Pumped hydro proposals could see taxpayers financing mine rehabilitation

Key Takeaways:

Proposals to build pumped hydro energy storage facilities in the voids left after mining pose risks to taxpayers and the environment.

Government should be wary of providing finance for these projects, as this could set a precedent of taxpayers, at least partially, funding mite rehabilitation.

The National Electricity Market (NEM) has little need for the specific storage capabilities these projects would offer, which recent evidence suggests might be delivered more competitively by alternate technologies like batteries.

Australia needs to define a clear policy framework for final voids left after mining, to ensure governments are not liable for potential clean-up or rehabilitation costs.

8 August 2024 - (IEEFA Australia): Pumped hydro projects are being proposed as a post mining use for the large holes left after open-cut mining, but new research from an independent think tank suggests governments – and taxpayers – should be wary.

The Australian mining sector faces a challenging task over the next few decades as it looks for ways to make use of the voids left by mining. One widely suggested option is to convert these sites to pumped hydro facilities that would provide energy storage for the electricity grid.

However, a new report from the Institute for Energy Economics and Financial Analysis (IEEFA) highlights the technical, environmental and financial risks these projects could pose. Pumped hydro has a history of delays and cost-blowouts, and projects implemented in mine voids could also entail severe contamination risks.

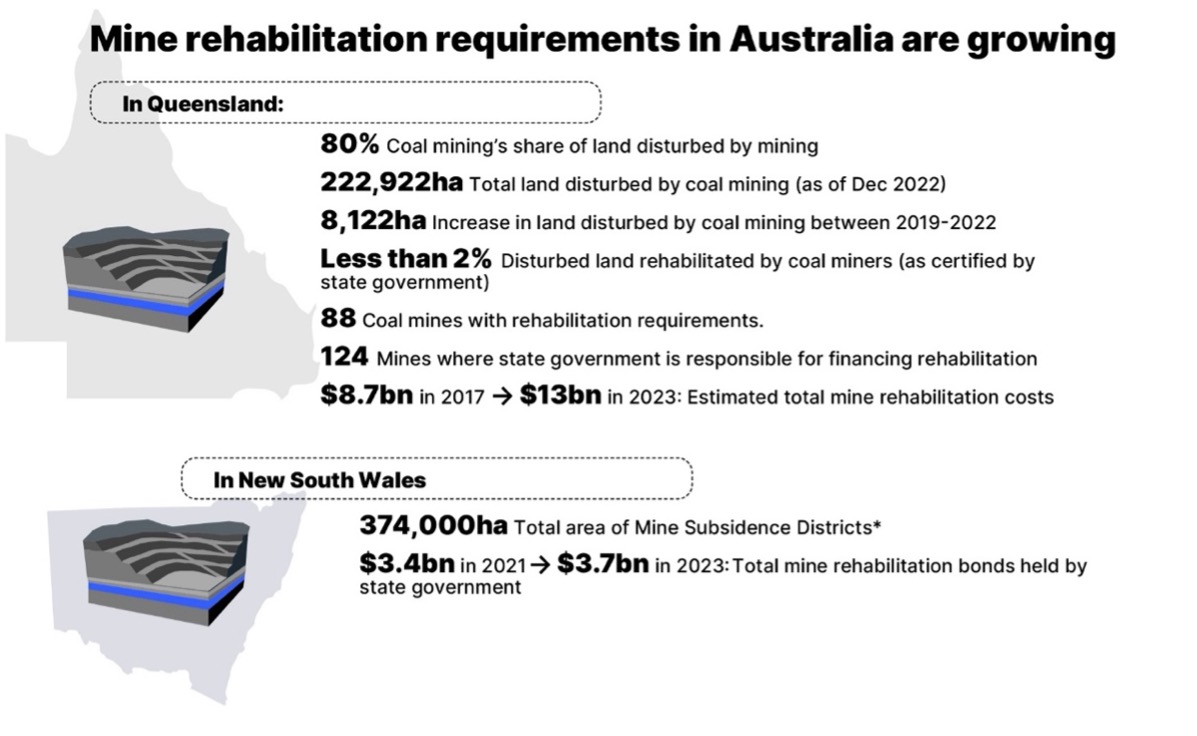

The report, entitled Filling the voids: Pumped hydro proposals could see taxpayers financing mine rehabilitation, also warns of the possibility these projects would effectively set a precedent of governments partially funding the rehabilitation of mine sites – a responsibility that should sit with the mine operator.

Anne-Louise Knight, Lead Analyst, Coal Industry Australia and the report’s author, says: “Rehabilitating mine sites is a legal obligation miners enter when their mining licences are approved, and they should be budgeting for this ahead of the mine’s closure. IEEFA’s research raises concerns that proposals to build pumped hydro in these final voids may potentially be a way to get governments to share some of that financial burden, with taxpayers ultimately losing out.”

Along with the risks, IEEFA’s research found these projects are unlikely to deliver significant benefit for Australia’s energy system. While large-scale, strategically placed pumped hydro such as Snowy 2.0 could play an important role providing deep energy storage to complement renewable electricity generation, most of the schemes proposed for mine voids only offer medium-duration storage. Analysis of projected storage requirements in the National Electricity Market (NEM) suggests demand for these specific projects will be limited, and might be met more competitively by alternative technologies.

Knight says, “There is little to no requirement in the NEM for the pumped hydro proposed in mine voids. The primary driver for pumped hydro proposals in mine voids appears to be an attempt to find a suitable post-mining use for mine voids rather than to fill the energy storage requirements in the NEM.”

The report argues that if final voids are permitted to be left after mining, then Australia needs a clearly defined policy that sets out the obligations of mining companies to rehabilitate or repurpose mine pits, to avoid significant financial burden on the taxpayer.

“Currently it is unclear what the rehabilitation strategies are for these giant holes dotted across the country,” says Knight. “Governments must ensure companies meet their obligations in managing the ongoing risks these structures pose, while ensuring that taxpayers are not left to pick up the bill.”

Read the report: Filling the voids: Pumped hydro proposals could see taxpayers financing mine rehabilitation

Media contact: Amy Leiper [email protected] +61 414 643 446

Author contacts: Anne-Louise Knight, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)