IEEFA Europe: Snam woos investors with net-zero claims, while growing its spending on fossil gas infrastructure

March 16, 2021 (IEEFA) — Even as it seeks to attract funding from sustainability-led lenders, Europe’s largest gas pipeline company continues to devote the vast majority of planned capital spending to unabated fossil gas infrastructure, according to a report from the Institute for Energy Economics and Financial Analysis (IEEFA).

Snam, the Milan-based gas transmission system operator, has advocated for a hydrogen economy and rebranded itself with the phrase, “Energy to inspire the world.” The company, however, has allocated just 9% of its spending plan to “energy transition” over the next four years, while continuing to expand its fossil gas network.

“I hate to use the word, but this is classic greenwashing,” said Arjun Flora, IEEFA director of energy finance studies for Europe and author of the report. “Snam claims to be targeting net zero, while refusing to acknowledge its largest source of carbon emissions – end-use of the gas it transports.”

At this important juncture in European energy policy, gas industry groups including Snam are lobbying the EU to create binding EU targets around renewable gas deployment, as well as including fossil gas as a transition fuel in the EU’s sustainable taxonomy, as the bloc looks to rapidly decarbonise.

“It is vital that appropriate scrutiny is applied to fossil fuel companies’ claims of sustainability,” said Flora. “This will prevent further fossil fuel lock-in, minimize stranded asset risk, and ensure cost-effective use of public funds.”

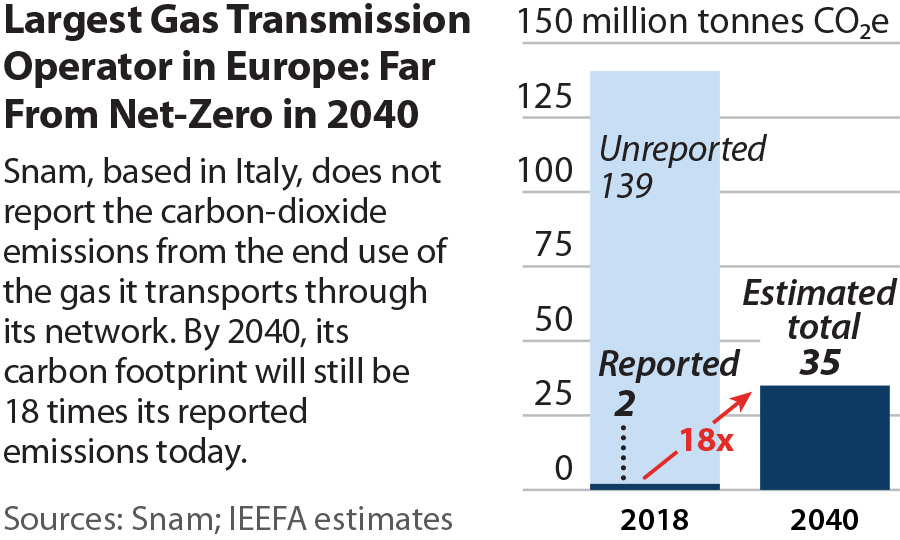

Snam’s plan for achieving net-zero emissions by 2040 suffers from two major weaknesses, according to the report. The company reports less than 3 percent of the roughly 140 million tons of carbon dioxide equivalents that are transported through Snam’s network, claiming that it’s not responsible for emissions resulting from the final use of the gas. The company’s net-zero plan also reveals that it still expects fossil gas to account for half of its transported fuel mix in 2040.

“Snam’s slogans mean nothing unless they’re backed up with a coherent, comprehensive plan to transition its network from fossil gas,” Flora said.

Snam claims to have received over EUR7 billion from sustainable financing and hopes to increase the amount to almost EUR10 billion by 2024. The report, however, raises questions about Snam’s use of proceeds from sustainable financing; it appears that money raised from a climate action bond, for example, can be used as working capital for non-eligible activities.

Full report: When net-zero means not-zero

Author contact

Arjun Flora ([email protected]) is IEEFA director of energy finance studies for Europe.

Media contact

Vivienne Heston ([email protected]) +1 (914) 439-8921.

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.