IEEFA: Lithium-ion battery manufacturing in India has got the power — for EVs and the grid

29 January 2022 (IEEFA India): Soaring requirement for electric vehicles as well as energy storage applications in India are necessary drivers for the Government of India to commit to serious investment in lithium-ion battery manufacturing in Budget 2022/23, finds a new report from JMK Research and the Institute for Energy Economics and Financial Analysis (IEEFA).

India’s transition to a future powered by clean, affordable, and reliable renewable energy is under way, yet critical battery storage is still an expensive imported technology.

Report co-author Vibhuti Garg says battery storage can help India transition by storing excess renewable energy when it is not needed and then discharging it when it is.

“In addition, batteries can also provide essential grid services,” says Garg.

“In Budget 2022/23, the government must offer essential funding for domestic manufacturing of lithium-ion batteries (LiB) as well as, for instance, offering duty rebates in sourcing the raw materials for LiB manufacturing.”

Automotive applications will account for 90% of LiB demand

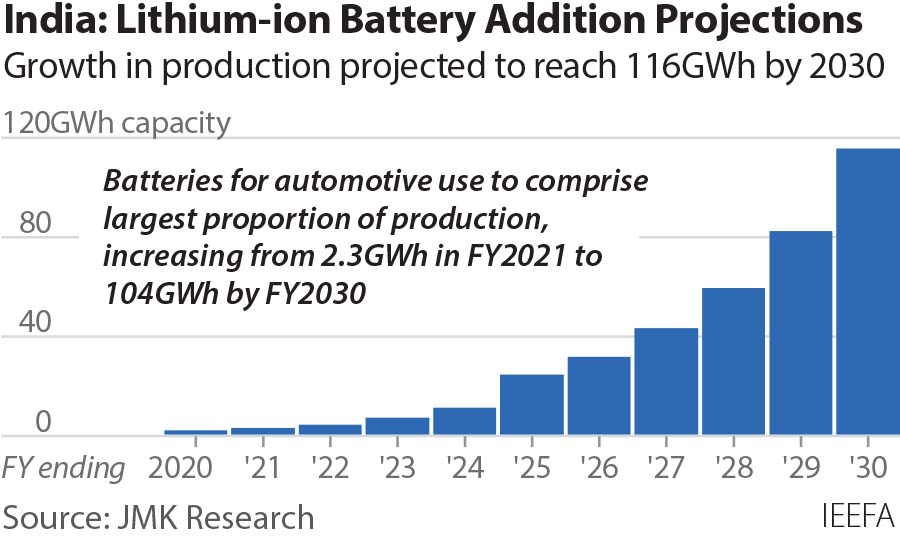

India is expected to be the world’s largest automotive market by 2026. The report finds automotive applications will account for 90% of LiB demand, with annual capacity growing nearly 50-fold — from 2.3 gigawatt hours (GWh) in financial year (FY) 2021 to 104GWh by FY2030.

The growth for non-automotive applications is almost as spectacular, from 0.3GWh to 12GWh in the same period, applied to telecom towers, data centres, grid-scale renewable energy integration, and rooftop solar (RTS), as well as newer areas including material handling and power tools.

The second phase of the Faster Adoption and Manufacturing of Hybrid & EV scheme (FAME-II), which aims to increase adoption of EVs and specifically electric two- and three-wheelers, is driving battery localization requirements and the setting up of battery assembly plants in India. The PLI Advanced Chemistry Cell (ACC) scheme is a step towards local cell manufacturing.

Furthermore, the government’s renewable energy targets will make stationary storage a significant contributor to this growth, says co-author of the report, Jyoti Gulia.

“Adding 450 gigawatts of renewables by 2030 will need 136 gigawatt hours of battery storage. India is poised to become a key LiB consumer,” she says.

India is poised to become a key LiB consumer

The report also highlights the challenges for battery pack and cell manufacturing in India, primarily the reliance on imports for key raw materials, the lack of safety standards in place, and the dearth of local technological know-how.

“End-use customers are wary of the quality of local assemblers’ packs, battery management systems (BMS), and the associated safety issues. There are lucrative opportunities, but current and potential players must be prepared for massive investments and low profit margins,” says co-author, Neha Gupta.

LiB technology has superseded lead-acid batteries in mobile and stationary applications alike, its growth encouraged in part by Government of India support allowing 100% foreign direct investment (FDI) and mandating domestic manufacture of battery packs.

The government further boosted manufacturing via the Production-Linked Incentive (PLI) scheme, as part of which, investments of over Rs450,000m (US$6,120 m) for 50GWh of capacity is planned.

India has huge cost opportunities in terms of cheap labour and power. Cell manufacturing costs in India, as of 2020, were the lowest (US$92.8/kWh) when compared with the United States, European nations, and even China (US$98.2/kWh) and South Korea (US$98.1/kWh).

Battery recycling is a solution to meet surging LiB demand

Because of the lack of availability of key minerals and metals in India, the report also suggests battery recycling as a solution to meet surging LiB demand, recovering 80-90% of lithium, cobalt, nickel, manganese and graphite and putting India on the path to a circular economy.

“Government and industry efforts to address this demand are commendable,” says Gupta.

In the absence of standardization in Indian battery manufacturing, the report says, pertinent steps are needed: on the government’s part, mandating voltage levels, form factors, functionality of BMS and battery types; for industry, minimising the skill gap between battery manufacturing and R&D.

“Battery life and performance will be key differentiators in the next three to five years,” says Jyoti Gulia. “This will hold true regardless of the end use, whether in EVs, mobile phones or laptops.

“Investments will be required for research to allow greater use of locally available raw materials and for increasing design expertise for BMS.

As a consolidated market, the cell industry into the future will be dominated by the likes of Exide, Amara Raja, Reliance and Adani, whose vertically integrated gigawatt-scale LiB factories will use key raw materials sourced via long-term contracts/investments in material-rich nations. EV makers are expected to have in-house battery pack manufacturing on automated assembly lines.

“The necessary push from government and enthusiasm from industry augur a bright future for cell manufacturing and for improvements in battery pack assembly and allied industries,” says Garg.

Read the report: Lithium-Ion Battery (LiB) Manufacturing Landscape in India: Market Trends and Outlook

Media contact: Kate Finlayson ([email protected]) +61 418 254 237

Author contact: Vibhuti Garg ([email protected]), Jyoti Gulia ([email protected]), Neha Gupta ([email protected]), Ayoosh Jadhav ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. IEEFA’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.