IEEFA update: Who would still fund a new coal power plant in India?

4 May 2020 (IEEFA India) ‒ The coronavirus pandemic and national lockdown has highlighted the growing financial risks to India’s coal-fired power plant sector, a technology being superseded by international finance investing in new, cheaper, and cleaner renewable energy, finds a new IEEFA briefing note out today.

Entitled Who Would Still Fund a New Coal Power Plant in India? the note finds renewable energy delivered more than two-thirds or 9.39 gigawatts (GW) of India’s new generating capacity additions in the fiscal year 2019/20, while new thermal power plants delivered 4.3GW, net of the 2.5GW removed due to end-of-life plant closures.

Further, coal-fired power plants today are running at half the capacity rate assumed in the Central Electricity Authority’s modelling guidelines used to evaluate the financial and operating performance of new coal-fired power plants.

Author of the note Tim Buckley, IEEFA’s director of energy finance studies, says the National Electricity Plan of 2018 is predicated on an additional 70GW or more of new coal-fired power plants installed by 2026/27, and the closure of another 39GW, relative to the position as at 31 March 2020.

“That assumes some US$70bn of new investment in coal-fired power,” says Buckley.

“Yet, renewable energy installs nearly doubled traditional thermal power capacity installs during 2019/20, and the pricing trends for new electricity generation entirely favour renewable energy over coal, particularly when it comes to expensive non-minemouth or import coal-fired power proposals.

Instead of backing coal, new finance is getting behind renewable energy.

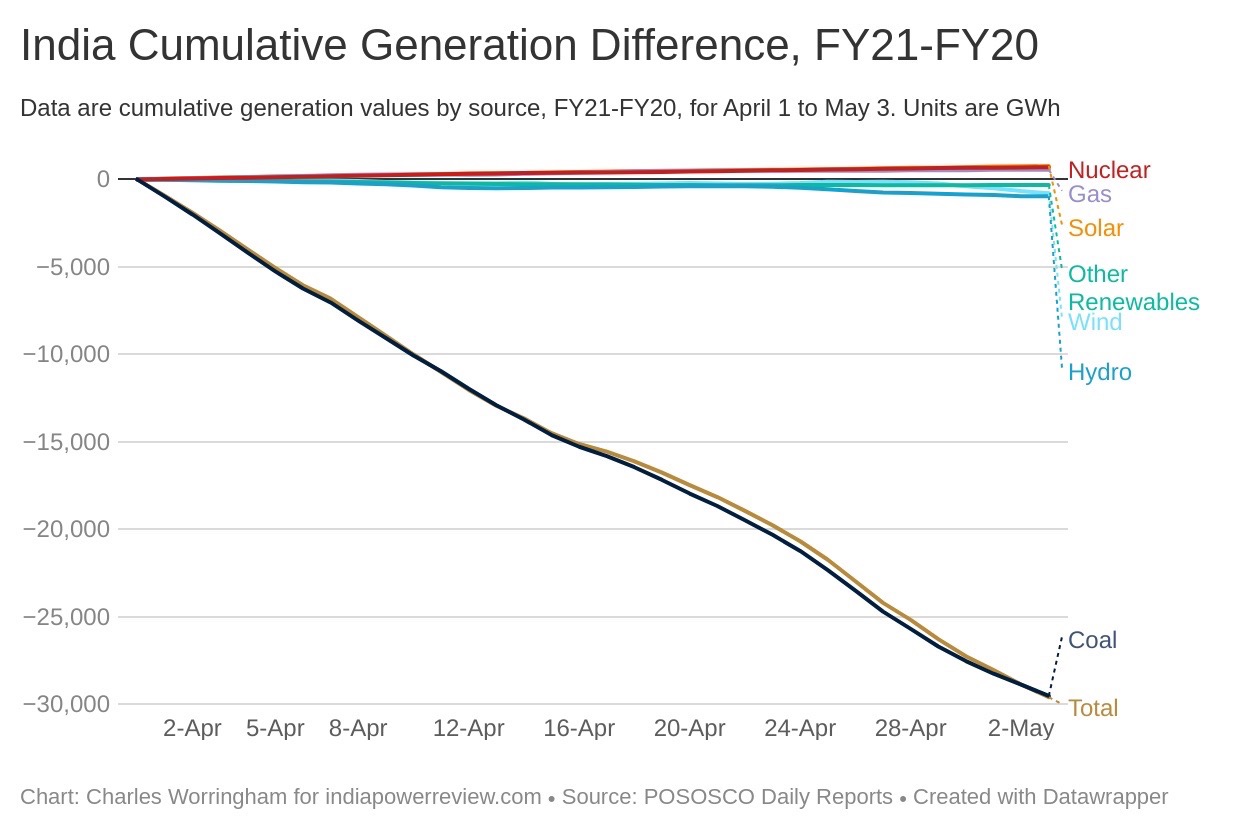

The COVID-19 pandemic and national lockdown has reduced power demand, with the casualty being coal-fired power generation.

In the first 33 days of the 2020/21 fiscal year, coal-fired power generation was down just shy of 30 Terawatt hours (TWh). This decline has now eclipsed the total electricity consumed in Ireland in the entire 2018 year (28.7 TWh, IEA).

“Coal-fired power generation has worn more than 100% of the COVID-19 power demand loss,” says Buckley.

“Renewables get priority over coal when power demand drops given their “must run” status, which is a reflection of their zero marginal cost of production. Coal-fired generation, the high marginal cost producer, is losing out.”

The note finds new domestic and international finance is backing solar, with a landmark 2GW solar tender awarded by NHPC in April 2020 priced at a near record low of Rs2.55/kWh, fixed flat for 25 years. This tender was won by leading Indian renewable energy developers, most of whom have access to global capital backers like SoftBank of Japan, EQT Infrastructure of Sweden, Temasek of Singapore, EDF and Total of France and Brookfield of Canada; a who’s who of innovative global financial leaders.

Further, April 2020 also saw global private equity leader KKR enter the Indian renewable infrastructure sector, acquiring 317MW of solar from Shapoorji Pallonji Solar Holdings.

“Why would any debt or equity capital providers fund a high emission, highly polluting new coal-fired power plant at double the cost of deflationary, domestic renewables?”

Read the note: Who Would Still Fund a New Coal Power Plant in India? Stranded Asset Risks Continue to Rise as Solar Deflation Continues

Media Contact: Kate Finlayson ([email protected]) +61 418 254 237

Author Contact: Tim Buckley ([email protected]) +61 40 810 2127

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.