12.5GW of India’s existing gas capacity can serve as peaking plants to firm up renewables – until battery storage becomes cost-competitive

Increased domestic gas supply should be allocated to stranded and underutilised power plants to help meet peak demand and maintain grid stability

Key Takeaways:

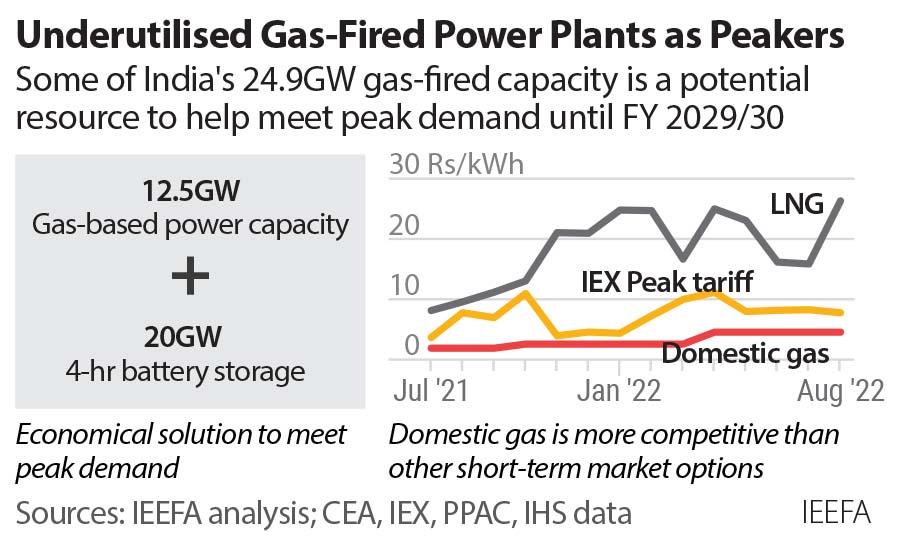

Using some of India’s existing gas-based power capacity as peaking plants would be more economical than other options in the short-term market for peak power supply.

Gas-based power plants can provide ancillary services to maintain the grid’s power quality, reliability and security as renewable energy capacity increases.

The government’s plans to set up a separate higher price market for gas-based power plants and battery storage could be useful to meet peak demand and maintain grid stability – but only until gas and battery prices soften.

Gas-based power should only be used in sectors with no competitive alternatives or where it supports renewable energy uptake or helps maintain grid flexibility.

6 October 2022 (IEEFA India): Allocating India’s additional domestic gas supply to the power sector would enable some stranded and underutilised gas-based plants to serve as flexible generation – providing an interim solution to firm variable renewable energy while battery storage scales up and becomes cost-competitive, according to a new report by the Institute of Energy Economics and Financial Analysis (IEEFA).

“Energy storage will be critical to managing higher levels of renewable generation,” says report author Purva Jain, Energy Analyst and Guest Contributor at IEEFA. “To tide over the period until storage options become more widely available and affordable in India, some existing gas-based power plants could be used to serve the peak demand or provide grid-balancing ancillary services.

“However, any transitional use of gas should be limited to sectors with no competitive alternatives or where gas use supports renewable energy uptake or helps maintain grid flexibility,” Jain adds.

India’s 24.9 gigawatts (GW) of gas-based power plants are either stranded or operating at sub-optimal levels due to the shortage of affordable fuel. Of these, 31 gas-based power plants – totalling 14.3GW capacity – are completely stranded, locking in Rs500 billion (US$6.3 billion) in bank funding.

Operating 12.5GW of existing gas capacity as peaking plants, complemented by 20GW of four-hour battery storage systems, could help India meet the maximum peak demand anticipated in the financial year (FY) 2029/2030, according to the report.

With an additional 30 Million Metric Standard Cubic Meters Per Day (MMSCMD) of domestic gas supply expected in 2023, the report says the government should consider revising its gas allocation policy to supply the fuel to some of the underutilised and stranded power plants.

The report recommends the government adapts a scheme it had proposed in 2019, which sought to bundle gas-based power produced using imported liquefied natural gas (LNG) with solar power. Given the soaring LNG costs and that global gas prices are likely to remain high for the next few years, domestic gas would be a far more cost-effective way than LNG to meet peak demand.

“Blending domestic gas-fuelled electricity and solar power would result in an average tariff below Rs5/kilowatt-hour (kWh) rather than buying at Rs12/kWh, as capped in the spot market for now. This would considerably increase power supply reliability, and the country will not have to go into bouts of load shedding witnessed in the summer months of April-July 2022,” says Jain.

The report says the government’s plans to set up a separate higher price market for gas-based power plants and battery storage could be useful for serving peak demand and maintaining grid stability – but only until gas and battery prices soften. The move allows higher tariffs than the current spot market ceiling rate as the costs for both gas-based plants and battery storage are currently high.

“This will incentivise developers and investors to utilise existing gas-based plants and deploy more storage technologies,” says Jain.

The report also recommends the government expedites efforts to utilise green hydrogen for fertiliser production instead of grey hydrogen produced from natural gas. Instead, the government could allocate the required domestic gas to the power sector under a “no cut” category.

Read the report: Flexible Generation: A Role for India’s Stressed and Stranded Gas-based Power Plants?

Media contact: Rosamond Hutt ([email protected]) Ph: +61 406 676 318

Author contacts: Purva Jain ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)

Note to Editors: IEEFA’s calculation of operating 12.5GW gas plants, complemented by 20GW of four-hour battery storage systems, for meeting maximum peak demand is based on Exhibit 11 in the Central Electricity Authority (CEA’s) Report on Optimal Generation Capacity Mix for FY2029/30 which shows the hourly generation dispatch for the predicted peak day in 2029.