Japan needs a more nuanced perovskite strategy

Download Briefing Note

Key Findings

The Japanese government has repeatedly emphasized the importance of perovskite solar — an unconventional, non-silicon based solar technology — in the country’s energy plans due to its potential benefits for emissions reduction, industrial strategy, and energy security.

National energy plans have set ambitious targets for perovskite production and deployment, aiming for over 1 gigawatt (GW) of domestic production capacity by 2030 and 20GW by 2040. They also target a levelized cost of electricity (LCOE) of JPY10–14 per kilowatt-hour (kWh) by 2040.

Leading Japanese perovskite manufacturers forecast the LCOE to be considerably higher than the government’s target, while far exceeding conventional residential and utility-scale solar photovoltaic (PV) costs. Moreover, perovskite cells face commercialization challenges, including a short durability of 5–12 years compared with 25-year lifetimes for conventional solar panels.

The cost and performance disadvantages of perovskite solar cells are likely to prevail. The Japanese government should adopt a more nuanced strategy where silicon-based solar PV and other well-established clean energy technologies are prioritized over nascent-stage perovskites.

In October 2025, Japanese Prime Minister Sanae Takaichi told parliament that perovskite solar panels, along with nuclear power, would be central to her administration’s approach to energy security and affordability. This emphasis on perovskites builds on the Ministry of Economy, Trade and Industry’s (METI) 2024 “Next Generation Solar Cell Strategy,” which positioned the unconventional solar cell technology as a priority in Japan’s renewable energy plans and set production and price targets for its deployment.

Japanese companies are aggressively developing and piloting this technology, while other countries — including China, Germany, and the United Kingdom — have also made recent advances in perovskite solar cell production.

But how realistic are the Japanese government’s perovskite targets? The technology remains in early development, and cost outlooks by leading Japanese firms suggest that perovskite solar cells will not be competitive with conventional, silicon-based solar photovoltaic (PV) by 2040. Taking this projection seriously would mean Japan’s perovskite strategy requires more nuance. Perovskites should be treated and promoted as a niche technology to be deployed where conventional solar PV cannot be installed, and as a supplemental technology that enhances the efficiency of conventional PV.

Current state of perovskite solar cells and Japan’s strategy

Perovskite solar cells are a non-silicon based PV technology that uses perovskite crystals, which are well-suited for absorbing light. There are currently three types of perovskites under development. The first is thin film, in which the perovskite layer is deposited onto thin substrates — often plastic or metal foil. The second is the glass type, where the perovskite cells are encapsulated in glass, making the design structurally stable and durable. Lastly, the tandem type combines perovskite cells with another PV technology, most commonly silicon.

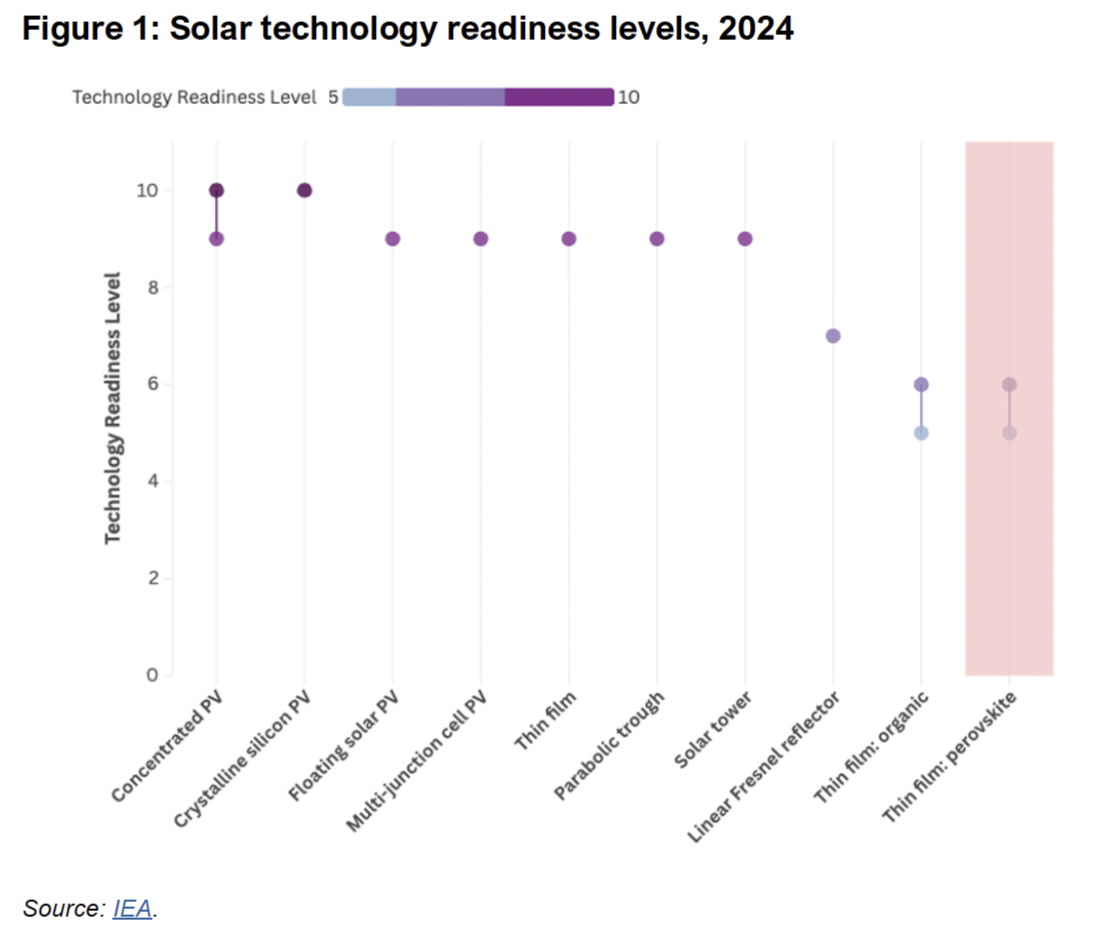

Of the three, the thin film type has garnered the most attention, particularly in Japan. However, among the various solar energy technologies, these perovskite solar cells are still in their early stages. The International Energy Agency’s (IEA) ETP Clean Energy Technology Guide indicates that perovskites have reached the stages of large prototypes and full prototypes at scale, but remain far from maturity and market scalability.

The IEA notes that, depending on the type, experimental perovskites have achieved conversion efficiencies of between 25% and 34%, but so far only with small cell areas. A major barrier to commercialization is their limited durability. When exposed to moisture, oxygen, light, and heat, cell lifetimes can fall to between 5 and 12 years — much lower than the 25-year lifetimes assumed for conventional solar panels. Many companies piloting the technology still do not disclose stability analyses or cell lifetimes.

Despite this challenge, Japan’s strategy sets ambitious targets for perovskite production and deployment. By 2030, METI envisions a domestic production capacity of over 1 gigawatt (GW) of perovskite solar cells. Japan does not currently mass-produce perovskite cells, but has plans to commission new production lines later this decade. By 2040, it aims for installations totaling 20GW and an entirely self-sufficient supply chain. Equally important, METI also announced price targets, aiming for the levelized cost of electricity (LCOE) for perovskites to progressively decline from JPY20 per kilowatt-hour (kWh) to JPY14/kWh in 2030, and finally to between JPY10–14/kWh by 2040. METI reiterated these targets in its 7th Strategic Energy Plan in February 2025.

Although Japan’s 7th Strategic Energy Plan sets clear targets for perovskite deployment, it does not contain similarly precise goals for conventional solar technologies. Current estimates indicate that total solar capacity would need to rise to 200GW–250GW to meet the plan’s generation targets. This means that if Japan can achieve its perovskite installation target of 20GW by 2040, perovskites will account for up to 10% of the country’s solar generation capacity.

The Japanese government has been supporting the research and development of perovskites well before these targets were formalized. Between fiscal years 2022 and 2024, it spent JPY54.8 billion (approximately USD364.5 million) in subsidies for what it calls “next generation renewable energy,” which includes perovskites. Over the next decade, it plans to spend another JPY1 trillion (USD6.65 billion) to help catalyze JPY31 trillion (USD206 billion) in public-private investments.

The benefits of perovskites are real

Why are Japanese policymakers so committed to bringing perovskites to technological maturity and widespread deployment? The “Next Generation Solar Cell Strategy” highlights several advantages that perovskites could offer Japan’s energy system, industrial competitiveness, and emissions reduction.

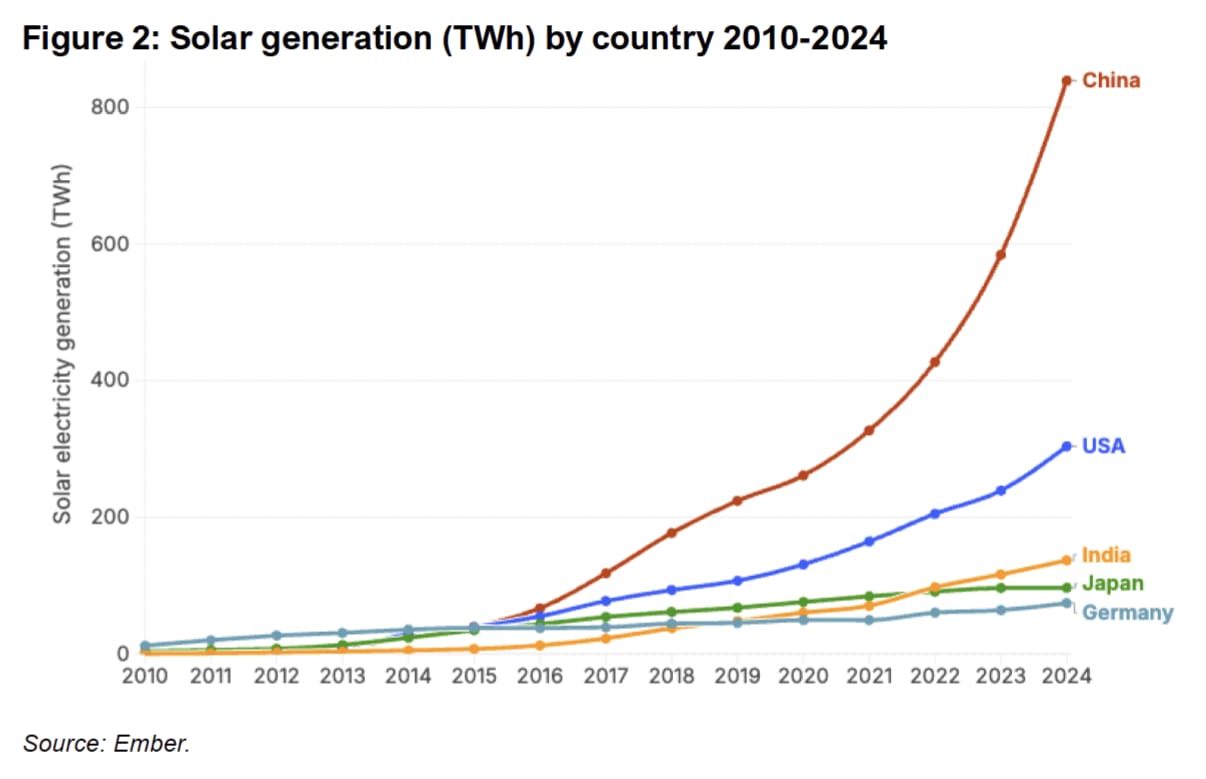

First is the perceived limits in the future growth of conventional solar PV in the country. The introduction of feed-in tariffs in 2012 initially spurred rapid solar deployment, elevating Japan’s solar energy generation to the fourth-highest in the world. In recent years, however, solar deployment has slowed. As an Institute for Energy Economics and Financial Analysis (IEEFA) August 2025 report shows, this slowdown is due partly to grid infrastructure constraints, a prioritization of fossil and nuclear technologies, and wavering policy support for renewable energy.

Thin, lightweight, and highly versatile, perovskites hold the potential to circumvent these barriers because they can, in theory, be installed on building walls, windows, and many other urban surfaces. Urban installations also mean perovskites can be co-located with electricity demand centers. This can then ease the burden on Japan’s regional power grids, enhancing the resilience of the electric transmission and distribution system.

The Japanese government also highlights the advantages of perovskites from an industrial strategy and energy security standpoint. Once a leading solar panel manufacturer, Japan was surpassed by China as a global solar panel exporter from 2005 onward. With the still-nascent perovskite solar cell industry, Japan sees an opportunity to regain its competitiveness vis-à-vis China and other rivals. This is especially true because Japan is the second-largest producer of iodine — a key input in perovskite solar cells — lending credence to METI’s aim of establishing an entirely self-sufficient supply chain. The possibility of gaining a competitive advantage in a solar technology not yet dominated by any one country, therefore, holds a particular allure.

But price targets are unrealistic

While the touted benefits of perovskite solar cells are real, METI’s price targets seem less realistic. This is perhaps unsurprising given that policy priorities have tended to color METI’s cost assumptions.

In a press conference in January 2025, Japan’s leading perovskite maker Sekisui Chemical explained that it expects the LCOE of its film type perovskites to be around JPY20/kWh by 2030, compared to the government’s target of JPY14/kWh by the same year. This discrepancy between targets and projections is likely to persist. A few months after publishing its strategy document, METI compiled cost outlooks of the six perovskite solar cell manufacturers in Japan. According to the resulting projection, the LCOE from perovskites will be around JPY15.3/kWh by 2040 — considerably higher than the ministry’s target of between JPY10–14/kWh by 2040. More importantly, perovskites’ LCOE projection will remain far higher than conventional residential and utility-scale solar PV — JPY7.6–10.4/kWh and JPY6.6–8.4/kWh by 2040, respectively.

METI’s projection also suggests that perovskites will still fall short compared to conventional PV in terms of their durability. While commercial and residential solar PV is estimated to perform for 25 years, perovskites’ performance under ideal conditions is expected to only reach 20 years by 2040.

These are important differences that will impact the demand for perovskite solar cells. Today, Japanese construction companies and facility operators note that the higher cost and shorter durability of perovskites make them unattractive investments compared to conventional solar PV. While technological improvements and economies of scale will narrow these gaps in the medium and long term, it is wishful thinking to expect perovskite solar cells to become perfect substitutes for existing solar PV by 2040.

A case for a more nuanced perovskite strategy

Perovskite solar cells hold the promise of elevating Japan’s international competitiveness, resource and energy security, and emissions reduction. However, their cost and performance disadvantages are likely to prevail. This reality calls for a more nuanced strategy than the one the government is currently pursuing.

First and foremost, perovskites should be considered secondary to silicon-based solar PV and other well-established clean energy technologies. A new study led by Tohoku University, for example, has shown that rooftop solar panels, when combined with electric vehicles as batteries, could supply 85% of Japan’s electricity demand and reduce carbon dioxide emissions by 87%. Previous studies, including those by Japan’s Ministry of Environment, have also shown that existing renewable energy technologies can meet an overwhelming majority of the country’s energy demand. The government should, therefore, prioritize subsidizing the production and adoption of these mature and cost-competitive clean energy technologies, while setting firm, ambitious targets for their deployment.

Second, film type perovskites should be understood as a niche technology designed to fill gaps that silicon-based solar panels cannot address. Incentives for their deployment should therefore target instances where silicon-based PV systems cannot be installed, rather than attempt to make perovskites directly competitive with proven, cost-effective solar technologies. These circumstances include roofs that cannot support the weight of silicon-based panels, building walls, and other infrastructure close to electricity demand centers.

Third, the government and manufacturing companies should emphasize tandem type perovskite solar cells as a way to enhance the performance of existing solar PV. Tandem type perovskites combine perovskite cells with another PV technology — most commonly silicon. Since the silicon and perovskite layers generate electricity using different parts of the solar spectrum, the tandem type greatly enhances power conversion efficiency.

At present, the Japanese government and companies are investing heavily in commercializing film type perovskite solar cells. Yet companies’ own projections suggest that these cells will not be competitive with conventional solar PV in cost and performance even by 2040. This highlights the need for a more realistic assessment and nuanced strategy for determining how perovskites should fit into Japan’s broader solar energy deployment plans.