IEEFA Report: Kayenta Mine Is Unlikely to Find New Customers Once Navajo Generating Station Closes

June 29, 2017 (IEEFA.org) — The Institute for Energy Economics and Financial Analysis (IEEFA) published a report today concluding that Peabody Energy’s Kayenta mine in northeast Arizona is not likely to find new customers or markets once its sole customer, Navajo Generating Station, closes.

June 29, 2017 (IEEFA.org) — The Institute for Energy Economics and Financial Analysis (IEEFA) published a report today concluding that Peabody Energy’s Kayenta mine in northeast Arizona is not likely to find new customers or markets once its sole customer, Navajo Generating Station, closes.

The Navajo Nation Council voted this week to approve a deal with the plant’s four utility-company owners that will shutter the coal-fired plant at the end of 2019.

The report— “As U.S. Coal Markets Decline, Kayenta Mine Is Not Likely to Find New Customers When the Navajo Generating Station Closes” — acknowledges that questions about the mine’s fate remain.

“Could Peabody or the Navajo Nation find a new owner for the plant, and therefore keep the mine open as its supplier?” said Tom Sanzillo, IEEFA’s director of finance. “Could Peabody sell the mine to someone else, who would then look for new customers for the coal?”

The report concludes that either outcome is unlikely and in either case would prove “unwise.”

Key findings:

- Demand for coal-fired power in the region is shrinking: the same market conditions that are causing Navajo Generating Station to close have led to the announced retirements of at least 2500 additional megawatts of coal-fired power in the Southwest, along with declining usage of existing plants. This will make it tough for the mine to find customers.

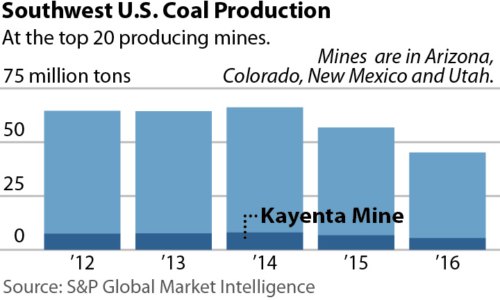

- Coal production at mines in the Southwest U.S. is declining. Production at 20 of the largest coal mines in the four-state region of Arizona, Colorado, New Mexico and Utah decreased from 66 million tons in 2014 to 45 million tons in 2016, a 32 percent decline. Production at Peabody Energy’s three mines in the region (Kayenta, El Segundo (in New Mexico) and Twentymile (in Colorado) dropped from 23 million tons in 2014 to 12.8 million in 2016, a 44 percent decrease.

- Regional coal prices are flat or in decline meaning that any new owner would have trouble making a profit.

- A new mine owner would face steep obstacles to entering coal-export markets. Kayenta mine coal would be competing for market share with companies who already have global trade networks.

Peabody Energy’s plans to sell mines in the region last year failed: Peabody’s proposed sale of its El Segundo, Twentymile and Lee Ranch to Bowie Resource Partners in 2016 fell through after Bowie failed to find financial backing for the transaction. The loss of that sale helped to trigger Peabody’s bankruptcy filing.

The report notes that while Peabody Energy is lobbying the Trump administration to keep the Navajo Generating Station open through federal subsidies beyond 2019, such an allowance would be unprecedented in the electricity-generation industry.

It also calls out “Peabody’s track record of saddling communities with high costs in order to increase its own bottom-line.”

“The utility owners of the Navajo Generating Station have offered employment to all of the men and women who currently work at the power plant if it closes,” the report says. “By contrast, Peabody Energy has made no such public offer of employment opportunities to current workers at the Kayenta mine.”

IEEFA estimates that a subsidy of $1.4 billion to $2.4 billion would be required to keep the plant open through 2030.

“A more prudent—and considerably less expensive—use of federal funds would be to support a forward-looking economic transition plan that would help the Navajo Nation and the State of Arizona turn the page on this coal plant and the Kayenta mine,” Sanzillo wrote.

Full report: “As U.S. Coal Markets Decline, Kayenta Mine Is Not Likely to Find New Customers When the Navajo Generating Station Closes”

Media contact: Karl Cates, [email protected], 917.439.8225

About IEEFA

The Cleveland-based Institute for Energy Economics and Financial Analysis (IEEFA) conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.