IEEFA U.S.: Shortage of high-quality sites threatens future Bakken oil and gas production

November 3, 2021 (IEEFA) — A shortage of high-quality drilling sites poses a long-term risk to oil production in the Bakken formation, according to an analysis by the Institute for Energy Economics and Financial Analysis (IEEFA).

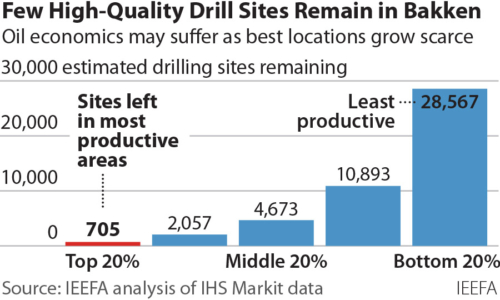

Since the Bakken boom began 13 years ago, producers have focused on core areas where horizontal wells provide easier access to oil. The IEEFA analysis, however, suggests that barely 700 top-tier wells remain available. By comparison, Bakken producers drilled 600 high-caliber wells in 2019 alone.

“As the Bakken oil industry depletes its remaining inventory of top-tier wells, it will have no choice but to shift drilling to less-productive areas,” said Clark Williams-Derry, an IEEFA energy finance analyst and lead author of the report. “The new wells will produce less oil and gas, and will require steadily higher prices to justify the roughly $7 million price tag to drill and complete a Bakken well.”

The decline in high-caliber wells carries major fiscal, financial and policy implications. Investors will have to temper expectations. State and local budgets will lose oil and gas revenues. Regulators will need to reconsider the economic rationale for existing pipelines, including the controversial Dakota Access Pipeline (DAPL).

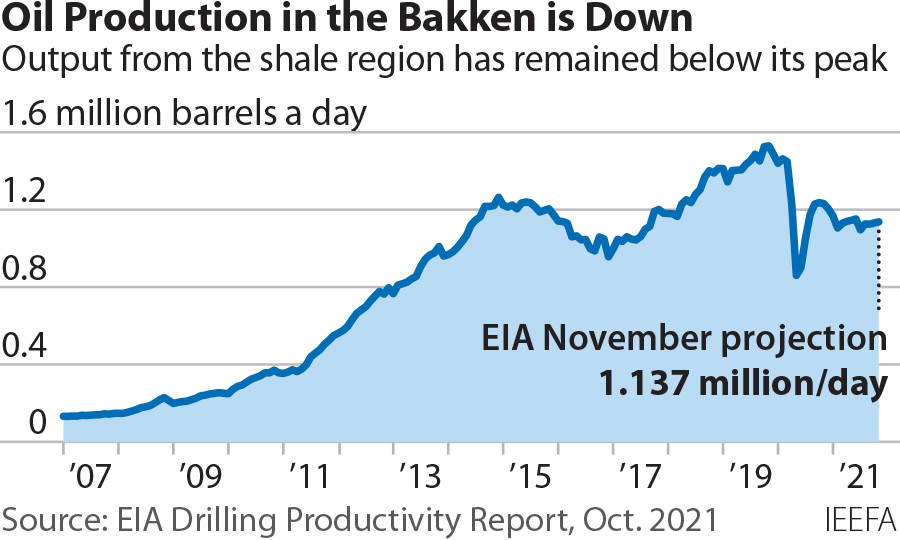

North Dakota officials had predicted Bakken production would rise to 2 million barrels per day by 2030 after watching the amount of oil rise from 200,000 barrels per day in 2007 to 1.5 million barrels per day in 2019. Bakken oil output, however, has fallen to a little more than 1.1 million barrels per day—25 percent from its peak and lower than its early 2014 levels. Even at a production rate of 1 million barrels per day, IEEFA estimates that the top Bakken drilling sites will likely be used up by the end of 2024.

The decline in top-tier wells is likely to affect a pipeline and rail infrastructure capable of shipping 2.8 million barrels per day from the fields. Oil pipelines account for 1.5 million barrels per day of potential transport; plans are on the drawing board to add 180,000 extra barrels of daily capacity to the Dakota Access Pipeline, and its owner has proposed increasing its total capacity to 1.1 million barrels per day.

“If recent production declines continue, the pipeline’s capacity could become superfluous,” said Williams-Derry. “Given the significant surplus of pipeline capacity, even modest declines in production could allow the region to handle its crude production without DAPL.”

The dwindling number of top-tier wells is highlighted by the sharp decline in the region’s supply of drilled-but-uncompleted (DUC) wells. Since June 2020, the industry has reduced its DUC inventory by about 40 percent; IEEFA estimates the Bakken, which had almost 900 DUC wells in June 2020, now has roughly 350 DUCs that could be classified as top-tier wells.

“Today’s high oil prices support current drilling levels in the Bakken, but long-term prices are unpredictable,” according to Williams-Derry. “Yet one thing is certain: The Bakken will progressively exhaust its best remaining drilling prospects. As that happens, the quality and productivity of new wells will decline, and the economics of Bakken oil production will face new and growing challenges.”

Full Report: Has the Bakken Peaked?

Author

Clark Williams-Derry ([email protected]) is an IEEFA energy finance analyst.

Media contact

Muhamed Sulejmanagic ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. IEEFA’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.