renewable energy development

Read this press release in Bahasa

Author contact: Mutya Yustika ([email protected])

Media contact: Alex Yu ([email protected])

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable, and profitable energy economy. www.ieefa.org