Floating LNG import terminals pose cost and climate challenges for Asian markets

Download Briefing Note

View Press Release

Key Findings

South and Southeast Asia are the largest potential growth markets for liquefied natural gas (LNG) in the coming decades, but LNG infrastructure projects have been notoriously slow. As a result, the industry is promoting floating LNG import terminals as quicker, cheaper options compared with larger onshore configurations.

Despite lower initial capital costs, floating import terminals have higher operating costs than their onshore counterparts and are more vulnerable to harsh weather and oceanic conditions. These risks are especially important for countries in South and Southeast Asia, which are highly exposed to increasingly severe natural disasters caused by climate change.

None of Asia’s largest LNG importers – including mainland China, Japan, South Korea, Taiwan, India, and Thailand – currently have floating import terminals.

Almost 90% of the floating import projects in South and Southeast Asia are proposed in countries prone to oceanic disturbances brought on by tropical storms and typhoons, including India, the Philippines, and Vietnam. The case of Bangladesh shows that these storms can have prolonged impacts on energy security.

Recent project cancellations in Bangladesh and the Philippines show that floating terminals may not be so simple to complete, adding to a suite of challenges for rapid LNG demand growth forecasts.

Introduction

In the coming decades, South and Southeast Asia are widely expected to drive global demand for liquefied natural gas (LNG), but LNG import projects in these regions have been repeatedly beset by lengthy delays and financial obstacles.

To expedite demand growth in emerging markets, the global LNG industry has promoted floating LNG import terminals as quicker, cheaper “plug-and-play” options, in contrast to their larger, more conventional onshore counterparts. While onshore terminals are the norm in the world’s largest LNG importing countries, newer buyers such as Pakistan, Bangladesh, and the Philippines are opting for offshore alternatives, owing largely to their lower upfront costs, shorter construction timelines, and locational flexibility.

However, floating terminals face several key drawbacks that are often overlooked. Due to high operating costs, they can become more expensive than onshore configurations over time and are often unable to operate during periods of intense weather. These risks are especially crucial for developing countries in South and Southeast Asia that are highly exposed to climate change, as stronger and more harmful weather events increasingly threaten the reliability of offshore projects.

In 2024, storms have disrupted operations at several of the region’s floating terminals. Interruptions are often brief, but the experience of Bangladesh demonstrates that weather-related operational challenges can have prolonged impacts on fuel supply, foreshadowing energy security risks for other countries building offshore LNG import projects.

Moreover, recent cancellations of floating storage and regasification unit (FSRU) projects in Bangladesh and the Philippines, along with ongoing delays in Vietnam, show that bringing these plug-and-play projects to fruition may not be so simple, potentially curbing industry expectations for rapid, near-term LNG demand growth.

I. An Overview of Floating LNG Import Terminals

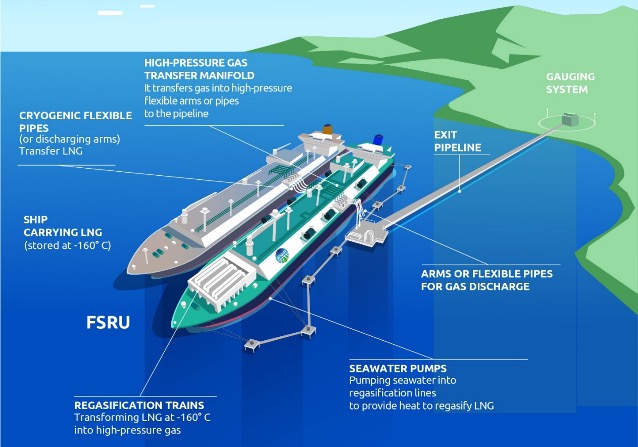

The most common floating import terminals are FSRUs, which store the fuel in frozen liquid form and reheat it to a gaseous state for distribution. The FSRU vessel is moored offshore where it unloads LNG from a tanker through cryogenic discharging arms before sending the regasified fuel onshore via a subsea pipeline (Figure 1).

FSRUs, which can be converted from existing LNG vessels or built from scratch, typically take one to three years to deploy, compared with more than four years for onshore terminals. They are typically smaller in scale than onshore terminals and can be relocated to meet demand.

Figure 1: Basic FSRU Operations

Source: Rivista Italiana Difesa.

FSRUs were pioneered in 2005 and remain a small but growing segment of global LNG import capacity. As of 2023, global FSRU capacity was 186 million tonnes per annum (MTPA), or just 16% of the total regasification capacity of 1,143MTPA.

FSRUs are particularly attractive for emerging markets due to faster lead times and lower capital costs. While more permanent onshore terminals can cost more than US$1 billion to build, FSRUs can cost less than US$100 million, although estimates are highly site-specific. An existing offshore terminal in Bangladesh, for example, costs US$500 million (Tk60 billion), while a proposed onshore terminal would reportedly cost US$1 billion (Tk120 billion).

Despite lower upfront costs, FSRUs face higher operating costs than onshore facilities. Charter rates for FSRU vessels typically range from US$80,000-$120,000 a day (US$29 million-$44 million a year), although prices surged after Russia’s invasion of Ukraine in 2022. A recently terminated FSRU project in Bangladesh (see Section IV) reportedly came with a daily fee of US$300,000 (Tk33.8 million) or US$110 million (Tk13.2 billion) annually. Maritime energy technology group Wartsila estimates that onshore terminals can be cheaper than FSRUs after six to seven years of operation.

Notably, none of Asia’s largest LNG importers – including mainland China, Japan, South Korea, India, Taiwan and Thailand – have FSRUs. China, the world’s largest LNG importer, reportedly stopped using them in 2016 due to higher costs. In Japan, the world’s second-largest buyer, harsh oceanic conditions limit their potential. Taiwan and India are still pursuing FSRU projects despite challenging metocean conditions, while Thailand has shelved three FSRU projects, according to data from Global Energy Monitor.

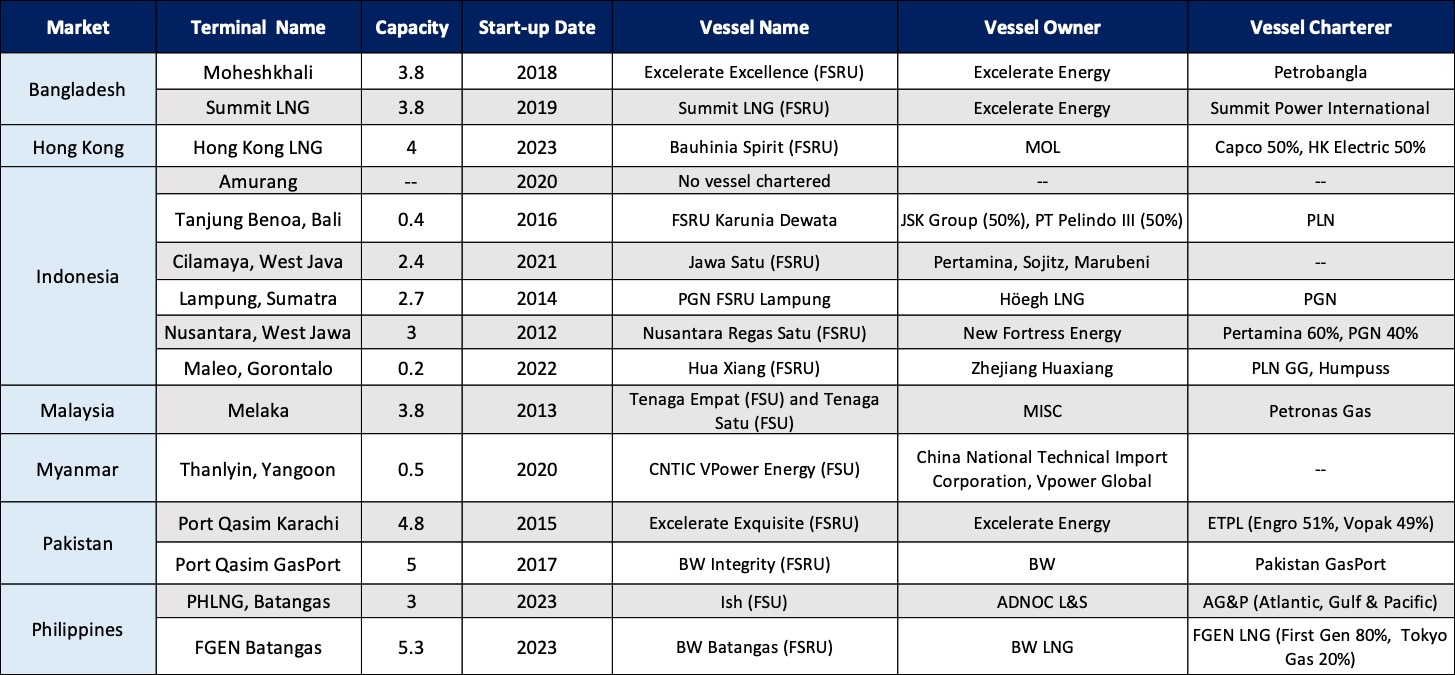

Table 1: Existing Floating LNG Terminals in Asia

Source: GIIGNL Annual Report.

II. Climate Risks for FSRUs

Along with higher operational costs, FSRUs are more sensitive to oceanic conditions such as wind speeds, wave heights and ocean currents, meaning ship-to-ship transfer of LNG from a tanker to the FSRU vessel can only take place in benign conditions.

These challenges are unavoidable for maritime trade, but efforts to manage them can lead to higher costs. The World Bank notes, “FSRUs do not have universal application. FSRUs exposed to harsh metocean conditions may have unacceptably low availability, and extensive dredging or costly breakwaters can negate the cost and financing advantages of FSRUs.”

Yet, despite their oceanic sensitivity, most of the proposed FSRU projects are in countries most vulnerable to the impacts of climate change. Many of the countries most devastated by extreme weather events in the past two decades are in South and Southeast Asia, where the LNG industry hopes to build the largest share of FSRU capacity (see Section IV). For example, the Philippines and Vietnam – where a combined 10 floating import terminals are planned – rank among the top 10 countries affected by intense tropical storms.

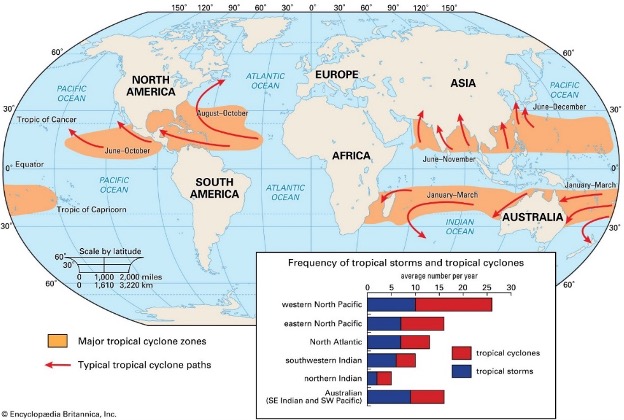

Figure 2: Major Tracks and Frequency of Hurricanes, Typhoons, and Cyclones

Source: Encyclopedia Britannica.

Tropical depressions are characterized by wind speeds up to 17 meters per second (m/s), while tropical storms can reach up to 33m/s. Higher speeds are typically classified as typhoons. Meanwhile, a typical wind limit for connecting an LNG tanker to an FSRU may be less than 7.5m/s, while a cargo may be offloaded safely at wind speeds below 13m/s. These speeds are considered moderate to strong breezes.

Storm swells also produce large waves that can hinder FSRU operations. While wave heights from tropical storms vary due to a variety of factors, FSRUs require wave heights under 2m to berth and unload LNG, and are unable to navigate if waves exceed 3.5m. This range is classified as moderate to rough wave heights.

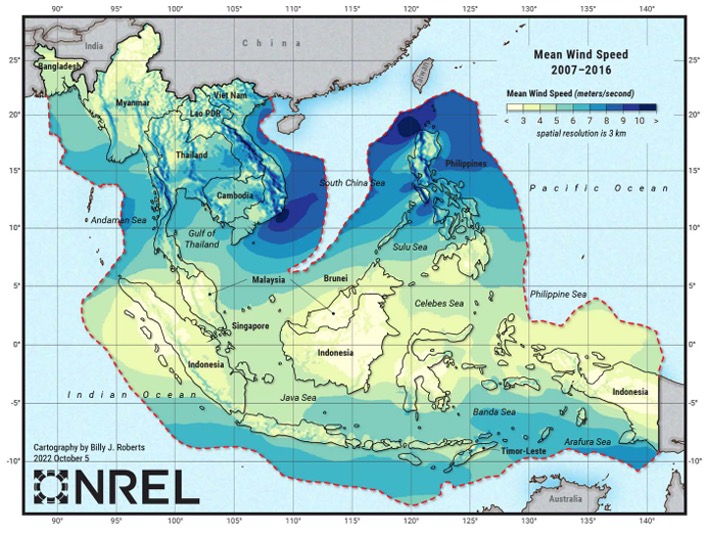

While onshore terminals with adequate breakwater facilities are more resilient, the inability to operate an offshore terminal due to oceanic conditions affects the stability of LNG supply and commercial aspects of the project. On the other hand, high average wind speeds throughout South and Southeast Asia are often cited as a boon for offshore wind energy potential (Figure 3).

Figure 3: Long-term Average Wind Speeds in South and Southeast Asia

Source: US National Renewable Energy Laboratory. Wind Resource Data for Southeast Asia Using a Hybrid Numerical Weather Prediction with Machine Learning Super Resolution Approach. June 2023.

Climate change is exacerbating operational risks for floating LNG import terminals. Scientific consensus has shown that tropical depressions and typhoons are forming closer to coastlines, becoming more intense, and lasting longer due to anthropogenic warming. In a scenario of high global greenhouse gas (GHG) emissions to 2100, recent studies show a statistically significant increase in storm intensity throughout the Northwest Pacific, South China Sea, and the Bay of Bengal.

In Southeast Asia, storms have intensified by 12-15% in the past 37 years, and the proportion of Category 4 and 5 storms has “doubled or even tripled”. The Philippines already experiences 20 tropical storms a year on average, while Vietnam is also highly exposed, particularly along its northern and central coasts. According to a recent study on climate events in Bangladesh, “the situation is going from bad to worse” as “extreme events are likely to inundate much larger areas of the coastal zone, causing enormous loss of life, property, and a decline in the economy.”

III. Offshore LNG Terminals in Bangladesh: A Cautionary Tale

While FSRUs can be relocated during periods of extreme weather, the case of Bangladesh shows that rough conditions can have prolonged impacts on energy security.

Bangladesh imports LNG via two FSRUs, the Moheshkhali and Summit LNG projects, which began operating in 2018 and 2019, respectively. Since coming online, both projects have faced equipment issues and weather-related challenges that have resulted in fuel and power shortages.

The Summit LNG terminal, for example, was offline for a total of nearly six months between January and September 2024. The vessel was initially sent to Singapore for routine repairs from January 22 to March 31, according to Kpler ship-tracking data. Two months later, on May 24, the FSRU halted operations due to Cyclone Remal, which brought wind speeds of 25-33m/s. Days later, during the storm’s peak, a steel structure collided with the terminal, causing significant damage to the vessel’s hull. The government had no choice but to cancel four shipments of LNG and send the FSRU back to Singapore for further repairs.

The terminal was initially expected to resume operations in Bangladesh within three weeks, but unexpected damage to the subsea mooring system prevented engineers from reconnecting the FSRU upon its return from Singapore in early July. To make matters worse, flooding in eastern Bangladesh caused silt to flow into the sea, hampering underwater visibility and the reconnection process.

Moreover, the initial diving vessel used to fix the subsea equipment was, according to Summit Group, “unable to exert the force required”, so a stronger vessel had to be contracted and brought to the site. The FSRU was successfully reconnected on September 11 after 131 dives in challenging conditions with engineers from around the world. LNG deliveries to the terminal resumed on September 19.

All told, Cyclone Remal lasted four days, but the FSRU was offline for nearly four months, reducing the country’s gas supply and, in turn, causing outages at several gas-fired power plants. The storm killed at least 19 people and caused nearly US$600 million (Tk7,000 crore) in economic losses and damage, in addition to the US$22 million (Tk2,600 crore) demanded by the Summit LNG Terminal Company – partly owned by Japan’s JERA (16.5%) and Mitsubishi (25%) – for contractual payments during the time the terminal was offline.

Following the cyclone and recent political change in Bangladesh, the new interim government terminated Summit Group’s application for a second FSRU and rejected a bid by Excelerate Energy – the world’s largest FSRU owner – to build another vessel in the Bay of Bengal.

This isn’t the first time floating LNG terminals have experienced extensive outages and opposition in Bangladesh. In 2018, operations at the country’s first terminal were disrupted for months during the monsoon season, which led the government to declare that it would no longer approve offshore import terminals.

In 2021, the Summit LNG terminal was out of service for three months due to a damaged mooring line, resulting in gas shortages for power plants, industries and households. In May 2023, Cyclone Mocha shut down both of the country’s terminals, followed by maintenance work for the Moheshkhali terminal from November 2023 to January 2024.

IV. Implications for Other Countries in South and Southeast Asia

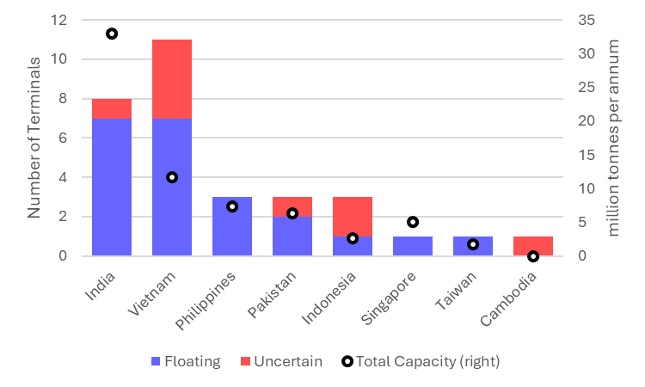

There are 122 LNG terminals under development in Asia (excluding Western Asia), 22 of which are floating configurations. All the proposed offshore terminals are in relatively new LNG markets in South and Southeast Asia, except one in Taiwan. This includes nine projects in South Asia – India (7) and Pakistan (2) – and 12 in Southeast Asia, including Vietnam (7), the Philippines (3), Singapore (1), and Indonesia (1). Floating terminals comprise 47% of the import terminals being developed in South Asia and 46% in Southeast Asia.

Nearly 90% of the floating LNG import projects planned in South and Southeast Asia are in countries prone to tropical storms and typhoons/cyclones, including India, the Philippines, and Vietnam.

Figure 4: Proposed Floating LNG Projects in Asia by Quantity (left) and Capacity (right)

Sources: IEEFA analysis; Global Energy Monitor. Global Gas Infrastructure Tracker. Accessed October 2024.

Note: Includes proposed and under construction projects. “Uncertain” refers to projects that have not specified onshore or floating configurations. Many of the projects with uncertain configurations have not specified a planned capacity.

Some of the region’s newest floating terminals have already faced operational challenges due to severe weather. In the Philippines, an FSRU chartered by power producer First Gen was offline for maintenance from August to October 2024, after being in service for less than a year. On returning to Batangas on October 19, however, the BW Batangas LNG vessel was quickly relocated to avoid Tropical Storm Trami, the 11th and deadliest storm to hit the Philippines in 2024. A 12th storm, Typhoon Kong-rey, hit northern Philippines provinces days later, before becoming the largest super typhoon to strike Taiwan in 27 years. In November alone, the Philippines was struck by five more destructive tropical storms and typhoons.

Vietnam plans to use FSRUs to achieve its ambitious target of commissioning 13 LNG-to-power projects by 2030. However, the unfavorable metocean conditions of Vietnam’s coastline – including scarce, protected deepwater areas near shore – challenge FSRU prospects. An International Finance Corporation study screened 12 possible sites in Southern Vietnam and found two potentially suitable sites for a permanently moored FSRU. However, neither of those sites are where FSRUs have been proposed.

Instead, proposed FSRUs under development in Vietnam are targeting areas with metocean conditions that are “too rough” to operate at commercially acceptable levels. For example, Excelerate Energy is pursuing two phases of a potential FSRU project in the Northern Haiphong province, where Vietnam’s strongest typhoon in 15 years made landfall in the summer of 2024.

India has seven proposed floating terminals, but even its onshore terminals have endured significant operational challenges during monsoon seasons. For example, Gail’s onshore Dabhol LNG terminal operates at about 58% capacity, closing for about four months a year due to turbulent monsoon weather. Expansions of both the Dabhol and Chhara onshore terminals include the installation of breakwaters to allow for year-round operation.

India nearly deployed its first FSRU in 2022, but the project was shelved just weeks before commissioning after Hoegh LNG – the world’s second-largest FSRU owner – terminated a 10-year charter agreement for the regasification vessel. Although the vessel had berthed at the Jaigarh LNG facility, it was subsequently relocated. Competition for FSRUs since Russia’s invasion of Ukraine has hindered the chartering of a replacement, delaying the start of the terminal.

The case demonstrates that along with weather and oceanic conditions, FSRUs may also face challenging market conditions. The locational flexibility of FSRUs – often touted as an advantage by LNG industry proponents – may not benefit all counterparties if the market provides an opportunity for the vessel owner to secure higher charter payments elsewhere.

V. Fair-weather Reliability Challenges for FSRUs are Just the Tip of the Iceberg

Importantly, weather-related operational issues for floating terminals are just one of many challenges hindering the rapid uptake of LNG in emerging Asian markets. The lower capital and shorter timeline advantages of floating terminals do not solve LNG’s underlying affordability issues for more price-sensitive, less creditworthy buyers compared with traditional customers in Europe and Northeast Asia.

In addition, supply chain issues, downstream contractual negotiations, and a lack of standard operating procedures or legal guidelines have often led to extensive project development timelines for LNG projects, particularly in the power sector.

In Vietnam, negotiations over key project terms – including the pass-through of fuel and power prices, take-or-pay commitments, and government guarantees, among others – have delayed LNG-to-power projects and the buildout of LNG terminals. Vietnam Electricity (EVN) recently signed its first power purchase agreement (PPA) for an LNG-to-power plant, Nhon Trach 3 and 4. However, the project’s development has reportedly taken eight years, from early feasibility studies to financing and construction.

As the Vietnamese government evaluates deals on a case-by-case basis, new LNG-to-power projects may continue to face extensive delays. It remains to be seen whether the structure of key contracts such as the PPA will be replicable for future projects, especially considering that loans were provided to the Nhon Trach 3 and 4 project without government guarantees. Moreover, the government has capped the price of LNG-fired electricity at US$102 (VND2.58 million) per megawatt-hour, limiting the full pass-through of volatile LNG fuel costs to EVN and shifting price risk to project sponsors.

High and volatile LNG prices have already hindered the utilization of newly constructed terminals in Vietnam. The Cai Mep LNG terminal, three months into its effort to tender a commissioning cargo, has yet to award due to high prices. Similarly, the onshore Thi Vai terminal has only imported four spot cargoes in its first 18 months of operation, while First Gen in the Philippines has imported just five cargoes in 14 months through its FSRU in Batangas.

Another terminal in the Philippines, the AG&P floating storage unit, was briefly disconnected and relocated during Typhoon Aghon in May 2024, ceasing operations at the 1,200 megawatt (MW) Ilijan gas-fired power plant. Moreover, data from the Manila Electric Company (Meralco), which buys power from the Ilijan plant, shows that the price of electricity from the plant has increased by 15% since LNG was introduced.

Surging prices are prompting policymakers in the Philippines to advocate for the expansion and prioritization of domestically sourced gas over LNG imports, which, if successful, could limit the need for more FSRUs. In August 2024, a long-delayed floating LNG terminal project was canceled as the developer opted to focus solely on building a gas-fired power plant.

Myanmar began importing LNG in 2020 during the onset of COVID-19, using a floating storage unit to store fuel for two power plants. But in 2021, a combination of soaring LNG prices and the deterioration of the Myanmar currency following a military coup impaired the project’s viability. The government and plant operators mutually agreed to cease operations and halt imports in July 2021, and the floating terminal departed the country in April 2023.

Conclusion

Weather-related challenges for FSRUs present material risks for energy security for emerging markets, and these risks may become more severe due to the impacts of climate change. These issues apply to LNG import terminals as well as export facilities. For example, most export projects in the U.S. are in Hurricane Alley, an area known for intense storms from June to November.

While these risks may not be insurmountable for participants in the maritime natural gas trade, efforts to manage them will add costs and complications to an already expensive fuel for emerging markets. While FSRUs are touted as quicker and cheaper to build than onshore import terminals, reliability challenges may continue to threaten their application in South and Southeast Asia, hurting industry expectations for rapid LNG demand growth.