The ill-fated Petra Nova CCS project: NRG Energy throws in the towel

NRG Energy Inc. just sold its 50 percent stake in the world’s largest carbon capture plant for only about $3.6 million, less than a half-percent of the Texas project’s roughly $1 billion construction costs. The sale leaves JX Nippon Oil & Gas Exploration Corp. as the sole owner of the 240-MW coal-fired Petra Nova power plant.

S&P Market Intelligence described the deal as “a setback for supporters of carbon-capture projects at existing fossil fuel plants.” It is far more.

The U.S. Department of Energy (DOE) sank $195 million into the carbon capture and storage (CCS) plant, hoping to demonstrate the potential for the technology to counteract greenhouse gas emissions of coal plants. The NRG fire sale of its half of the project is a declaration that the taxpayer investment was a technological failure and a financial loss.

The U.S. government needs to ask hard questions about investing more taxpayer dollars in CCS for coal plants. The CCS technology used in the Petra Nova project was not new. The DOE called it “proven.” But it did not work as well as promised. Other CCS projects attempted at power plants have failed, as well.

A history of poor performance

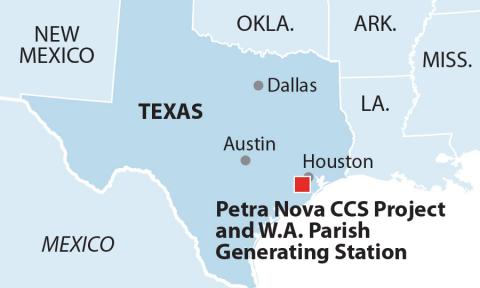

The Petra Nova facility began operations in 2017. The CCS equipment was installed to capture CO2 from a slipstream of the W.A. Parish Unit 8’s flue gas. The captured CO2 traveled via 80-mile pipeline to an oilfield near Houston for use in enhanced oil recovery (EOR) operations to increase extraction. Petra Nova’s target CCS capture rate was 90 percent. NRG claims it met the target.

But Petra Nova’s owners have never provided the actual data behind that claim. Emissions data for Parish Unit 8 reported to the EPA suggests the actual CO2 capture rate was substantially lower than 90%, perhaps as low as 65% to 70%. And the average capture rate does not include emissions from the gas-fired combustion turbine used to power the facility. Adding those emissions lowers the overall on-site capture rate to perhaps as low as 55% to 58%.

Petra Nova also was expected to be in operation some 85% of the time but failed to meet its target because so many technical problems and so much downtime were experienced—not just in the CCS facility and in Parish Unit 8, but also in the CO2 pipeline and the oilfield where the captured CO2 was injected. Similar problems can be expected to affect any carbon capture project, especially at an aging coal plant.

The unit was taken offline in May 2020 and remains down. JX Nippon now says it anticipates bringing Petra Nova back online in the second quarter of 2023 but has not provided an exact schedule or cost estimate.

Methane emissions from the mining of coal, which have received too little attention to date, also weren’t reported. Using the coal-fired San Juan Generating Station as an example, IEEFA found that even if a CCS system could achieve 95 percent capture rate from the plant—which based on IEEFA’s research is not at all likely—taking the coal mining methane emissions into account would drop the actual capture rate to 72 percent.

A track record of poor financials

IEEFA observed in a 2020 report that NRG Energy recorded three impairment charges related to the plant and to Petra Nova Parish Holdings, a subsidiary. The charges, recorded in 2016, 2017 and 2019, totaled $310 million. NRG Energy had written off essentially all its investment in the project. This is striking, given that Petra Nova not only benefitted from the U.S. Energy Department’s $195 million grant but also had received $250 million in concessionary lending from the Japan Bank for International Cooperation (JBIC) and Mizuho Bank, Ltd.

The actual costs of carbon capture at Petra Nova have never been officially released. An assistant DOE secretary for fossil energy said at a June 2020 webinar that the cost of carbon capture would need to drop by half, to $30 per metric ton, to be commercially viable. Since Petra Nova was the department’s flagship carbon capture project at the time, the comment may be an indication that the cost of carbon capture may have been $60 per ton, but it is not clear. Also, the figure did not include the costs to compress the CO2 for pipeline transport, or the pipeline transport and underground injection costs.

Petra Nova is not alone in its failure to capture CO2 cost-effectively from a fossil fuel plant

Southern Co.’s Kemper CCS project was designed to gasify lignite (a soft coal formed from peat) and capture the carbon before combustion. The cost initially was estimated at $3 billion, but it ballooned to $7.5 billion. Also, the project’s coal gasification process did not operate reliably during pre-operational testing, and the CCS capture portion of the project was scrapped. The unit now runs solely on natural gas with no CO2 controls.

IEEFA’s recent review of carbon capture efforts in other countries found similar problems abound. It concluded that using carbon capture to extend the life of fossil fuels power plants is a significant financial and technical risk.

Recommendation: Stop taking U.S. taxpayers for a ride on a CCS money guzzler

The U.S. government must sharply scrutinize all claims made by applicants for federal dollars to promote CCS technology. IEEFA research indicates that the technology is far from proven. Claims of high capture rates are meaningless when:

- The claimed high capture rates for CCS have not been sustained on an annual and multi-year basis;

- The data needed to verify Petra Nova’s claim of a 90% capture rate at any point has not been made public;

- The technology does not capture all air pollution emission streams from the site;

- The upstream extraction or mining emissions are not taken into account; and

- The downstream emissions from the plant and from the use of captured CO2 for EOR are not considered.

Given the amount of funds involved and the exposure of taxpayer dollars to risk, the U.S. government must implement robust due diligence and get beyond the advertising hype to the actual facts about carbon capture technology. It should not tolerate any more wasteful Petra Nova debacles.