How to save the Barossa Project from itself

Download Full Report

Key Findings

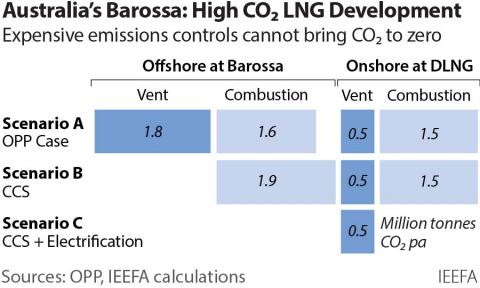

Even if it employed carbon capture and storage, Barossa gas will continue to release financially risky carbon dioxide emissions onsite, onshore and across the supply chain, making it one of the more expensive and dirtiest gas projects in the world.

The majority (57%) of emissions are from combustion, and capture of that is not practical.

Santos should be obliged to be as good as its word and be required to implement the CCS scheme as part of the Barossa development and to demonstrate its satisfactory operation before reaching full LNG output at Darwin and commencing exports of Barossa gas as LNG.

Executive Summary

There are implications surrounding Santos’ recent announcement of the BayuUndan carbon capture and storage (CCS) plan to save its Barossa offshore development project in the Timor Sea offshore Australia.

The carbon dioxide (CO2) content of Barossa gas is extremely high - about twice that of the next highest gas resources currently being converted to liquefied natural gas (LNG) in Australia. It is also much higher again than the gas feeding LNG plants in competitor LNG exporting countries – in a market growing increasingly sensitive to emissions arising from its purchases. Perhaps that is why Santos is trying to reduce the Barossa project’s emissions: to stop it being an emissions factory with an LNG by-product.

The average emissions intensity of Australian-made LNG is approximately 0.70 tonne CO2 per tonne of LNG produced, whereas LNG from the Barossa project would have an emissions intensity of 1.47 tCO2/tLNG before it is transported and burnt in North Asian markets. That makes both the product and the project itself in need of being saved or abandoned, as the majority (57%) of emissions are from combustion, and capture of that is not practical.