Key Findings

Over several decades of implementation in a range of sectors, carbon capture, utilisation and storage (CCUS) has accumulated a track record of underperformance and failure.

Capture rates at the world’s only commercial-scale CCUS plant for gas-based steel production are very low. There are no commercial-scale CCUS plants for coal-based steelmaking anywhere in the world, with almost nothing in the pipeline.

Major steelmakers are turning increasingly to direct reduced iron (DRI)-based steelmaking to replace coal-consuming blast furnaces. CCUS faces being left behind as it was in other sectors like power generation.

Due to the poor performance of CCUS, it seems increasingly likely steel consumers will not want coal in their supply chains at all going forward. Investors should question steel company decarbonisation plans that maintain that CCUS will play a significant role.

Executive Summary

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

Carbon capture utilisation and storage (CCUS) looks unlikely to play a major role in decarbonising the global steel sector, despite support for the technology at the 2023 COP28 climate conference.

It is increasingly obvious to many, including the International Energy Agency (IEA), that the uptake of direct reduced iron (DRI)-based steelmaking – which can run on green hydrogen with very low emissions – is accelerating. This technology – along with electric arc furnaces (EAFs) associated with renewable electricity – offers steelmakers a far more promising pathway to reduce their emissions than CCUS.

Despite this, many major steelmakers around the world still maintain that CCUS will play a role in decarbonising their operations. Their plans for CCUS tend to push commercial-scale implementation of the technology off into the 2040s and lack detail. There are no commercial-scale CCUS plants for blast furnace-based steelmaking in operation anywhere in the world. The few pilot projects that exist have not proven the technology’s feasibility.

CCUS’s weak track record

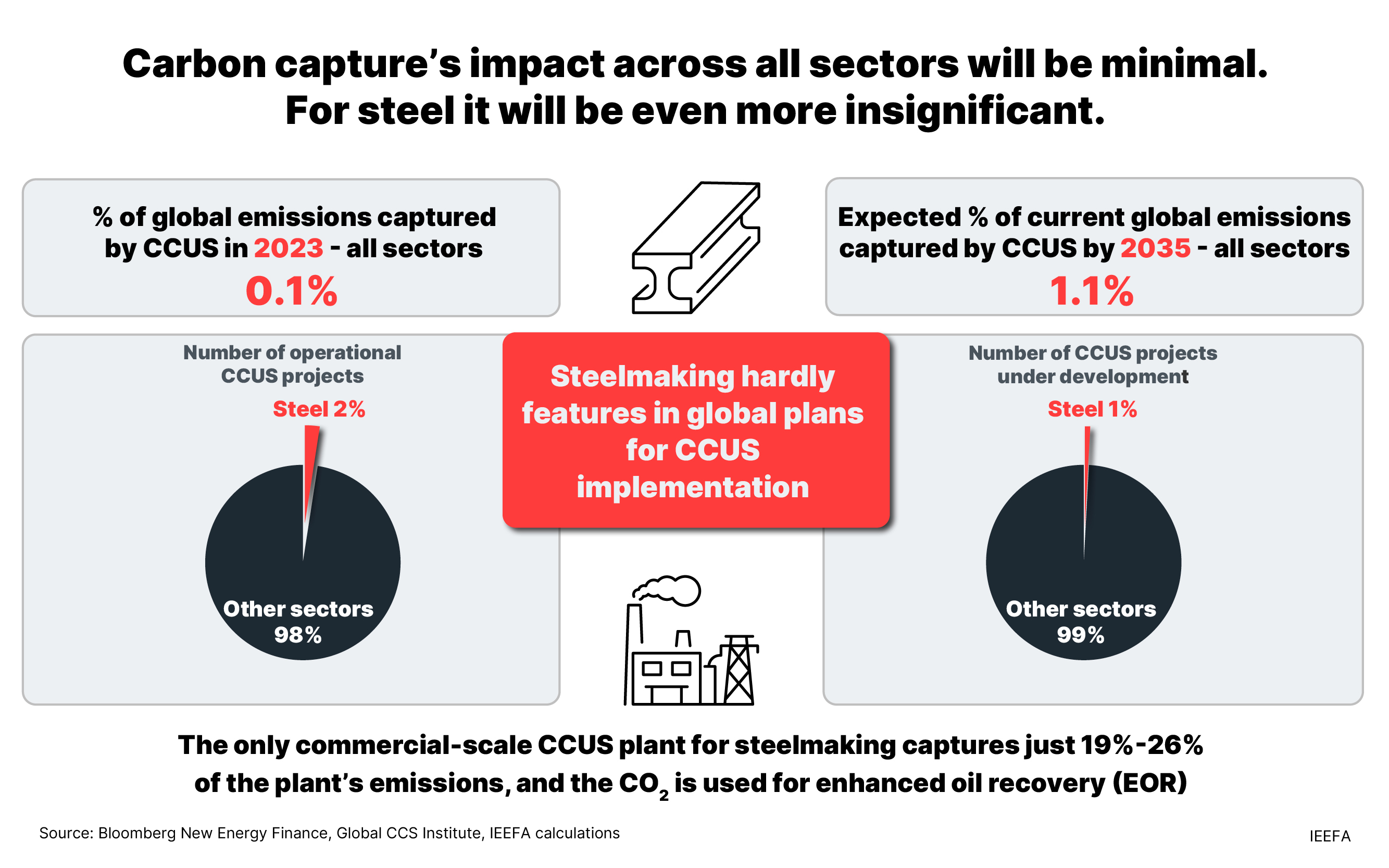

CCUS technology has been around for nearly 50 years and has accumulated a history of significant underperformance. According to Bloomberg New Energy Finance (BNEF), CCUS currently captures just 0.1% of global emissions despite decades of implementation efforts. The IEA’s updated 2023 Net Zero Roadmap report noted that “The history of CCUS has largely been one of underperformance.”

In 2022, IEEFA research showed that, out of 13 flagship, large-scale CCUS projects, five had materially underperformed, two were suspended, one was mothballed and two didn’t provide data that allowed performance to be assessed. The study found almost three quarters of captured carbon dioxide (CO2) was being used for enhanced oil recovery (EOR), enabling more fossil fuel extraction and therefore more carbon emissions.

CCUS is also susceptible to significant financial, technological and environmental risks, made worse by uncertainty over the long-term effectiveness of geological CO2 storage. Transportation and storage of CO2 in secure, dedicated geological sites pose significant challenges, requiring detailed studies for each project individually. The uniqueness of each CCUS project limits technological learning and cost reductions. The cost of carbon capture implementation has hardly reduced in 40 years while the cost of alternative technologies like renewable energy and battery storage has plunged, with further reductions to come.

One issue with CCUS that is often missed is its low rate of capture. CCUS projects have consistently struggled to reach targeted capture rates. Moreover, targeted carbon capture itself is often far below overall carbon emissions. Installations that capture low CO2 levels cannot be viewed as “decarbonised” – as illustrated by the world’s only commercial-scale CCUS facility for steelmaking.

Poor results at the only commercial-scale CCUS plant for steel

The Al Reyadah CCUS facility is the first and only commercial-scale plant in the steel sector. Commissioned in 2016, its primary objective is to receive captured CO2 from a DRI-based steel plant owned by Emirates Steel Arkan and transport it for use in EOR operations. Based on Emirates Steel Arkan’s disclosed emissions figures, and assuming the carbon capture facility was operating at full capacity (0.8Mt per annnum), the plant captured less than 20% of the total Scope 1 and Scope 2 emissions in 2020 and 2021.

In 2022, Emirates Steel Arkan was able to reduce its Scope 2 emissions significantly by procuring electricity produced from nuclear and solar power generation. This led to an increase in the percentage of overall Scope 1 and 2 emissions captured in 2022, though it was still only 26%. This rise was not attributable to the improved performance of the CCUS facility but rather to a greater proportion of clean electricity utilised in the total electricity consumption mix.

Despite being operational for seven years, and having a use for the captured CO2 in EOR, no other commercial-scale carbon capture facilities for DRI-based steelmaking have been built. Meanwhile, Emirates Steel Arkan is now turning to alternative technology that it appears to consider is more effective for decarbonising steel. The company is establishing the first pilot project for DRI-EAF using green hydrogen in the Middle East, expected to start up in 2024.

The outlook for steel CCUS

The Global CCS Institute (GCCSI) published its 2023 Global Status of CCS Report in November 2023. Despite carbon capture and storage (CCS) having been around for decades, the GCCSI is tracking just 41 commercial-scale projects in operation globally, with 351 in development. With the great majority of these categorised as being only in “early development” (i.e. a long way from final design or investment decision), IEEFA expects a large proportion to never reach commercial operation.

Of the combined 392 projects, just four are in the steel sector, including the operational Al Reyadah project. Three of these are for DRI-based steel plants, not for blast furnace-based steelmaking - the dominant and most carbon-intensive process. Two of the projects under development are only in the early development stage. Although the GCCSI’s report highlights an increase in the carbon capture project pipeline, this rise appears to have passed the steel industry by.

The IEA has a track record of reliance on CCUS for decarbonisation in its scenarios, but recently this appears to have started to shift in its long-term view on steel decarbonisation. In its landmark 2021 report Net Zero by 2050: A Roadmap for the Global Energy Sector, the IEA saw CCUS-equipped processes making up 53% of global primary steel production in 2050. In this first iteration of the IEA’s Net Zero Emissions by 2050 Scenario (NZE), 670 million tonnes (Mt) of CO2 would be captured from these processes.

However, just two years later the IEA’s view had already started to change significantly. In its 2023 update to the NZE Scenario, the IEA sees CCUS-equipped processes’ 2050 share of iron production down to 37%. The amount of CO2 captured in the global steel sector has been downgraded to 399Mt, from 670Mt in the 2021 version. At the same time, the share of hydrogen-based steelmaking has increased from 29% in 2021 to 44% in the 2023 update. IEEFA expects that the IEA will continue to decrease the role it expects CCUS to play in steel decarbonisation in future updates.

CCUS will not play a major role in decarbonising blast furnace steelmaking

The majority of global steel is currently produced in integrated, blast furnace-based steel plants. One key reason why CCUS for blast furnace-based steelmaking has not made an impact – and is unlikely to going forward – is that these plants have multiple sources of carbon emissions. Retrofitting multiple CCUS systems to such plants would incur significant additional cost.

Due to the high cost of CCUS, potential developers of the technology often state that a significant carbon price is needed to stimulate its implementation. Despite a clear and significant carbon price signal in the EU, CCUS for steel in Europe has made little or no commercial progress. If steel CCUS cannot advance in Europe where there is a significant carbon price, it cannot be expected to make headway in developing Asia, the seat of major steel demand growth.

The German think tank Agora Industry highlights that, since 2020, commercial-scale project announcements for new DRI-based steel plants and for CCUS projects for blast furnace-based steelmaking have developed very differently. To date, virtually all steel companies that plan to build low-carbon steelmaking capacity at commercial scale have opted for hydrogen-based or hydrogen-ready DRI plants, not CCUS. The 2030 project pipeline of DRI plants has grown to 94 million tonnes a year (Mtpa), while the pipeline for commercial-scale CCUS on blast furnace-based operations amounts to just 1Mtpa. It is clear that CCUS for blast furnace-based steelmaking is already being left behind by alternative technology, just as has happened in other sectors such as power generation.

Long-term risks for coal-based steelmaking are growing

As well as low capture rates, CCUS for integrated, blast furnace-based steel plants does nothing to address the emissions associated with metallurgical coal mining, particularly methane emissions. Total methane emissions from coking coal mines globally totalled 10.5Mt in 2023, according to the IEA. This equates to up to 913.5Mt CO2 equivalent over a 20-year impact timeframe. For comparison, global emissions from steelmaking amount to around 2,800Mt CO2 per annum.

This, along with low capture rates at integrated steelmaking sites, will likely mean that any CCUS installations will not decarbonise steel production enough to satisfy the growing number of steel consumers demanding truly green steel. Car makers are already signing purchase agreements for green steel made using green hydrogen with virtually no emissions. Tighter definitions of what exactly constitutes “green steel” can be expected in the near future. There is a significant risk that the low capture rates of CCUS will mean steel produced this way will not meet such definitions. Steelmakers will become increasingly exposed to the risk that steel consumers will not want coal involved in their supply chains at all. Investors should have questions for steelmakers that continue to maintain that CCUS will play a significant decarbonisation role.

At COP28, parties agreed to accelerate the deployment of low- and zero-emissions technologies, including “carbon capture utilisation and storage, particularly in hard-to-abate sectors…” The phrases “hard to abate” and “carbon capture and storage” often go hand in hand. Some steelmakers seem to be using the phrase “hard to abate” as an excuse to justify indefinite plans for CCUS in future decades while continuing business-as-usual to a large extent.

Where better and more cost competitive alternatives exist, CCUS is unlikely to play a role in decarbonisation. Global steelmakers will increasingly shift from blast furnaces to recycling steel in EAFs and DRI-based processes that can shift to green hydrogen. This process is already well underway. Using green hydrogen in DRI and renewable energy to power EAFs enables the production of truly low-carbon steel, a feat CCUS looks unable replicate.