Latest Stranded Assets Research

See more >

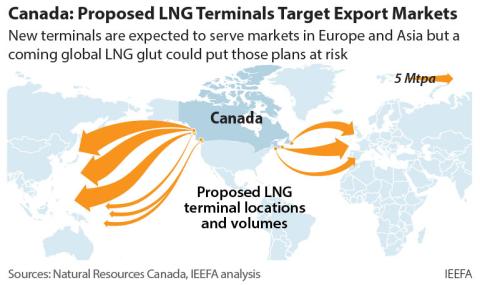

Canadian LNG expansion does not make sense, regardless of U.S. LNG pause

March 04, 2024

Mark Kalegha, Christopher Doleman

Insights

Volatile global LNG market: Impact on India

February 12, 2024

Purva Jain

Insights

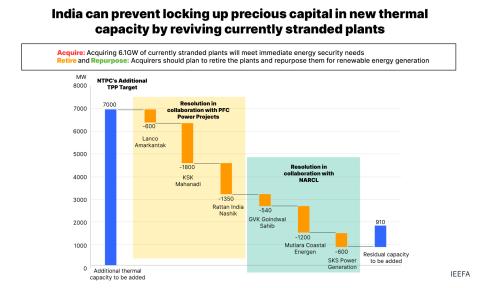

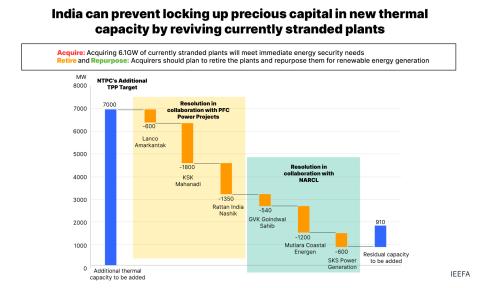

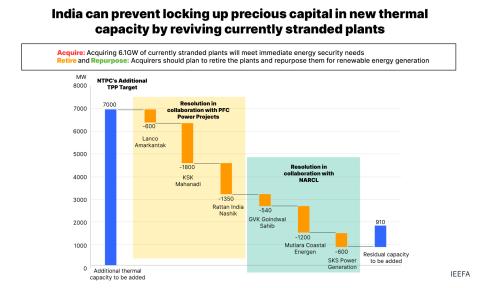

Resolving stranded thermal assets can guide India’s clean energy journey

January 11, 2024

Shantanu Srivastava

Insights

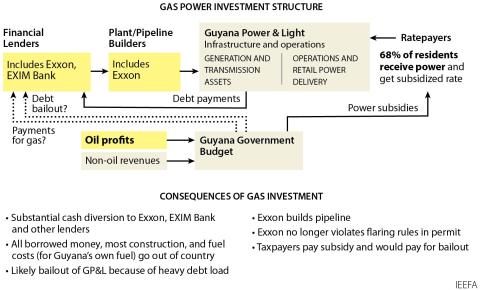

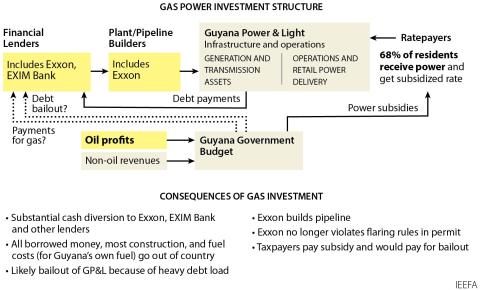

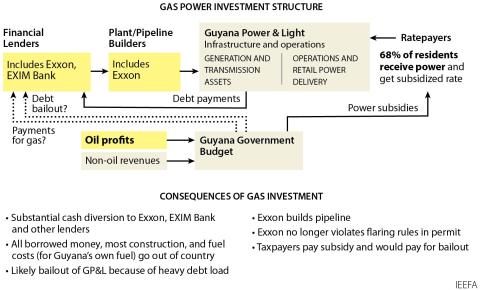

Guyana Gas to Energy Project is unnecessary and financially unsustainable

October 04, 2023

Tom Sanzillo, Cathy Kunkel

Report

NPAs in the Indian power sector and strategies for resolving them

August 03, 2023

Shantanu Srivastava

Insights

Cleaning up the last pile of India’s power sector non-performing assets

June 15, 2023

Shantanu Srivastava

Report

No economic case for new lignite plant in Bosnia and Herzegovina

March 07, 2023

Paolo Coghe, Arjun Flora

Report

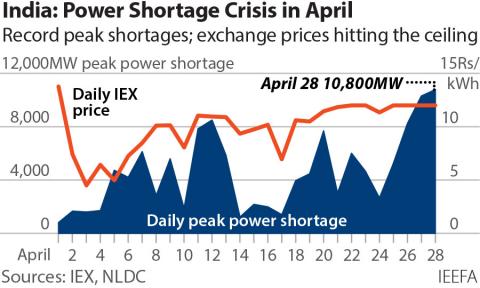

India’s power shortage crisis is an opportunity to spur the clean energy transition

May 03, 2022

Vibhuti Garg

Insights

IEEFA: Fuel price crisis should accelerate India’s energy transition

March 28, 2022

Vibhuti Garg

Insights

IEEFA Pakistan: Gwadar needs better electricity supply but coal-fired power is looking increasingly unviable

March 17, 2022

Simon Nicholas, Haneea Isaad

Insights

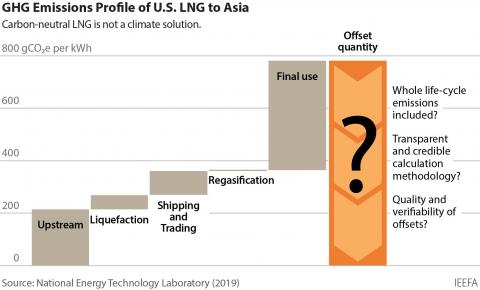

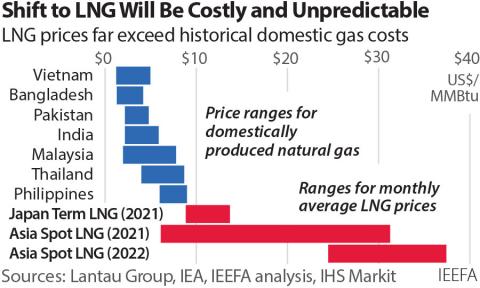

IEEFA: Despite “green” efforts, natural gas and LNG make little climate or economic sense

March 15, 2022

Christina Ng, Sam Reynolds

Insights

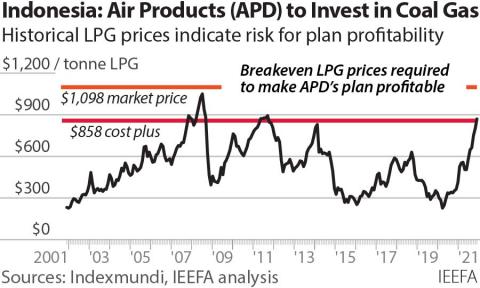

IEEFA: The high cost of Indonesia’s downstream coal projects is underestimated

March 07, 2022

Ghee Peh

Insights

Latest Stranded Assets Reports

See more >

Guyana Gas to Energy Project is unnecessary and financially unsustainable

October 04, 2023

Tom Sanzillo, Cathy Kunkel

Report

Cleaning up the last pile of India’s power sector non-performing assets

June 15, 2023

Shantanu Srivastava

Report

No economic case for new lignite plant in Bosnia and Herzegovina

March 07, 2023

Paolo Coghe, Arjun Flora

Report

Indonesia's Downstream Coal Plans Add up to a Black Hole

January 27, 2022

Ghee Peh

Report

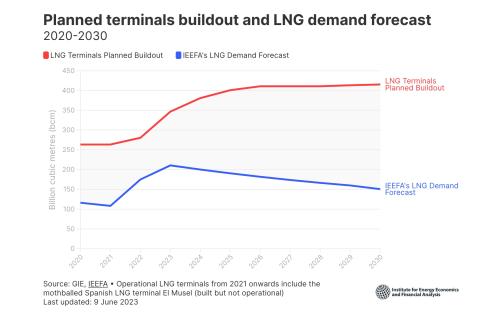

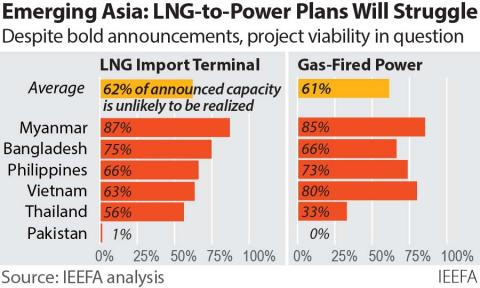

Examining Cracks in Emerging Asia's LNG-to-Power Value Chain

December 16, 2021

Sam Reynolds, Grant Hauber

Report

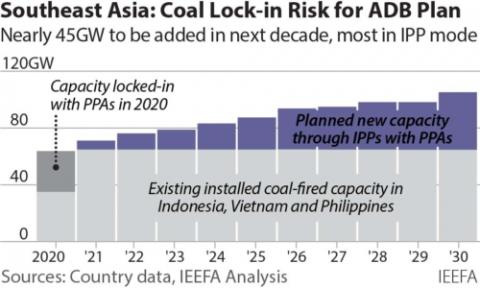

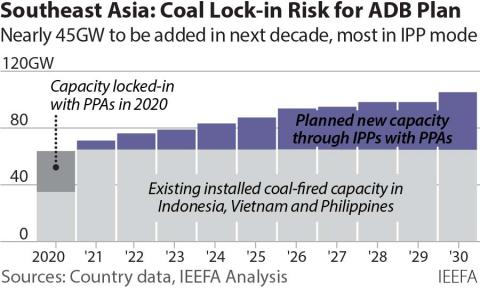

Coal Lock-In in Southeast Asia

December 01, 2021

Haneea Isaad

Report

Pension funds investing indirectly in Ohio’s Gavin coal plant are at risk as financial, environmental disadvantages mount

October 14, 2021

Dennis Wamsted, Seth Feaster, Tom Sanzillo...

Report

Role of gas in cooking and mobility in the transition to cleaner energy

October 06, 2021

Purva Jain

Report

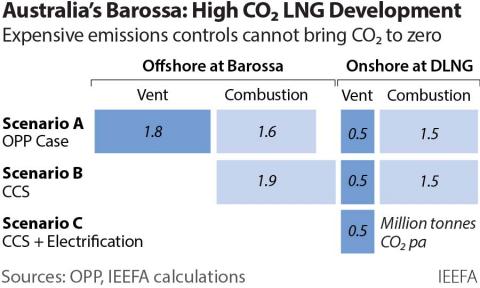

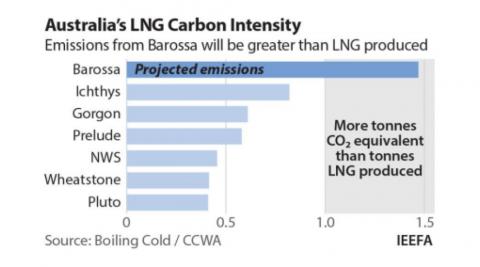

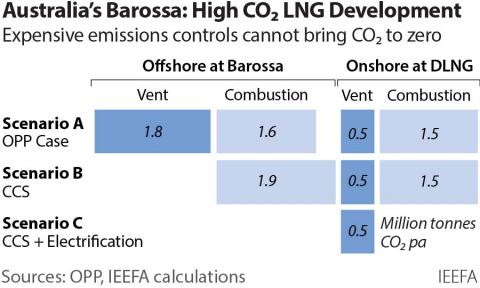

How to save the Barossa Project from itself

October 01, 2021

John Robert

Report

What led to increasing power prices at the exchanges?

September 29, 2021

Vibhuti Garg

Report

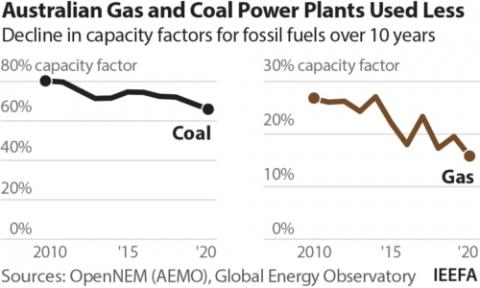

Australia's gas-fired recovery under scrutiny

June 24, 2021

Bruce Robertson, Milad Mousavian

Report

Tackling Indonesia's nuclear power euphoria

June 01, 2021

Elrika Hamdi

Report

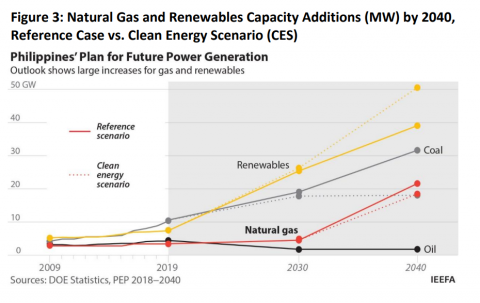

No guaranteed future for imported gas in the Philippines

May 05, 2021

Sam Reynolds

Report

Should Santos' proposed Barossa gas 'backfill' for the Darwin LNG facility proceed to development?

March 01, 2021

John Robert

Report

Key Shortcomings in Duke's North Carolina IRPs, An Issue-By-Issue Analysis: Part 2

February 01, 2021

Dennis Wamsted

Report

Latest Stranded Assets Press Releases

See more >

Guyana Gas to Energy project is unnecessary and financially unsustainable

October 04, 2023

Press Release

Reviving 6.1GW of stranded thermal power plants is better for India than investing in new fossil-fuel-based capacity

June 15, 2023

Press Release

Over half of Europe’s LNG infrastructure assets could be left unused by 2030

March 21, 2023

Press Release

Proposed Gacko II lignite-fired power plant is a non-starter

March 07, 2023

Press Release

For price-sensitive LNG buyers in Asia, now is not the time to build new LNG import terminals

March 31, 2022

Press Release

IEEFA: Air Products’ coal gasification proposal triggers looming policy disputes in Indonesia

January 27, 2022

Press Release

IEEFA: Emerging Asia’s unrealistic LNG-to-power project pipeline threatens macroeconomic and financial stability

December 15, 2021

Press Release

IEEFA: Coal lock-in in Southeast Asia presents a challenge for the Asian Development Bank’s coal retirement plan

December 10, 2021

Press Release

IEEFA video: Are gas and LNG investments safe?

November 29, 2021

Press Release

IEEFA Update: Santos won’t solve the problem of Barossa LNG with carbon capture and storage

October 20, 2021

Press Release

IEEFA U.S.: Pension funds investing indirectly in Ohio’s Gavin coal plant are at risk as financial, environmental disadvantages mount

October 14, 2021

Press Release

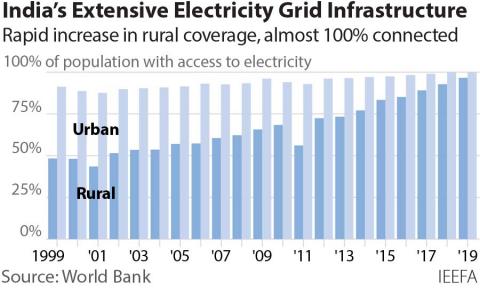

IEEFA: India’s new gas infrastructure investment must be part of a balancing act

October 06, 2021

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.