Heavy import reliance fuels Bangladesh’s power sector woes

Key Findings

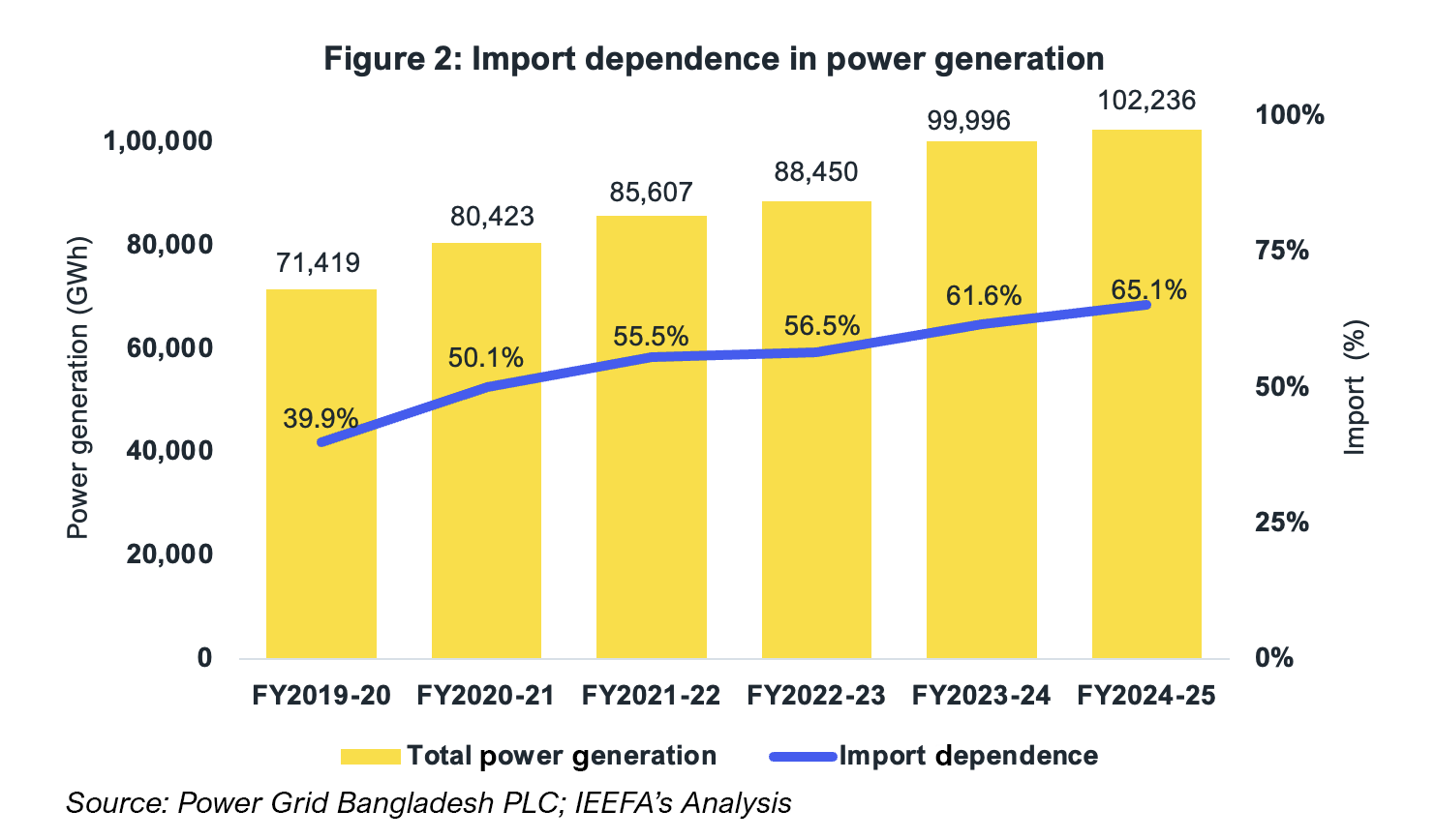

While Bangladesh has increased its power generation capacity, the sector’s troubles deepened due to heavy dependence on fossil fuel imports. In the fiscal year (FY) 2024-25, imports accounted for around 65% of the total power supply (including imported electricity and fuels used in electricity generation).

Bangladesh’s power sector challenges are unlikely to ease soon, and the country can better manage the situation by prioritising energy efficiency and conservation.

Between 2012 and 2024, industries in Bangladesh made remarkable progress on enhancing efficiency in captive power generation. Yet, many industries are not harnessing the benefits. These industries could save around 50 billion cubic feet (Bcf) of imported liquefied natural gas (LNG) by installing waste heat recovery boilers, using jacket cooling water and replacing old generators.

With Bangladesh preparing to graduate from its least developed country status in November 2026, it will likely face stiff competition in international business. This calls for fixing its fragile power sector, and minimising its reliance on dollar-denominated international energy markets.

Anticipating a surge in power demand in the summer of 2025, the Bangladesh government moved early with precautionary measures to manage the load. Peak consumption was expected to hit 18,000 megawatts (MW), up from 17,200MW on 29 April 2024. In February this year, the government issued a circular, restricting households from setting their air conditioners below 25 degrees Celsius, while the nation’s Sustainable and Renewable Energy Development Authority (SREDA) set benchmark energy consumption levels for government offices.

However, frequent rains kept temperatures lower than usual, reducing the use of energy-intensive appliances. As a result, peak power demand only reached 17,099MW on 23 July 2025. Yet, during the first two weeks of September, Bangladesh was hit by fuel supply shortages, forcing an increase in load-shedding. This underscores how the country’s heavy reliance on imported fossil fuels has made its power system fragile.

To ease the strain on utilities, large energy consumers must adopt energy management systems that reduce consumption. At the same time, the government must make a choice—either to enforce energy efficiency standards on industries to enhance the performance of captive generators, or ensure uninterrupted power so that inefficient captive generators remain only as back-up.

With global mean temperature rising and economic activity rebounding in Bangladesh, the country is likely to face surging power demand next year. To prepare, the country should curb inefficient and wasteful energy consumption, limit its reliance on the global fuels market, and work to build a resilient power sector.

Abrupt power cuts in September 2025

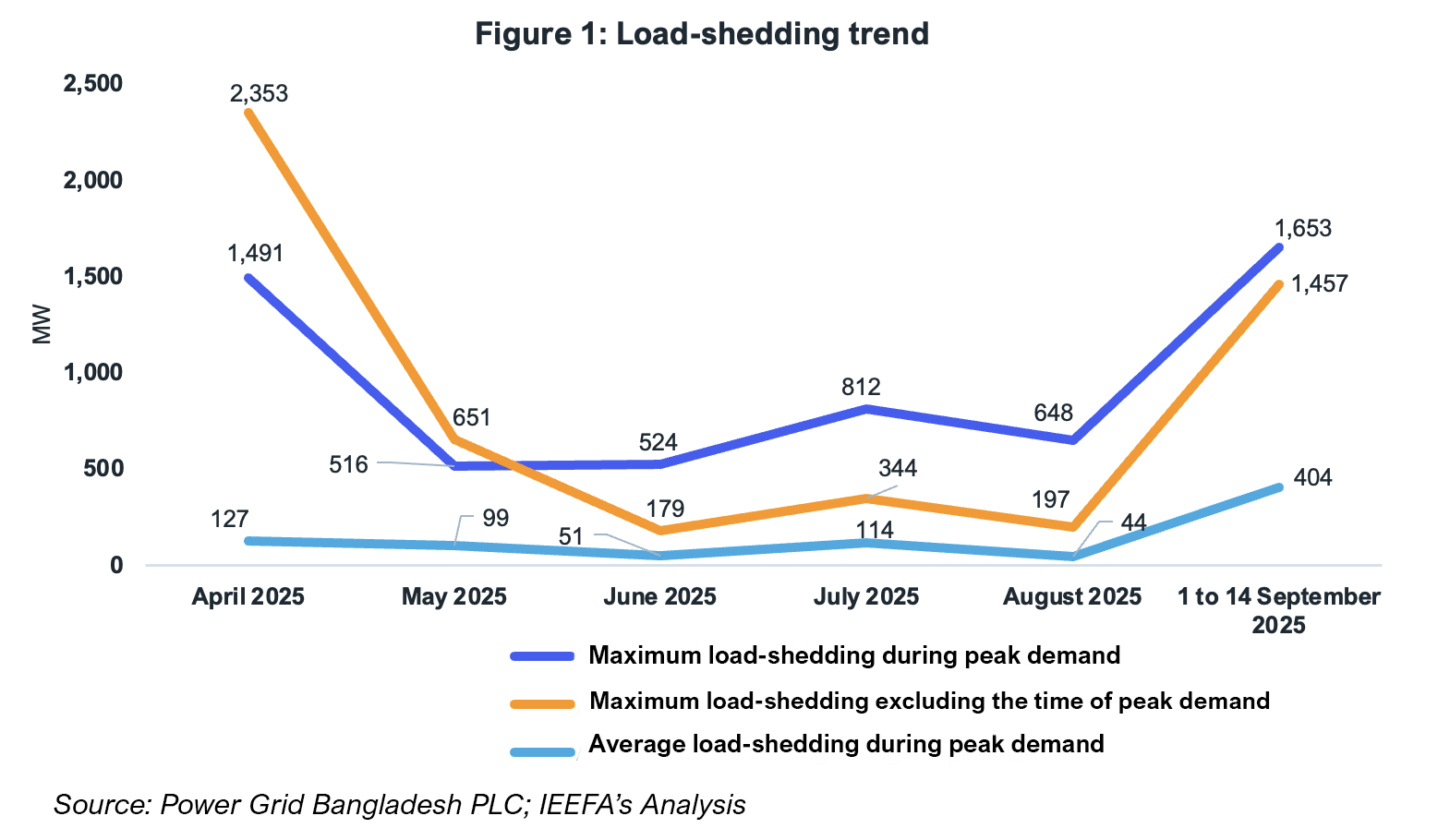

The power supply situation improved in the April to August period in 2025, compared to the heavy load-shedding of summer 2024. During this period in 2025, the supply shortfall occasionally exceeded 500MW, excluding the severe load-shedding of up to 2,353MW registered on 26 April 2025. On average, monthly load-shedding during peak hours ranged from a moderate 44MW to 127MW in these months (see Figure 1).

The country witnessed increased load shedding during the first two weeks of September 2025, with an average supply shortfall of 404MW during peak demand hours. While coal supply shortage and plant maintenance were cited as reasons for these disruptions, Bangladesh Power Development Board’s (BPDB) daily generation data shows gas supply shortfall also played a significant role. Between 31 August and 11 September 2025, the number of power plants experiencing gas supply shortages increased from 12 to 19, exposing the vulnerability of the country’s power sector.

The bigger picture

Despite Bangladesh having increased its power generation capacity, the sector’s troubles have deepened due to its heavy reliance on fossil fuel imports. In the fiscal year (FY) 2024-25, imports accounted for approximately 65% of the country’s total power supply (this includes imported electricity and imported fuels used in electricity generation). Such dependence surged by 63% between FY2019-20 and FY2024-25, significantly outpacing the 43% increase in power generation over the same period (see Figure 2).

The dollar-denominated fossil fuel imports often compel the country to undertake ad-hoc measures, such as opting for load-shedding or ramping up expensive oil-fired power plants. Meanwhile, fuel shortages keep some efficient and high-capacity gas-fired power plants almost idle.

Deploying energy management systems across large energy consumers

Bangladesh’s power sector challenges are not easing any time soon, making energy efficiency and conservation crucial. Large energy consumers—such as industries, commercial buildings or hotels—could cut down on energy consumption by deploying an energy management system. By systematically reviewing energy consumption, assessing energy saving opportunities, implementing feasible measures and monitoring progress, such a system could result in greater energy savings and ensure sustainability. For instance, the International Energy Agency’s (IEA) analysis, based on 300 case studies in 40 countries, shows that such management systems result in 11% energy savings within the first year of implementation. IEA further shows that a growing number of companies are saving around 30% energy relying on management systems.

Bangladesh has already made energy audits mandatory for 189 large energy consumers starting 2025. It should further encourage them to establish energy management systems. However, implementing these systems requires both technical and financial capacity. With support from multilateral and bilateral development agencies, SREDA could design a technical assistance programme to support the first batch of the 189 consumers to establish energy management systems. And with the government likely to enlarge the pool of large energy consumers, SREDA could extend its technical assistance to these new entities.

The choice between captive power systems and a reliable grid

Between 2012 and 2024, industries in Bangladesh made remarkable progress on enhancing efficiency in captive power generation, yet this progress is not always reflected across many industries. These industries could save around 50 billion cubic feet (Bcf) of imported liquefied natural gas (LNG) by utilising waste heat in productive applications and replacing old and inefficient generators.

Captive power generation diverts gas from some of the new, efficient gas-fired plants, leaving them idle during supply crunches. This not only results in more gas consumption but also increases capacity payments for idle baseload gas-fired plants. Moreover, prolonged shutdowns can damage these plants, creating technical issues.

The government must make rational choices based on technical and financial factors, encouraging industries to rely on grid power while modernising grid infrastructure for better renewable integration and keeping captive generators as back-up. If industries continue to operate gas-fired captive generators, the government must enforce efficiency standards.

With Bangladesh preparing to graduate from its least developed country status in November 2026, it will likely face stiff competition internationally. This calls for building a resilient power sector and ensuring reduced dependency on dollar-denominated energy markets.

This article was first published in Bangladesh Post.