IEEFA update: Renewable generation in U.S. is set to surpass coal in 2021

It now seems likely that annual renewable energy generation in 2021 will surpass coal-fired output in the U.S. for the first time.

Recent trends for coal, which has been rapidly declining, and for renewables, which have been rapidly growing, indicate that by 2021 power-generation totals for both will run at least neck-and-neck, and the odds favor renewables. The balance, it turns out however, will be affected by unpredictable factors, such as weather and changes in public policy, but coal and renewables are rapidly headed in opposite directions in terms of market share. If the crossover point doesn’t occur in 2021, it will without a doubt do so by 2022.

COAL’S INCREASINGLY RAPID DECLINE

Two of the largest coal-fired power plants in the U.S.—the three-unit, 2,250-megawatt (MW) Navajo Generating Station in northeast Arizona and the three-unit, 2,490MW Bruce Mansfield Station in western Pennsylvania—closed this month, the latest behemoths to fall in the rapid reconfiguring of the U.S. electric power generation sector. As a result of these closures and others (IEEFA sees a total of at least 24,000MW of coal-fired capacity closing from 2019 through 2021), the Energy Information Administration (EIA) is projecting that coal’s share of the electric generation market will drop to 25 percent this year (from 28 percent in 2018) and will continue falling in 2020, to just under 22 percent.

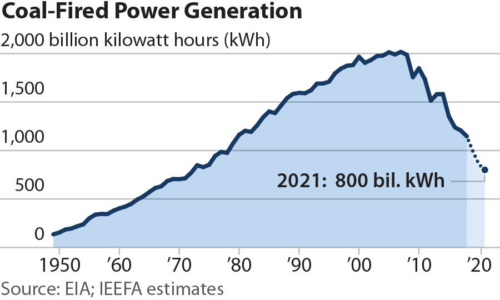

Also, according to the EIA, coal-fired electricity generation will fall to 993 billion kilowatt-hours (kWh) in 2019, sinking below 1,000 billion kWh for the first time in 40 years (see the coal generation graphic below). This estimate, drawn from the EIA’s November 2019 Short-Term Energy Outlook, is a 12.7 percent drop from a year ago, and the agency projects an even steeper decline of 13.4 percent in 2020, pushing down coal’s output for the year to 860 billion kWh.

IEEFA sees the trend continuing through 2021 and beyond; the only question is how quickly it will happen. If the sector’s output drops by an additional 13 percent in 2021, annual generation would fall to approximately 748 billion kWh. Even if a more conservative rate is projected—the 7 percent annual decline posted since 2015, for example—coal-fired generation would still fall to 800 billion kWh in 2021.

CONTINUING GROWTH OF WIND AND SOLAR

Meanwhile, renewable energy has gained market share over the past five years. (This analysis is based on the EIA’s utility-scale renewable resources, which include biomass, geothermal, hydropower, solar and wind, plus small-scale solar, primarily rooftop units). The EIA predicts that these resources combined will produce 721.5 billion kWh this year, up nearly 40 percent from 2015, when renewables generated 525 billion kWh. The EIA sees growth in renewables next year, essentially all from wind and solar (both utility-scale and rooftop additions), pushing total output to just over 784 billion kWh.

The question then becomes how much growth in renewable energy will be seen in 2021? It’s not unreasonable to argue that solar and wind generation will match EIA’s growth rates for 2019 and 2020. For the two solar components (utility and rooftop) that would translate to expected increases of 19 percent and 21 percent, respectively, while for wind the increase would be 10.8 percent.

Data from the EIA shows that a wave of new solar and wind capacity is now under development. The EIA estimates that the amount of installed utility-scale solar will climb to more than 50 gigawatts (GW) by the end of 2020, up from 31.5GW in 2018. The agency also forecasts that the total amount of rooftop solar will climb to 28.6GW by the end of 2020, up from 19.5GW in 2018. Looking into 2021, SEIA projects that 17.6GW of solar capacity will be installed that year as utilities and developers take advantage of the expiring tax credit for residential systems and the expected decline in the commercial tax credit.

On the wind side, the EIA has installed capacity topping 122GW in 2020, up from 94.2GW in 2018. The American Wind Energy Association (AWEA) estimates that installed wind capacity topped 100GW in the first half of 2019; it also says that an additional 22.6GW of wind capacity is under construction. Another 23.8GW of capacity is in “the advanced development stage,” which AWEA defines as projects with a signed power purchase agreement, those having placed a firm turbine order, or directly owned by a utility—all indicators that the projects are extremely likely to be built. So, using AWEA’s numbers, by 2021 or soon thereafter, total installed wind capacity in the U.S. will hit 145GW, significantly higher than the EIA’s 2020 forecast of 122GW.

In other words, the EIA estimates may very well turn out to be understated.

2021: THE CROSSOVER YEAR

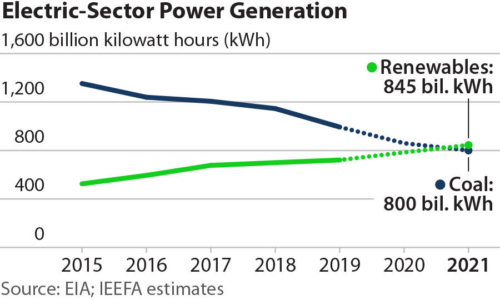

Adding the projected wind and solar increases mentioned above to the other three renewable components (hydro, geothermal and biomass), which, for the sake of argument, have been left at their 2020 levels, puts renewable generation in 2021 at roughly 845 billion kWh, 5.6 percent higher than the conservative projection for coal-fired generation that same year of 800 billion kWh (see the crossover graphic below).

By then, renewables will have achieved other milestones. The EIA is already projecting that total renewable generation in the second quarter of 2020 will top that of coal, building on a crossover first recorded in April of 2019, when, for the first time ever, renewable generation topped coal in a single month. As IEEFA noted at the time, this milestone was due in part to seasonal issues (with the spring being a period of relatively low demand for coal and of relatively high output for both wind and solar). But the transition is rapidly occurring now in other months, particularly in the high-demand summer and winter months.

By then, renewables will have achieved other milestones. The EIA is already projecting that total renewable generation in the second quarter of 2020 will top that of coal, building on a crossover first recorded in April of 2019, when, for the first time ever, renewable generation topped coal in a single month. As IEEFA noted at the time, this milestone was due in part to seasonal issues (with the spring being a period of relatively low demand for coal and of relatively high output for both wind and solar). But the transition is rapidly occurring now in other months, particularly in the high-demand summer and winter months.

As recently as 2015, coal-fired generation topped 100 billion kWh hours in eight out of twelve months over the course of one calendar year, but that phenomenon is rapidly becoming a relic of the past. In 2019, coal is expected to top 100 billion kWh just twice (in January and July, and just barely—at 100.3 billion kWh in each of those months). Next year, the EIA projects that coal will not be able to hit the 100 billion kWh mark during any single month. And perhaps just as importantly, next April, the EIA predicts that coal generation will fall below 50 billion kWh, a previously unthinkably low number.

These national trends have been foreshadowed in Texas, where wind and solar have generated more electricity than coal for the first 10 months of 2019—a result that has taken even IEEFA by surprise. In April, we noted that wind and solar generation had topped coal-fired generation in Texas for the entire first quarter, another first. But we hedged, noting that it might take several years for renewables to consistently beat out coal.

The data clearly shows that this is happening already, and that there is no longer any reason to hesitate: renewables are surpassing coal.

Dennis Wamsted is an IEEFA editor and analyst.

RELATED POSTS:

IEEFA U.S.: April is shaping up to be momentous in transition from coal to renewables

IEEFA update: Data shows U.S. shift away from coal-fired generation is intensifying

IEEFA U.S.: Extend solar tax credit to benefit communities hit by U.S. coal sector decline