Reviving 6.1GW of stranded thermal power plants is better for India than investing in new fossil-fuel-based capacity

Strategic acquisitions and subsequent revival of stranded thermal power plants will clear up the last pile of stranded assets on banks’ balance sheets and leave bank capital unlocked for investing in increasing renewable energy generation while meeting the country’s short-term power demand.

Key Takeaways:

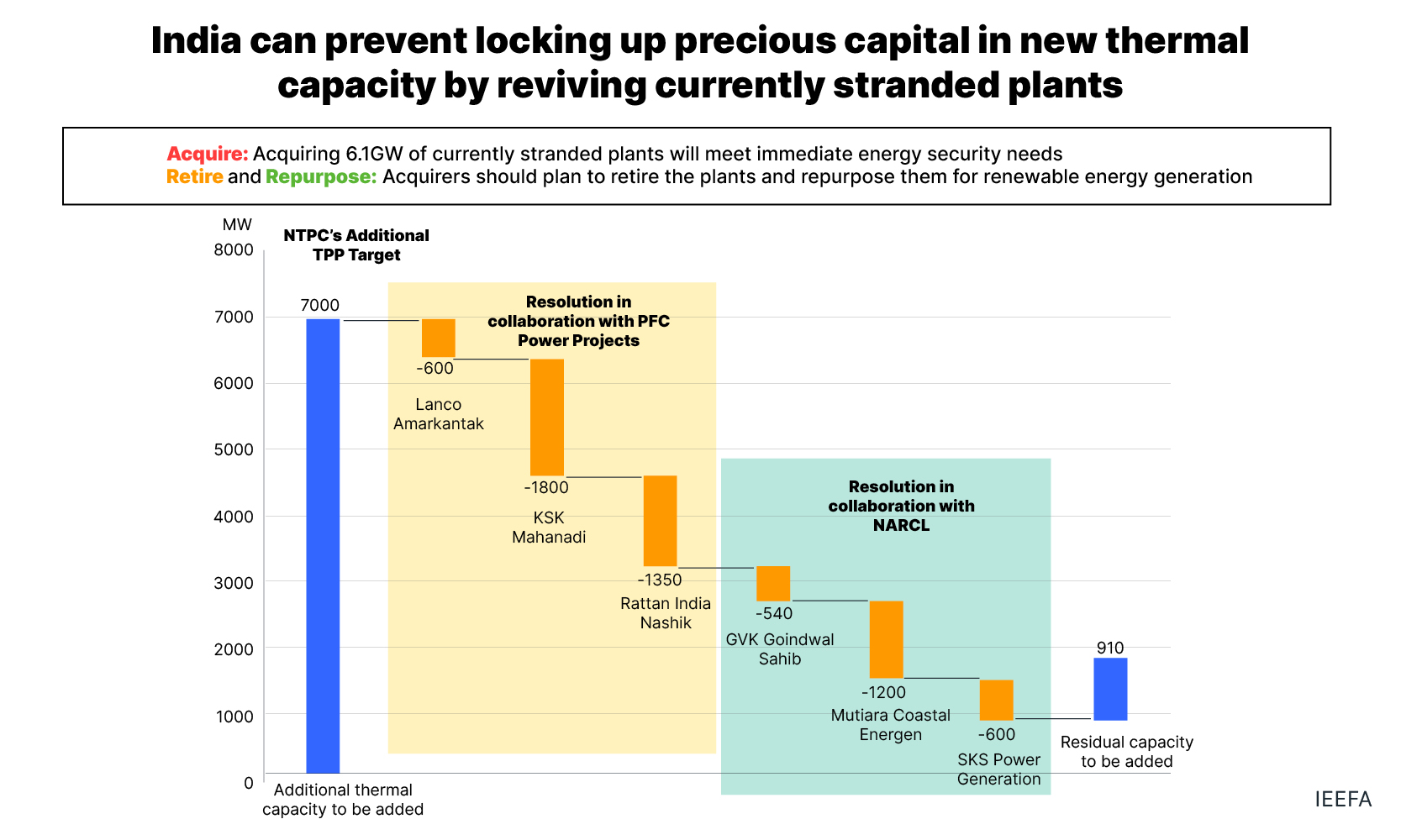

While the government has asked NTPC to add 7 gigawatts (GW) of thermal power capacity, we find that the company can acquire 6.1GW of stressed thermal assets through partnerships with Power Finance Corporation-REC and National Asset Reconstruction Company Limited with minimal investment.

The acquirer of the stranded thermal power plants should have an “acquire-retire-repurpose strategy”, wherein it should retire the plants after meeting short-term needs and repurpose them for renewable energy generation to keep their environmental, social and governance (ESG) profiles compelling.

The Indian banking industry is in a better state than it has been in years. A pivot towards thermal power, despite the benefits of renewables, could increase credit and climate risks for the banks.

15 June (IEEFA South Asia): Although the government wants NTPC, India’s largest power producer, to add 7 gigawatts (GW) of brownfield thermal power capacity, a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) finds that acquiring and subsequently reviving stranded thermal plants is a better option for all stakeholders.

The report identifies six plants with a cumulative capacity of 6.1GW that are ripe for strategic acquisition by NTPC in partnership with other government-owned companies like Power Finance Corporation, REC, and National Asset Reconstruction Company Limited.

“In light of energy security concerns, strategic acquisitions and subsequent revival of the stranded power sector capacity present in India can be a viable alternative to adding new thermal assets,” says Shantanu Srivastava, Sustainable Finance and Climate Risk Lead, South Asia, IEEFA.

“IEEFA believes any new investment in thermal power can potentially lead to stranded asset risk, given the clear economic case of renewable energy over thermal power. Financing these thermal plants will expose domestic banks to another set of potential power sector non-performing assets (NPAs) and a higher climate risk on their portfolios,” he adds.

According to the report, a strategy to strategically acquire and revive power sector NPAs will also clean up the books of Indian banks, which have been reeling under high NPAs for over a decade.

“It will give the banks more headroom to contribute towards achieving India’s ambitious clean energy goals,” says Srivastava.

The report proposes that NTPC can partner with other government-owned companies like the newly formed Power Finance Corporation (PFC)-REC joint venture, PFC Projects Limited (PPL), and India’s bad bank, the National Asset Reconstruction Company Limited (NARCL).

The report, through case studies, argues that by partnering with either PPL or NARCL, NTPC can save significantly on upfront investments while adding capacity for India’s immediate energy security needs.

“NTPC can undertake work on providing coal linkages and power purchase agreements where required, while PPL can provide finance for working capital requirements,” says Srivastava.

“On the other hand, there are examples of asset reconstruction companies acquiring stranded assets using a 15:85 model, wherein it pays 15% of the consideration amount upfront and issues security receipts for 85% of the consideration amount, payable on recovery of loans. Partnering with NARCL, with the 15:85 central to its strategy and security receipts having a sovereign guarantee, to acquire some of the stranded thermal assets means that NTPC will not have to invest much capital upfront,” he adds.

The report also highlights that acquisition and revival should be the first step, as adding new or acquired thermal assets will hurt the acquirer's environmental, social and governance (ESG) profile.

“NTPC aims to install 60GW of renewable energy capacity by 2030, which would require securing capital from global ESG investors. Hence, a post-acquisition strategy to retire and repurpose acquired stressed thermal assets for renewable energy generation will align well with ESG investors and prevent future stranded assets on NTPC’s books,” says Srivastava.

“The company can also explore the burgeoning market for carbon credits trading to further improve returns from repurposed projects,” he adds.

Read the report: Cleaning Up the Last Pile of India’s Power Sector Non-Performing Assets

Media contact: Prionka Jha ([email protected]) Ph: +91 9818884854

Author contacts: Shantanu Srivastava ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)