Delays, damages and poor service: LUMA Energy’s first two months highlight privatization flaws

August 16, 2021 (IEEFA)—Failures and frustrations identified in the first two months of LUMA Energy’s operation of Puerto Rico’s energy grid highlight underlying flaws with the privatization contract, according to an analysis by the Institute for Energy Economics and Financial Analysis.

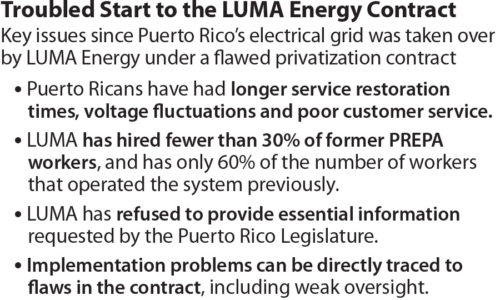

Since the June 1 takeover, Puerto Ricans have experienced significant problems as a result of LUMA’s implementation of its electric transmission and distribution services. The issues include longer service restoration times, voltage fluctuations and poor customer service.

“The problems experienced by the people of Puerto Rico over the last couple of months point to fundamental flaws in the contract that need to be resolved,” said lead author and IEEFA energy finance analyst Cathy Kunkel.

The challenges affecting Puerto Ricans can be directly traced to the LUMA contract, including:

- An obvious lack of personnel, which could be an even larger issue as the island enters peak hurricane season.

- Insufficient transparency, which has prevented anyone from precisely assessing the extent of LUMA’s failures.

- An absence of effective oversight, resulting in operations analyses void of any substance or data related to customer complaints.

A number of problems stem from LUMA’s lack of experienced employees. Fewer than 30% of transmission and distribution system employees at the Puerto Rico Electric Power Authority (PREPA) were hired at its successor. Additionally, LUMA is trying to operate its system with about 60% of PREPA’s previous transmission and distribution system workforce.

LUMA, a consortium of Houston-based Quanta Energy Services and Calgary-based ATCO Group, has repeatedly refused to provide information requested by the Puerto Rico Legislature. And no oversight documents related to LUMA’s performance in the last two months have been made public, furthering a culture of opacity.

Since its announcement in 2018 by former Gov. Ricardo Rosselló, the privatization of Puerto Rico’s grid has lacked necessary transparency and oversight. The Financial Oversight and Management Board (FOMB), which was charged with restoring public faith in government contracting, has aggressively defended the privatization contract that has so far resulted in worse service for the island’s residents.

The board has been unable to provide a financial analysis supporting its contention that the LUMA contract will result in reduced costs.

Ultimately, many of the problems resulting from the LUMA contract are FOMB’s responsibility, but it has yet to take its duties to reform electrical system contracting seriously. Its aggressive defense of the LUMA contract and refusal to consider amending the contract’s clear deficiencies have so far led to worse energy outcomes for the people of Puerto Rico.

“You want to be fair and give LUMA time to improve a very bad situation,” said Kunkel. “But it is not too early to see a weak recruitment effort and poor customer service.”

Full briefing: Puerto Rico Grid Privatization Flaws Highlighted in First Two Months of Operation

Versión en español: Fallas en la privatización de la red de Puerto Rico sobresalen en los primeros dos mesas de operación

Spanish Press Release: Retrasos, daños y mal servicio: los dos primeros meses de LUMA Energy ponen de relieve los defectos de la privatización

Author contact:

Cathy Kunkel ([email protected]) is an IEEFA energy finance analyst.

Tom Sanzillo ([email protected]) is IEEFA’s director of financial analysis.

Media contact:

Muhamed Sulejmanagic ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. IEEFA’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.