CCUS will not play a major role in steel decarbonisation

The steel industry has other, more effective options to reduce emissions

Key Takeaways:

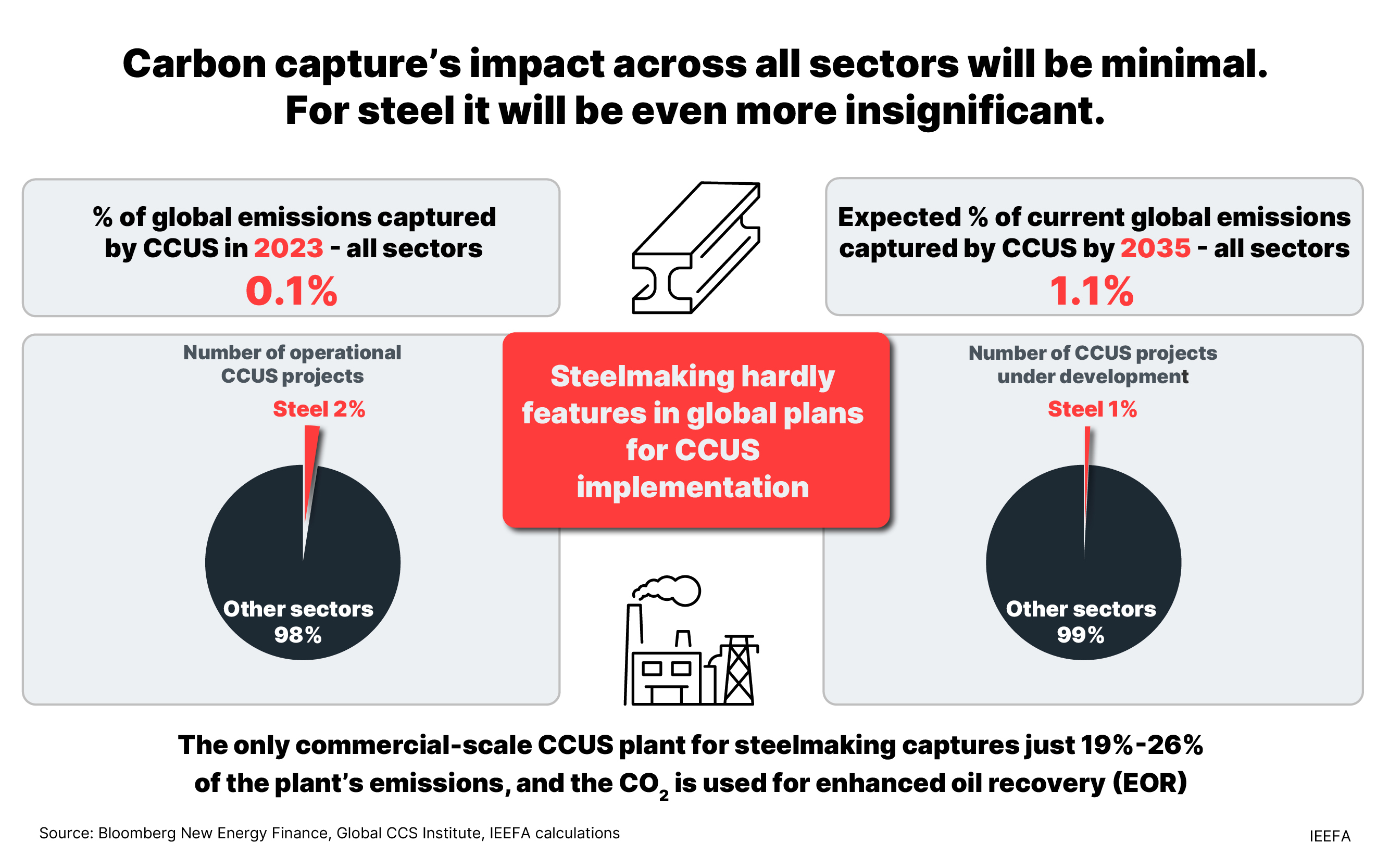

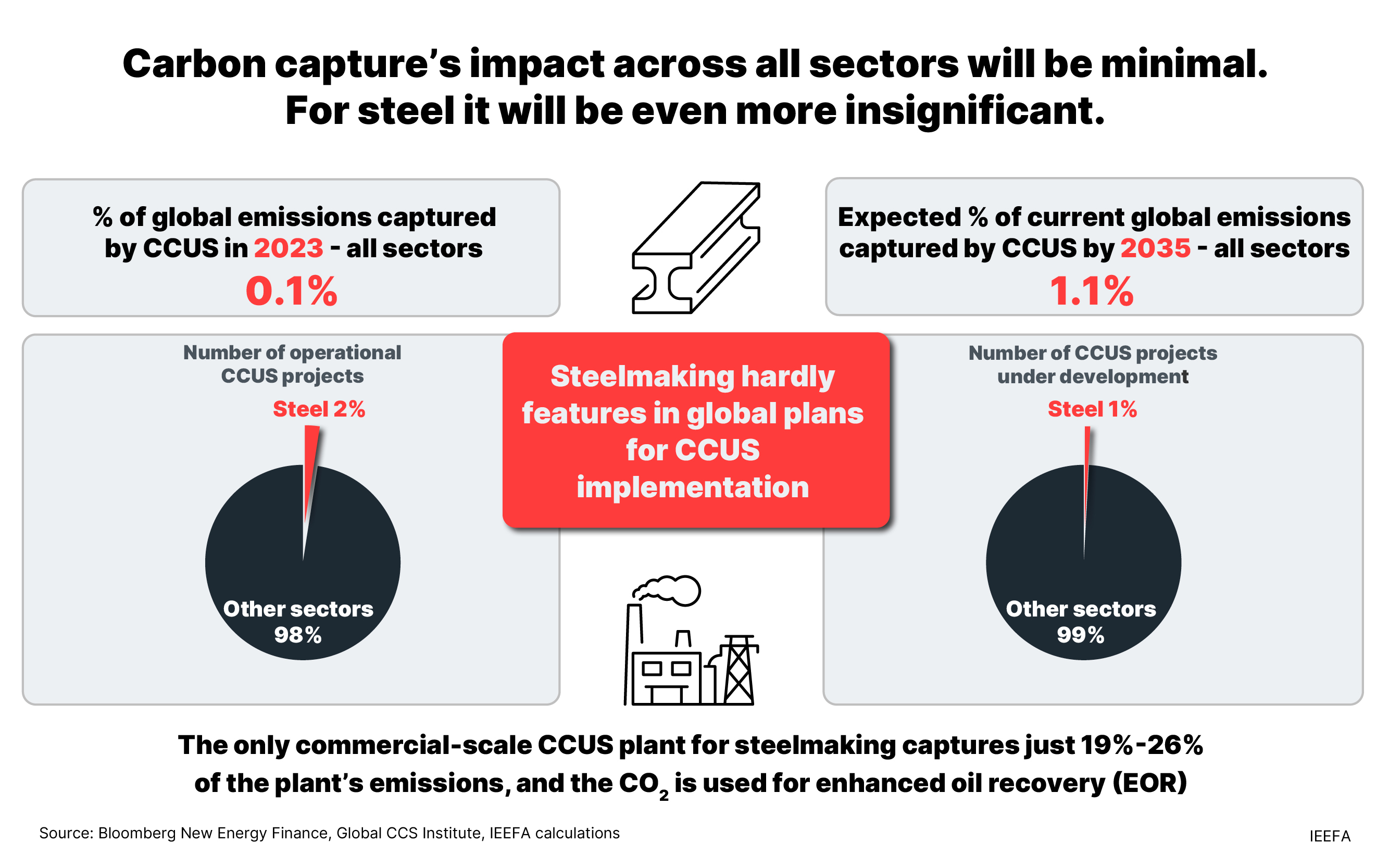

Over several decades of implementation in a range of sectors, carbon capture, utilisation and storage (CCUS) has accumulated a track record of underperformance and failure.

Capture rates at the world’s only commercial-scale CCUS plant for gas-based steel production are very low. There are no commercial-scale CCUS plants for coal-based steelmaking anywhere in the world, with almost nothing in the pipeline.

Major steelmakers are turning increasingly to direct reduced iron (DRI)-based steelmaking to replace coal-consuming blast furnaces. CCUS faces being left behind as it was in other sectors like power generation.

Due to the poor performance of CCUS, it seems increasingly likely steel consumers will not want coal in their supply chains at all going forward. Investors should question steel company decarbonisation plans that maintain that CCUS will play a significant role.

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

17 April 2024 - (IEEFA Australia): A new report by the Institute of Energy Economics and Financial Analysis (IEEFA) has shown that carbon capture utilisation and storage (CCUS) will not play a major role in steel decarbonisation despite support for the technology at the 2023 COP28 climate conference.

Direct reduced iron (DRI)-based steelmaking, which can run on green hydrogen, is gaining momentum in the steel sector. IEEFA’s research found that this technology – along with electric arc furnaces (EAFs) powered by renewable electricity – offers steelmakers a far more promising pathway to reduce their emissions than CCUS. Despite this, many major steelmakers around the world still maintain that CCUS will play a role in decarbonising their operations.

Simon Nicholas, IEEFA’s Lead Steel Financial Analyst, says: “Major steelmakers’ plans for CCUS tend to push commercial-scale implementation of the technology off into the 2040s and lack detail. CCUS technology has been around for nearly 50 years and has accumulated a history of significant underperformance.”

CCUS is susceptible to significant financial, technological and environmental risks, made worse by uncertainty over the long-term effectiveness of geological CO2 storage. The uniqueness of each CCUS project limits technological learning and cost reductions. The cost of carbon capture implementation has hardly reduced in decades, while the cost of technologies like renewable energy and battery storage has plunged, with further reductions to come.

“The International Energy Agency (IEA) has a track record of reliance on CCUS for decarbonisation, but now it appears to have started to shift in its long-term view on decarbonising the steel industry. We expect the IEA will continue to downgrade the role it expects CCUS to play in steel decarbonisation in future updates,” says Nicholas.

“A key issue with CCUS that is often missed is its low rate of capture. CCUS projects have consistently struggled to reach targeted capture rates. Moreover, targeted carbon capture itself is often far below overall carbon emissions. Installations that capture low CO2 levels cannot be viewed as decarbonised.”

The steel sector’s first and only commercial-scale CCUS plant, the Al Reyadah CCUS facility in the UAE, captured less than 20% of the total Scope 1 and Scope 2 emissions from Emirates Steel Arkan’s DRI-based steel plant in 2020 and 2021. Furthermore, the captured CO2 is used for enhanced oil recovery (EOR), enabling the production of more fossil fuels and the release of additional carbon emissions.

Soroush Basirat, co-author and IEEFA’s Global Steel Financial Analyst, says: “Despite being operational for eight years, no other commercial-scale carbon capture facilities for steelmaking have been built.

“Emirates Steel Arkan is now turning to alternative technology that it appears to consider more effective for decarbonising steel. The company is establishing the first pilot project for DRI-EAF using green hydrogen in the Middle East. The project is expected to start up in 2024.”

Low capture rates will likely mean that any CCUS installations will not decarbonise steel production enough to satisfy the growing number of steel consumers demanding truly green steel. Car makers are already signing purchase agreements for green steel made using green hydrogen with virtually no emissions. Tighter definitions of what exactly constitutes ‘green steel’ can be expected in the near future.

“There is a significant risk that the low capture rates of CCUS will mean steel produced this way will not meet such definitions. Steelmakers will become increasingly exposed to the risk that steel consumers will not want coal involved in their supply chains at all,” says Nicholas.

“The phrases ‘hard to abate’ and ‘carbon capture and storage’ often go hand in hand. Some steelmakers seem to be using the phrase ‘hard to abate’ as an excuse to justify indefinite plans for CCUS in future decades while continuing business-as-usual to a large extent.

"Where better and more cost-competitive alternatives exist, CCUS is unlikely to play a role in decarbonisation. Using green hydrogen in DRI and renewable energy to power EAFs enables the production of truly low-carbon steel, a feat CCUS looks unable replicate."

Read the report: Carbon Capture for Steel?

Media contact: Amy Leiper, ph 0414 643 446, [email protected]

Author contact: Simon Nicholas [email protected]; Soroush Basirat [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)