Volatile global LNG market: Impact on India

Key Findings

Gas expansion in India will not be easy, especially with the requirement of expensive infrastructure investments that run the risk of becoming stranded.

The fact that there is a very concerted effort to use new technologies and India being keen to gain global leadership in producing and exporting greener fuels, such as green hydrogen, will compound the stranded assets risk of gas infrastructure.

Government’s renewed focus on biofuels and biogas, with recent policy amendments such as the blending of compressed biogas (CBG) in the city gas grid, is expected to lower natural gas use.

Introduction

The global liquefied natural gas (LNG) market saw major volatility during the COVID-19 pandemic. But it was the Russian invasion of Ukraine that ushered in a new normal. It raised concerns in the narrative about the feasibility of natural gas as a bridge fuel and broke the myth of the fuel being a low-cost alternative.

The alterations in the global LNG market have impacted consumption in several emerging economies, including India. Extreme climate events, such as the heatwaves in Europe and flooding in Asian economies like Pakistan, exacerbated the LNG market’s demand-supply imbalance. The associated response of an increased understanding of climate catastrophes and the urgent need to take major decarbonisation measures might not augur well for the LNG market in the long term.

India, a net gas importer, also saw a decline in LNG demand. The LNG import volume decreased by 15% in fiscal year (FY) 2022-23 versus FY2021-22, even as the value increased by a whopping 27%, indicating import priciness.

This paper provides an overview of the global gas crisis and its continuing impact on major consuming countries. It evaluates the sectoral implications for India and what it means regarding the role of gas in India’s decarbonisation pathway.

LNG Market Sees Demand-Supply Shifts

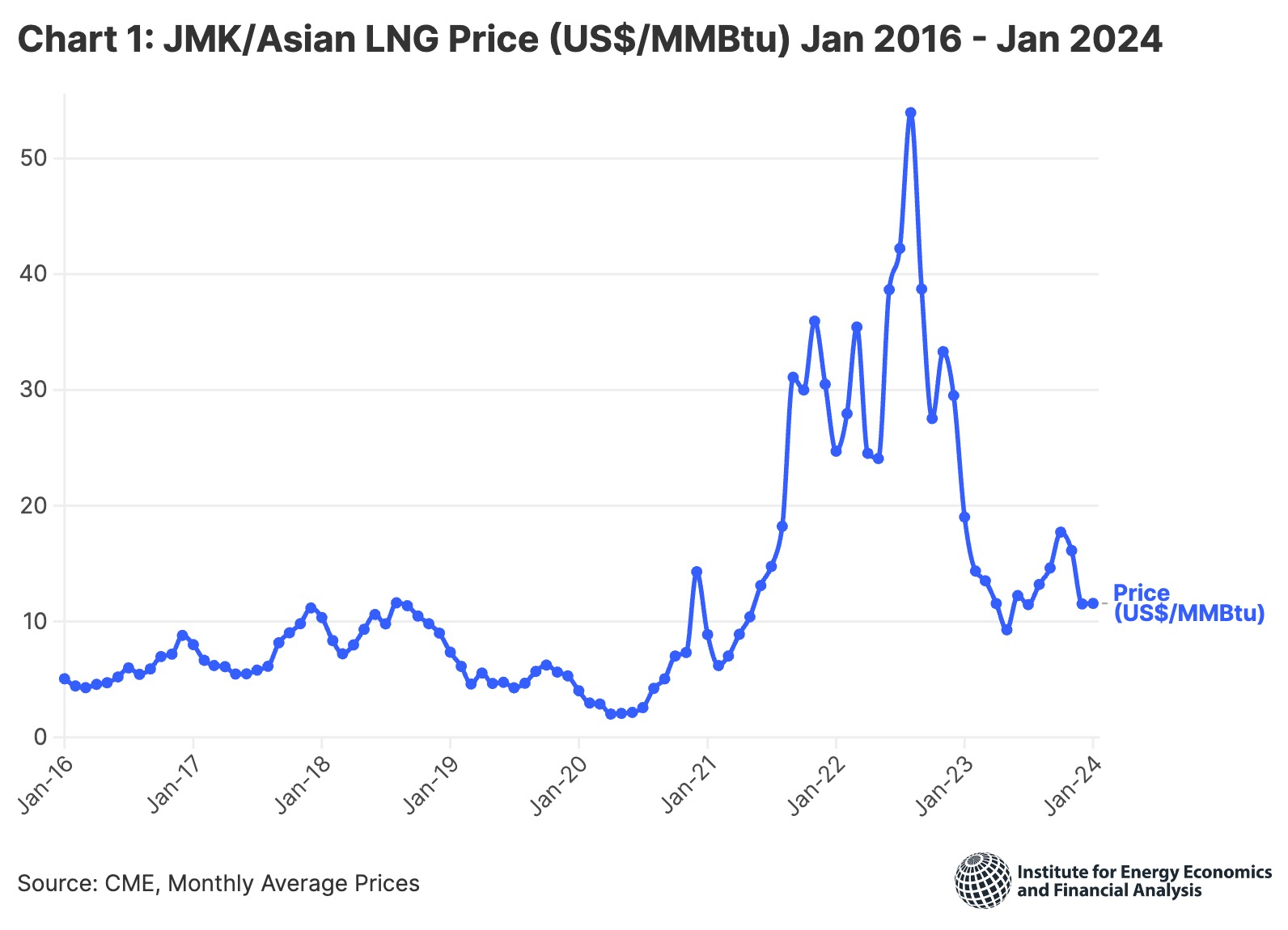

Global LNG markets saw structural changes after Russia invaded Ukraine and the ensuing decline in pipeline supply between Russia and Europe. LNG demand increased, led by European nations, while supply could only rise marginally, which sent prices soaring to unprecedented levels. The Japan-Korea Marker (JKM), a benchmark for Asian spot prices, recorded a single-day high of US$84.76 per metric million British thermal units (mmBtu) on 7 March 2022.

These high prices made LNG unaffordable fuel for many emerging economies, which saw power cuts and fuel switching. The high prices raised consumer bills in Europe, which also relied on alternatives like renewables and nuclear. The Institute for Energy Economics and Financial Analysis (IEEFA), in its Global LNG Outlook 2023-2027, noted that the European Union (the E.U.) is actively looking to lower gas consumption while LNG has acquired a reputation as a costly and unreliable fuel in Asian economies.

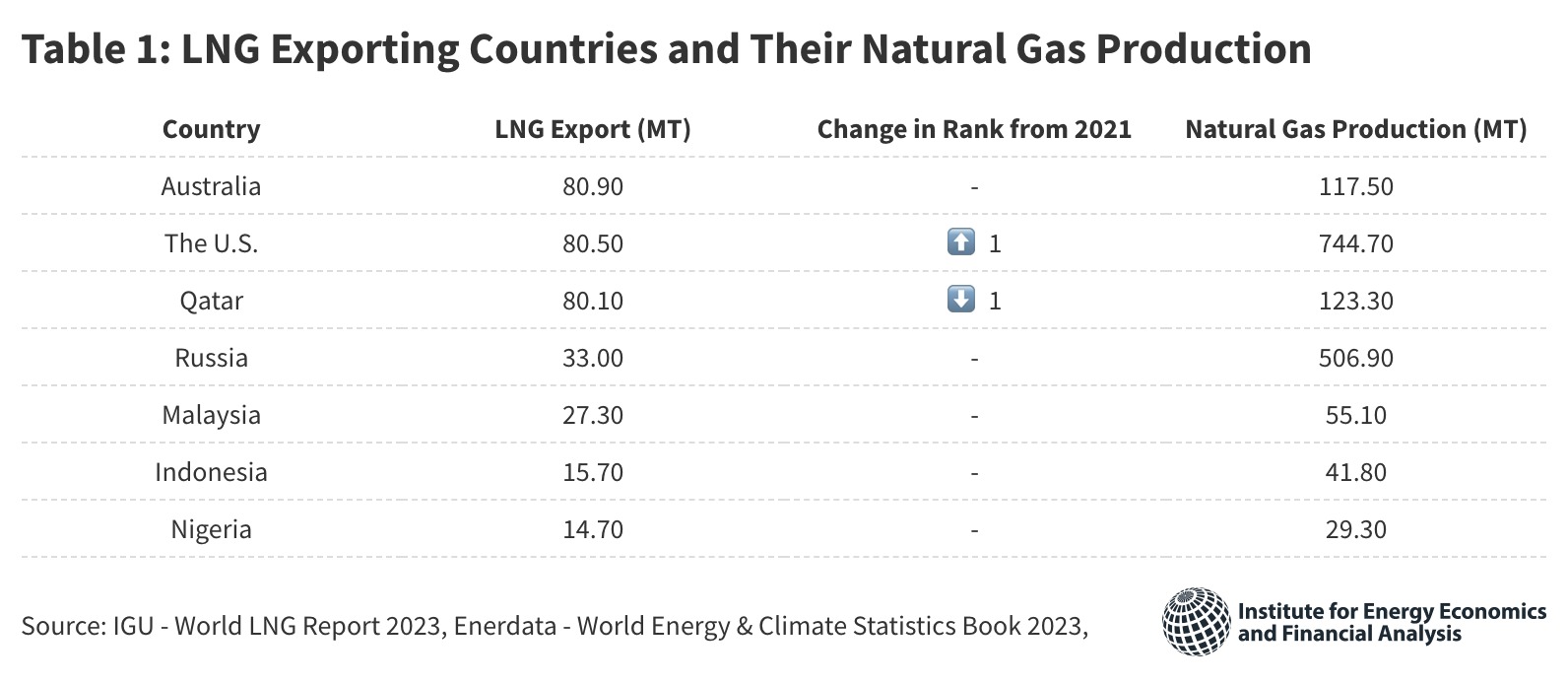

The infrastructure mismatch may also add to the demand-supply imbalances. In 2022, 31.2 million tonnes per annum (MTPA) of new import or regasification capacity came online, taking the total import capacity to 970.6MTPA as of April 2023. Meanwhile, the global LNG supply capacity or liquefication capacity was almost half at 478.5MTPA, including new capacity additions of 19.9MTPA. LNG markets also shifts in key players with U.S. emerging as one of the top exporters and pipeline exporters like Iran and Canada eyeing LNG exports.

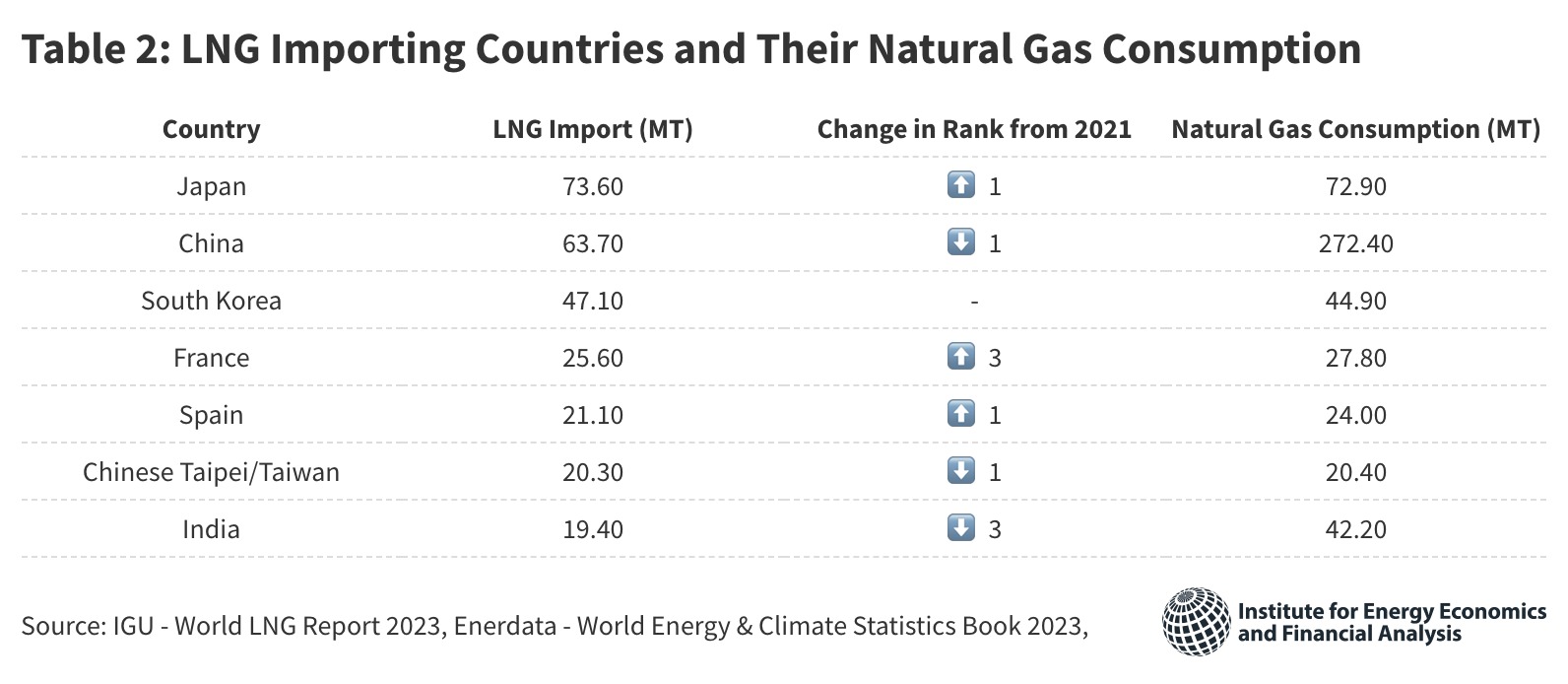

India and China emerged as top LNG markets in Asia in recent years but high prices impacted demand. Total Asian imports went down by 22.2MT in 2022. Asian LNG importers, including India, Pakistan and Bangladesh, relied more on long-term contracts or witnessed fuel switching to cheaper fuels.

LNG demand is expected to be weak even in Europe. Gas demand fell in Europe by 13% or 55 billion cubic metres (bcm) in 2022 due to a mild winter, energy efficiency, fuel switching and increased renewable energy use, among other reasons. This will likely continue due to strong European storage levels, which were 99.6% full until May 2023.

Price Volatility is the New Normal

Demand-supply imbalances have resulted in highly volatile LNG prices in the last few years. JKM prices touched a low of US$2/mmBtu during the pandemic, when there was complete demand demolition, to US$84.762/mmBtu on account of post-pandemic economic recovery. JKM prices are derived from the pricing of international hubs, which have also been very volatile. The chart below shows the average monthly prices, which have varied for many years but have been very volatile in the last few years.

The structural uncertainty of LNG markets due to demand-supply balances, trade flows and seasonality could make volatile gas prices the new normal over the next decade.

- Demand Supply Balances: Supply or demand shocks trigger the LNG prices upwards. The Russia-Ukraine war that lowered access to Russian pipeline gas to European countries is a supply shock, while Japan's increasing LNG imports due to the nuclear shutdown after the 2011 Fukushima disaster is a demand shock. Such shocks are becoming more recurrent, adding to the LNG market volatility. High LNG prices incentivise the construction of new supply facilities to temporarily balance the market. But increased supply with high prices leads to demand destruction, causing supply gluts and lowered production again, resulting in a demand-supply mismatch.

- Trade Flows: With higher trades on the spot market, 35% of total 2022 gas trade, LNG prices are more dynamic now, impacting global markets instead of only regional impacts. Unlike long-term gas contracts based on oil prices, spot prices use competitive prices at various gas hubs, adding to volatility. Though high spot prices rekindled a preference for long-term contracts, those are also now costlier with preference for market-based pricing.

- Seasonality: Increased events of extreme weather conditions or milder-than-expected winters in different regions result in increased volatility in the LNG market. The recent simmering down of LNG prices stems from muted demand from Europe due to mild winters. On the other hand, in 2022, there was increased demand from Europe due to lowered Russian pipeline supply along with extreme heat conditions, reducing hydro and nuclear output resulting in high LNG prices.

Global Shifts Impact the Indian Market

The price volatility witnessed in global markets translated to the Indian market as well. The domestic price formula up until recently was based on the volume-weighted average price (VWAP) of four international benchmarks (U.S. Henry Hub, U.K. National Balancing Point, Russian domestic gas price and Alberta reference price) calculated twice a year for trailing four quarters and with a lag of one quarter. This resulted in a mismatch in domestic and spot gas prices and exceptionally high prices after a year of sustained high prices seen in 2022.

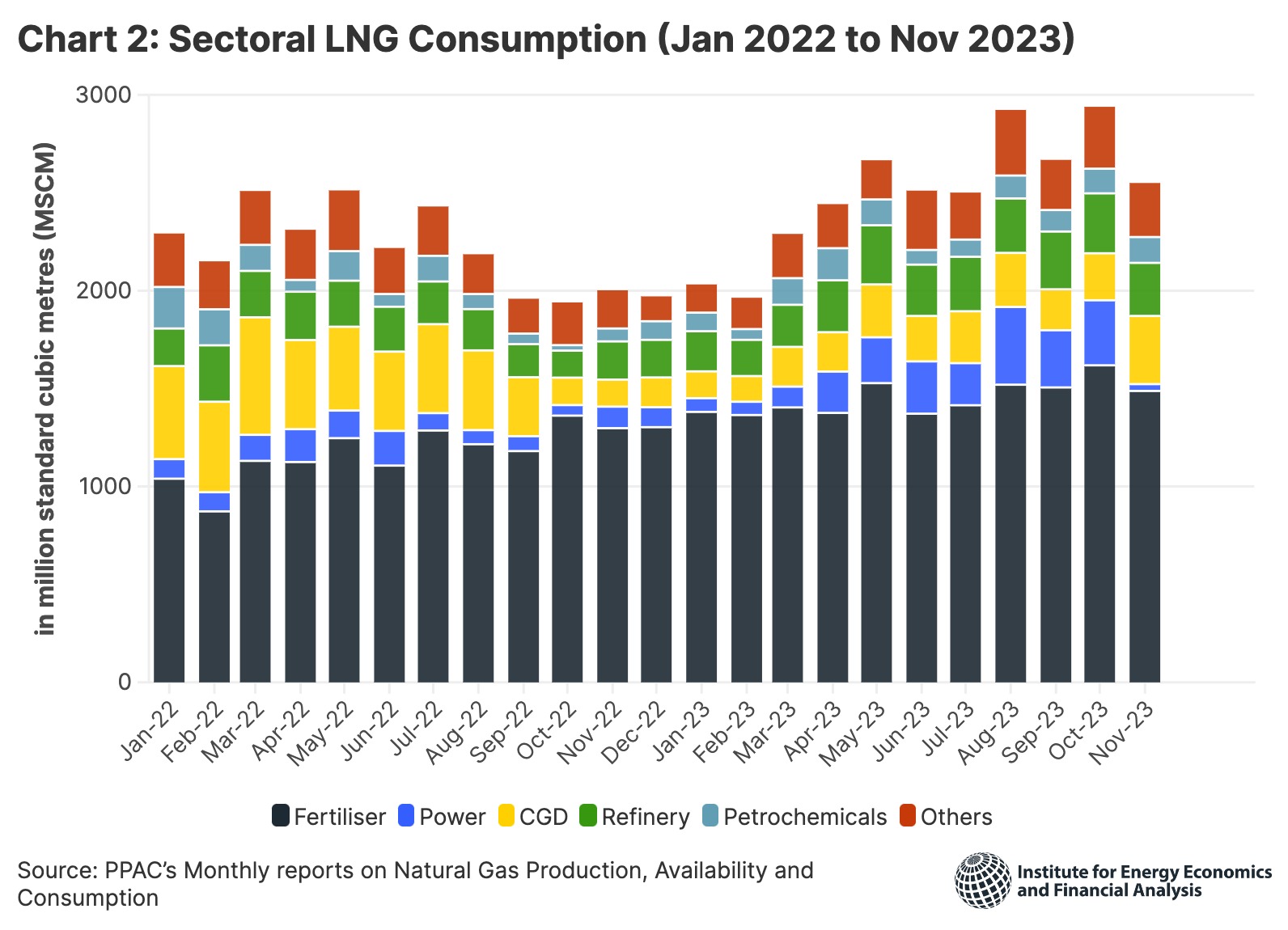

The high prices resulted in demand destruction and fuel switching in industrial and city gas distribution (CGD) sectors, which had started to emerge as key gas consumers in India. Owing to the pass-through price policy and price-sensitive consumers, CGD players could not use exorbitantly priced LNG lowering demand. A key LNG consumer was the highly subsidised fertiliser sector, with subsidies costing the exchequer about US$30 billion in FY2022-23 and budgeted to be US$21 billion for FY2023-24.

In 2023, to counter the impact of high LNG prices, domestic prices are announced monthly linked to Indian crude basket. A floor and ceiling price has been fixed for nomination fields at US$4/mmBtu and US$6.5/mmBtu for two years, post which the floor and ceiling would increase by US$0.25/mmBtu. The ultimate objective is deregulating gas prices in the medium term, notably by 2027.

While this might stabilise the domestic gas prices and usher in demand, imports have to meet almost half the demand which could go up to 70% if gas consumption increases. LNG markets are going through their most geopolitically and macroeconomically unstable periods, with volatility becoming the new normal. If India continues to import large volumes of LNG, it will continually be at the mercy of unpredictable global commodity prices, leading to huge energy security and trade balance risks.

Future of Gas in India

Gas expansion in India will not be easy, especially with the requirement of expensive infrastructure investments that run the risk of becoming stranded. The country’s gas demand is price elastic, but downstream gas assets are capital-intensive. Therefore, volatile prices result in miscalculations in project returns and hamper profitability. Volatile fuel prices also raise the operating costs of downstream projects in the industrial, power and CGD sectors, harming product competitiveness, utilisation rates and returns on investment. All this results in difficulty in sourcing project finance debt capital for new projects.

The domestic gas allocation priority and regulated pricing have enhanced infrastructure investment in the CGD sector. There has been an increase in CNG (compressed natural gas) stations, from 3,711 in January 2022 to 6,088 in October 2023. Over the same time, there has been an increase in the PNG (piped natural gas) connections for domestic, commercial and industrial segments by 37%, 16% and 35%, respectively. This entails a major stranded assets risk for the CGD infrastructure as with increased demand, India’s dependence on LNG, which is likely to remain expensive and volatile this decade, would rise.

The fact that there is a very concerted effort to use new technologies and India being keen to gain global leadership in producing and exporting greener fuels, such as green hydrogen, will compound the stranded assets risk.

Targets for green hydrogen and green ammonia, along with the increasing awareness of natural fertilisers, could largely displace the need for urea-based fertiliser in the medium- to long-term. Similarly, the increased focus on electric vehicles and their associated infrastructure may encourage people with city driving needs to invest in a newer technology rather than natural gas. Moreover, the rapid advancement in possible range, charging speed and available charging infrastructure will make the choice easier for consumers.

The government’s renewed focus on biofuels and biogas, with recent policy amendments such as the blending of compressed biogas (CBG) in the city gas grid, is expected to increase the offtake and lower natural gas use.

In such a dynamic energy environment, globally and more so in India, it is important that the useability of a fuel is well understood and defined for a longer-term period, especially one such as gas that requires massive capital investments in infrastructure. A report by IEEFA notes that 12.5 gigawatts (GW) of current gas capacity can provide peaking power and ancillary services to maintain grid quality and flexibility. Similarly, gas can promote more renewable generation and new technologies, such as battery storage, by announcing more round-the-clock tenders for renewable technologies with gas.

(This article was first published by the Petroleum Planning and Analysis Cell)